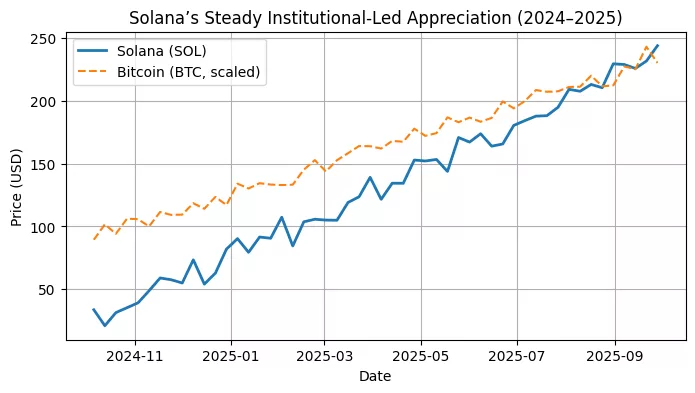

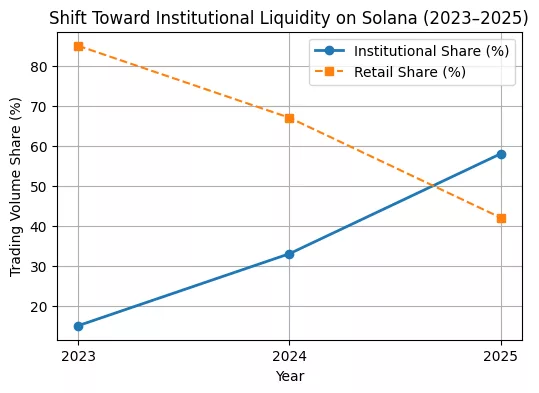

- Quiet but consistent institutional inflows are driving Solana’s growth in 2025, taking the place of retail speculation.

- CME’s credibility in conventional finance is anchored by its impending Solana futures and ETF optimism.

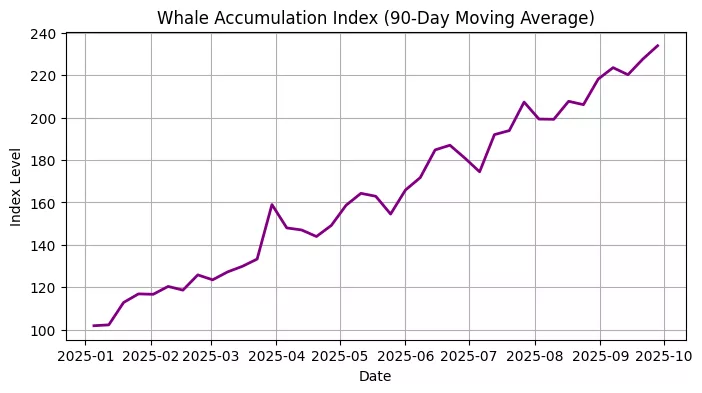

- Long-term conviction among high-capital investors is demonstrated by whale accumulation and off-exchange outflows.

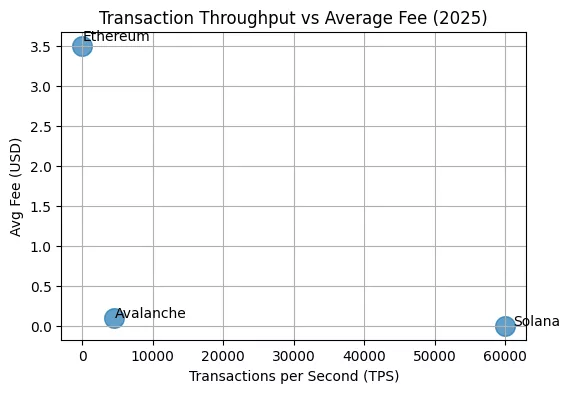

- Solana’s advantage in institutional-grade trading and tokenization is strengthened by its unparalleled throughput-to-fee ratio.

- A structural rotation is signaled by the “silent surge,” which places Solana at the center of the upcoming financial cycle.

The silent rotation begins

For months, the attention of markets has been captivated by the chatter surrounding memecoins and ETF news. However, beneath that apparent instability, a different narrative is quietly forming. Institutional portfolios, previously limited to Bitcoin and Ethereum, have started directing significant investments towards Solana. There are no major press statements or trending tweets to reveal it, just a trend of steady inflows, custody transactions, and futures interest that suggests a larger event. In early 2025, when liquidity moved away from speculative retail investments, Solana quietly benefitted from institutional adjustments. With a 400-millisecond block time, consistent performance, and strong developer interest, it became an ideal option for funds aiming for high throughput without facing Ethereum’s congestion expenses.

From speculation to structure

The cryptocurrency market is changing, and so are its players. Organizations have shifted away from chasing hype; they now necessitate robust infrastructure, adherence to regulations, and dependable liquidity. The storyline regarding Solana in 2025 is based on framework rather than conjecture: CME’s introduction of Solana futures, institutional perspectives from Bitwise, and custody partnerships with Anchorage and Fireblocks. These developments have given traditional desks a recognized framework for managing exposure. What began as an experiment in swift DeFi has evolved into a robust financial system capable of supporting tokenized assets and settlement mechanisms. Unlike Ethereum’s expensive gas fees, Solana’s consistent charges have drawn treasury teams exploring on-chain transactions, settlements, and RWA-backed assets.

Whale accumulation and on-chain evidence

On-chain information validates analysts’ suspicions over the past months: a quiet increase of significant wallets gathering SOL. Exchange outflows surged, with more than $160 million in SOL moving from centralized platforms to cold storage, reminiscent of initial Bitcoin accumulation stages. Addresses with over 100 K SOL rose consistently, whereas short-term holders decreased. Even in market declines, the 90-day moving average of whale accumulation remained stable, indicating confidence from affluent participants. In contrast to speculative pumps, these movements involve intentional portfolio managers establishing long-term positions in anticipation of forthcoming ETF approvals.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The network institutions can trust

Performance and dependability are more important to institutions than hype. With the help of recent validator enhancements, Solana achieved 99.99 percent uptime in Q2 2025 and minimized network outages. Sub-second settlement and throughput exceeding 60 K TPS are provided by the protocol’s special Proof-of-History and Proof-of-Stake combo at a negligible cost. Solana’s throughput-to-fee ratio is unparalleled when compared to Ethereum or Avalanche, and it is a statistic that is being used to evaluate suitability for high-frequency financial applications. Infrastructure that can manage order-book-level latency is necessary for funds that deal with real-time arbitrage or tokenized securities, and Solana provides just that.

The 2025 institutional narrative

The emergence of Solana’s institution parallels more general macro changes. Capital that previously moved cyclically between Bitcoin and Ethereum is now structurally diversifying as U.S. interest rates stabilize and the likelihood of ETF approval increases. Funds view Solana as a “third-pillar” asset an infrastructure wager on the next-generation settlement layer rather than a speculative token. In order to comply with AML regulations, NFT marketplaces are rebranding under institutional custodianship, and DeFi TVL on Solana has more than tripled since Q1. According to analysts, Solana may go through the same reflexive growth cycle that changed the liquidity profile of Bitcoin in 2024 after CME futures are introduced and ETF inflows start.But the narrative is still subtle. The entire extent of institutional adoption has not yet been priced by the market. This is the silent upsurge and rotation that is taking place behind the scenes, rewriting the 2025 hierarchy of cryptocurrency without any retail hoopla.