-

Nasdaq’s adoption of tokenized securities marks a significant merging of Wall Street and blockchain technology.

-

Tokenization offers efficiency, worldwide access, and enhanced liquidity, yet it presents issues in regulation, stability, and cybersecurity.

-

The future of tokenized securities hinges on achieving a balance between empowerment and stability throughout global markets through integration.

The boundaries between traditional Wall Street institutions and the leading edge of blockchain technology have never been more indistinct. Nasdaq’s choice to permit tokenized securities on its trading floor signifies a pivotal moment in financial history. For many years, the exchange has represented the core of traditional markets, where billions of dollars in stocks and derivatives are traded every day. By adopting tokenization, Nasdaq is paving the way for a new system where blockchain transforms the issuance, trading, and settlement of assets. The consequences are extensive, spanning from improvements in efficiency to challenges in regulation, and this shift paves the way for a transformed Wall Street, which may either adapt smoothly or break apart due to the pressures of change.

From certificates to code: The evolution of securities

Financial markets have consistently relied on trust, efficiency, and transparency. In the beginning, securities were tangible certificates exchanged directly and documented by hand. The digital revolution substituted paper with digital records, and stock exchanges transformed into systems driven by advanced infrastructure. However, settlement cycles, intermediaries, and back-office issues persist, leading to expenses and delays.

Tokenized securities symbolize the upcoming advancement. Through the transformation of conventional stocks or bonds into blockchain-based tokens, Nasdaq is effectively incorporating financial agreements into programmable code. Transactions that previously took days to finalize can now be completed in minutes. Custodian-based ownership records can now be permanently monitored on distributed ledgers. This transformation is not only concerning speed but also about changing the fundamental structure of capital markets.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Nasdaq’s leap into Tokenization

Nasdaq’s declaration to back tokenized securities is not an abrupt trial but the result of years of study and the steady integration of blockchain technology. The exchange has consistently established itself as a progressive institution, testing blockchain-driven settlement systems and collaborating with fintech pioneers. What distinguishes this announcement is the magnitude and authenticity it provides.

By allowing tokenized securities on its trading floor, Nasdaq is clearly indicating to the world that blockchain has transitioned from a niche interest to an essential financial tool. Institutional investors, previously reluctant, now recognize an opportunity to engage in markets where tokens embody tangible value, such as corporate stock, government debt, or structured investment products. For issuers, tokenization provides innovative methods to secure funding while accessing a worldwide audience of investors familiar with digital-first assets.

