- Treasuries determine the future; markets shape the news. Sustainable advancements arise from diversified, transparent, and rules-based war chests financing multi-year R&D, security, and talent whereas listings and promotions typically generate temporary surges.

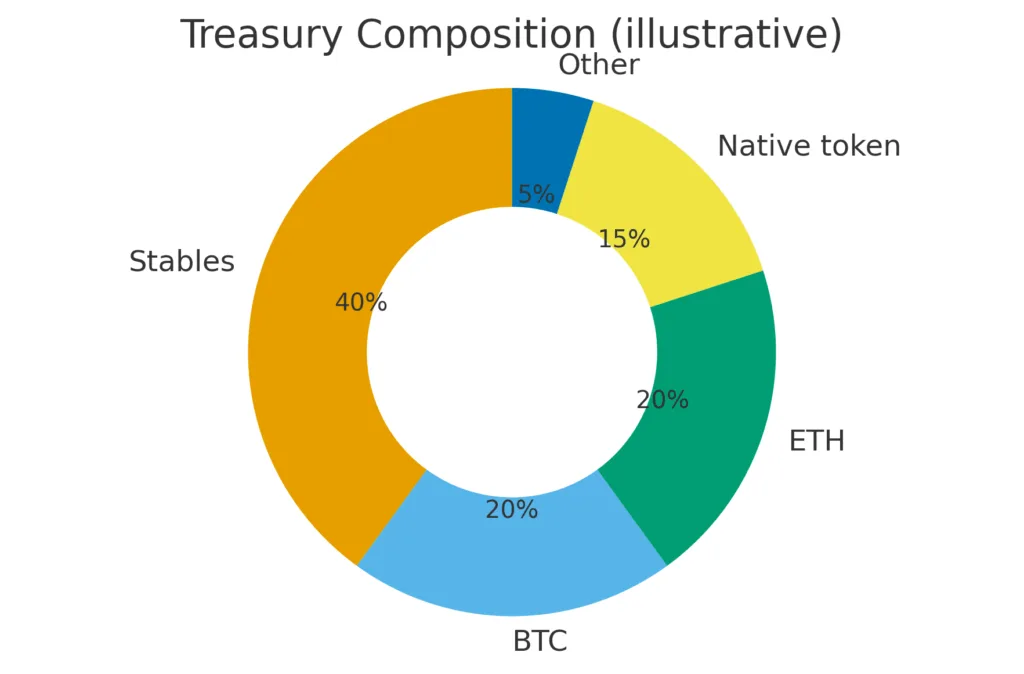

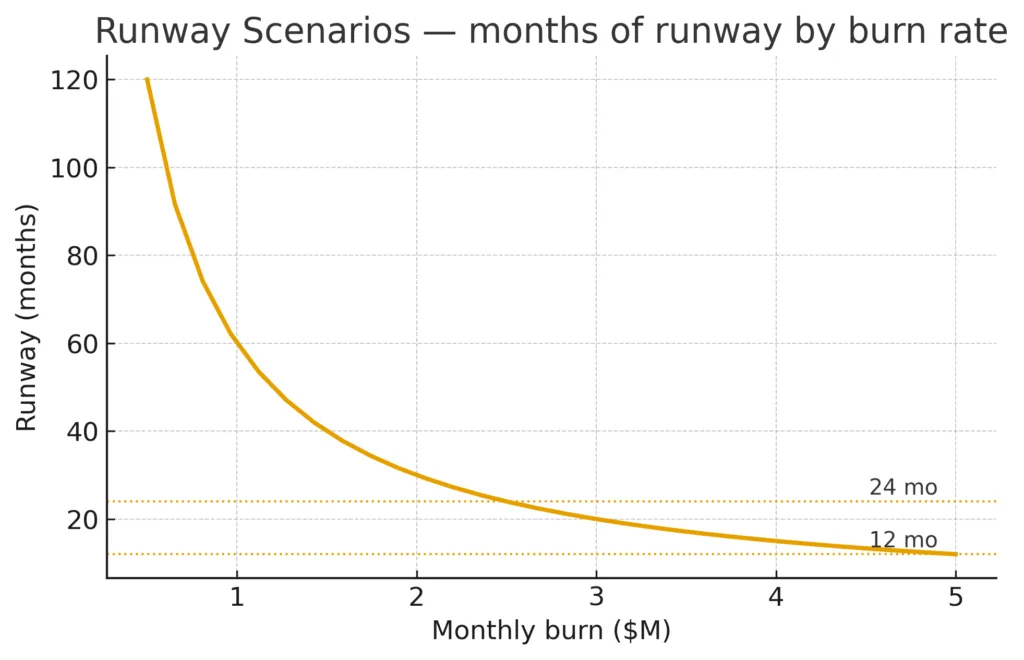

- Five-minute wellness assessment = runway, blend, focus, evidence. Robust indicators: ≥24 months of runway; diversified assets in stables + BTC/ETH (not only the native token); structured outflows linked to KPIs; consistent, verifiable reports and transparent custody/governance procedures.

- Support the long-lasting catalysts. Focus on treasury initiatives (grants, rule-based buybacks, hedging, KPI-related incentives) instead of exchange activities; teams need to formalize on-chain regulations and expiration dates, while tokenholders must vote on runway, public goods, and tangible results.

Markets generate news; treasuries shape strategies. A listing, fee waiver, or points promotion can boost volumes for a week. An effectively managed treasury finances the upcoming two years of research, supports security, retains core contributors during downturns, and aligns incentives to ensure users remain engaged after the excitement diminishes. To predict a protocol’s future, cease fixating on tickers and begin examining the treasury.

Treasuries are operating systems, not piggy banks

A crypto treasury serves as the management hub for a network’s strategic future. It determines the timing for hiring and hibernating, which primitives are developed, the support for validators and delegates, and if liquidity is acquired or leased. Robust treasuries expand beyond their specific token, maintain a blend of stablecoins and blue-chip assets, and allocate capital based on structured guidelines rather than intuition. That framework transforms market fluctuations into flexibility: when values drop, funding persists; when prices surge, reserves are adjusted instead of being hastily depleted to “maintain the graph.”

Durability arises from three characteristics: time perspective, discipline, and openness. Time horizon refers to considering years instead of blocks, ensuring that research, audits, and infrastructure migrations continue without interruption. Discipline manifests as automated outputs and KPI-linked rewards that decrease as product-market fit enhances. Transparency serves as a compounding force: consistent reports with evidence foster trust, while public policies regarding custody, signer rotation, hedging, and buybacks lessen the urge to “act” whenever social feeds become noisy.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

How to judge a treasury in five minutes

Begin with runway: calculate unrestricted liquid assets divided by monthly expenses. Twenty-four months or longer is stability; fewer than twelve is vulnerability. Examine the liquidity composition: if 70–90% consists of the native token, the protocol is essentially leveraged to its own currency; a diverse mix of stablecoins along with BTC/ETH ensures resilience through cycles. Review the policy documents: identify who has the authority to transfer funds, determine which actions need on-chain consent, understand how grants are granted over time, and ascertain if market activities follow rules rather than being at the discretion of individuals. Ultimately, verify that reporting frequency and sporadic attestations do not constitute governance dashboards.