The empowerment narrative: efficiency, access, and liquidity

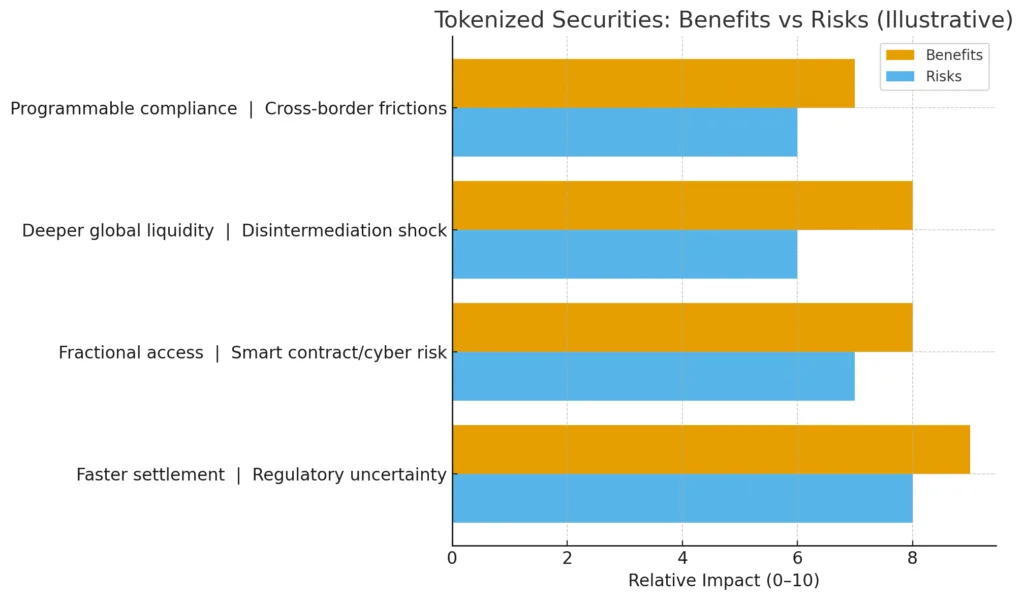

Supporters of Nasdaq’s action highlight empowerment. One of the most apparent benefits is settlement efficiency. The capacity of blockchain to automate clearing and reconciliation lowers counterparty risk and releases capital tied up in multi-day settlement processes.

Access represents another transformative aspect. Tokenized securities reduce entry barriers by allowing fractional ownership. Rather than acquiring a full share or bond, investors have the option to purchase fractions, making access to formerly exclusive markets more democratic. Worldwide liquidity is the third foundation. When assets are represented on interoperable blockchains, cross-border trading becomes smoother, connecting Wall Street’s liquidity with worldwide demand.

The empowerment perspective views tokenization as a driving force that enhances financial inclusion, increases liquidity, and updates systems that, despite being advanced, continue to suffer from inefficiencies.

The stability debate: regulation, risks, and resistance

However, empowerment carries inherent risks. Critics caution that tokenized securities might undermine traditional systems. Regulatory certainty continues to be one of the major obstacles. Although Nasdaq’s participation indicates credibility, tokenized assets must still adhere to securities regulations, anti-money laundering laws, and international limitations.

Market structure also presents risks. Blockchain offers disintermediation, yet eliminating intermediaries might weaken the protections that brokers, custodians, and clearinghouses provide. These institutions operate not solely for profit but also to mitigate shocks and ensure accountability. Tokenized markets might reveal new vulnerabilities for investors, ranging from bugs in smart contracts to cyber threats.

Ultimately, resistance from Wall Street must not be overlooked. Legacy systems entail trillions in unrecoverable costs, and intermediaries facing the threat of disintermediation are unlikely to passively relinquish their positions. For each proponent of blockchain efficiency, there is an established figure supporting the consistency of the previous system.

Global implications: a new benchmark for markets

Nasdaq’s adoption of tokenized securities has a global impact as well. Stock markets in Asia, the Middle East, and Europe are paying close attention to the situation. Singapore’s SGX and Switzerland’s SIX have both tested digital asset platforms, whereas Dubai has established itself as a center for tokenized finance. By taking bold actions, Nasdaq is establishing a standard that others will either imitate or oppose with different models.

This establishes a new competitive environment. Similar to how exchanges previously competed for supremacy in derivatives or ETFs, the quest for dominance in tokenized markets could shape the upcoming decade. Nasdaq’s initial lead provides it with influence, yet regulatory challenges and execution risks may still alter the dynamics to another party.

A middle ground: integration, not disruption

Certain analysts contend that the future is found not in disruption but in integration. Tokenized securities do not inherently imply the breakdown of Wall Street’s framework. Rather, they could coexist, slowly integrating blockchain efficiencies into current structures. Custodians might continue protecting assets, yet they will utilize blockchain infrastructure. Clearinghouses might still be operational, but their reconciliation procedures will be automated.

This intermediate position sees tokenization as an addition instead of a substitution. It harmonizes empowerment with stability, innovation with tradition, and decentralization with supervision. Nasdaq’s action is not so much focused on replacing the established order but rather on developing a hybrid model where the advantages of both realms can coexist.

The open-ended future

Nasdaq’s choice represents more than just an operational adjustment; it signifies a symbolic change. It indicates that the financial system is prepared to recognize blockchain not as an outsider but as a collaborator in forming the upcoming era of markets. The future of tokenized securities as a mainstream tool or a niche offering hinges on regulatory flexibility, acceptance by institutions, and investor confidence.

The issue is no longer if blockchain has a place on Wall Street. It determines the distance and speed at which it will transform the foundation of the globe’s most renowned exchanges.