Why exchanges still matter but less than you think

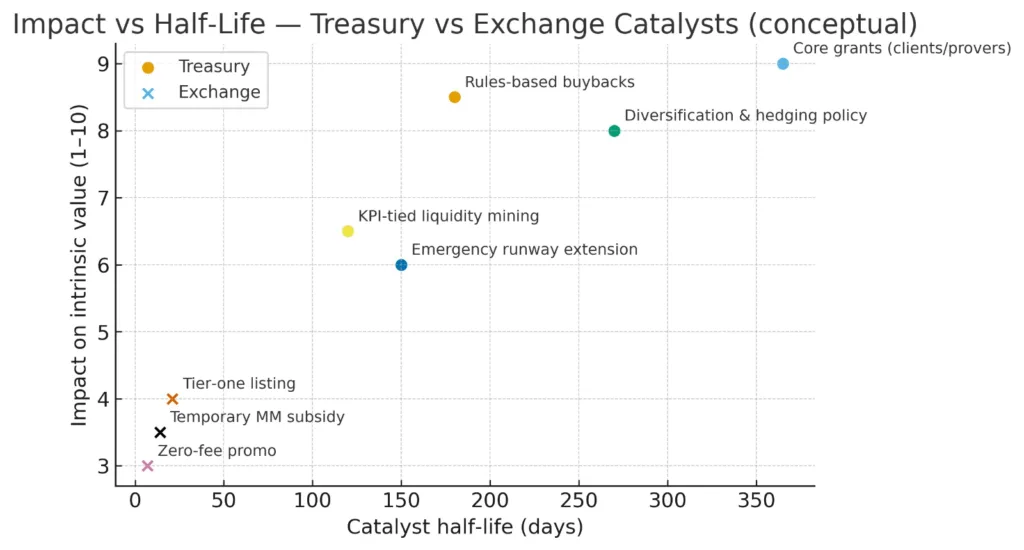

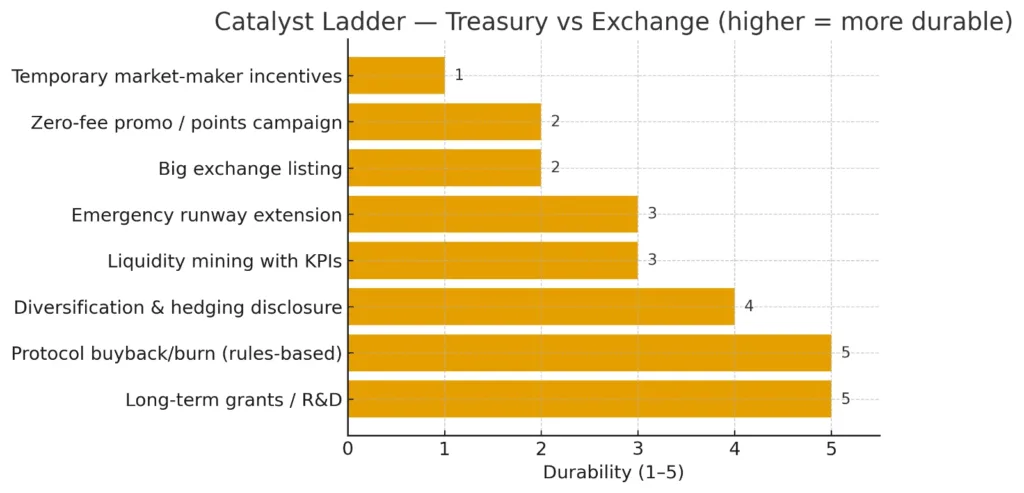

Listings expand access, fill order books, and can occasionally activate regional demand. Programs for market-making and promotional fees can stimulate engagement. However, they rarely alter inherent worth. The enduring catalysts are driven by treasury: buybacks and burns governed by rules with established triggers; long-term allocations for key clients, provers, and middleware; clear diversification and hedging; liquidity initiatives with cliffs and expiration dates. These actions enhance utility and cash-flow prospects. In contrast, “tier-one” listings and short-term incentives frequently generate interest but lack retention.

The catalyst ladder

An effective mental framework is a durable ladder. At the forefront are treasury initiatives that enhance a protocol’s ability to attract and retain users by funding essential R&D, delivering audited updates, or carrying out pre-planned buybacks. At the center are focused incentives featuring quantifiable goals and gradual reduction. At the bottom are exchange events that generate activity surges but seldom enhance fundamentals. Markets often misvalue this hierarchy, aggressively pursuing quick noise while eventually compensating for gradual signals. Long-term champions often reverse that order of importance.

A playbook for teams

Handle the treasury as if it were mission control. Implement on-chain policies, such as limits for multisig adjustments, hedging boundaries, buyback criteria, and conflict assessments for delegates. Diversify wisely in favorable periods to allow yourself time during unfavorable ones. Connect emissions to targets; allow programs to conclude automatically when usage is reached. Isolate market actions from governance to allow rejecting short-term price perceptions without disrupting the plan. Release a timetable: monthly financial reports, quarterly strategy assessments, and yearly mandate renewals. During bear markets, prolong the runway; in bull markets, allocate funds for the next two years of research and development.

What tokenholders should demand

Choose for longevity. Favor proposals that lengthen runway, enhance public goods, and strengthen the infrastructure instead of isolated emissions. Request evidence, not assurances, independent confirmations of reserves, transparent risk explanations, and recorded custody practices. Emphasize KPIs for incentive initiatives and expiration dates that eliminate wasteful expenditure. Incentivize teams that engage in frequent and timely communication, and closely examine any action that utilizes the treasury to influence governance results instead of furthering the protocol’s objectives.

Bottom line

Exchanges serve as a means of distribution. Treasuries determine fate. In a market that continues to seek quick triggers, the advantage goes to those who support the unexciting, gradual tasks: balance sheets that endure, policies that avoid slippage, and initiatives that keep delivering regardless of cost. If the future of crypto lies on-chain, it will be shaped by the guardians of the war chest who can finance that future discreetly, consistently, and openly.