- Tokenomics is shifting focus from emissions to earnings, reflecting the corporate finance strategy of buybacks and dividends.

- Hyperliquid directs over 50% of its trading fees toward HYPE buybacks, establishing a strong flywheel linked directly to platform engagement.

- Pump.fun’s Project Ascend combines token burns with staking incentives, providing a mixed approach of buybacks and dividends for holders.

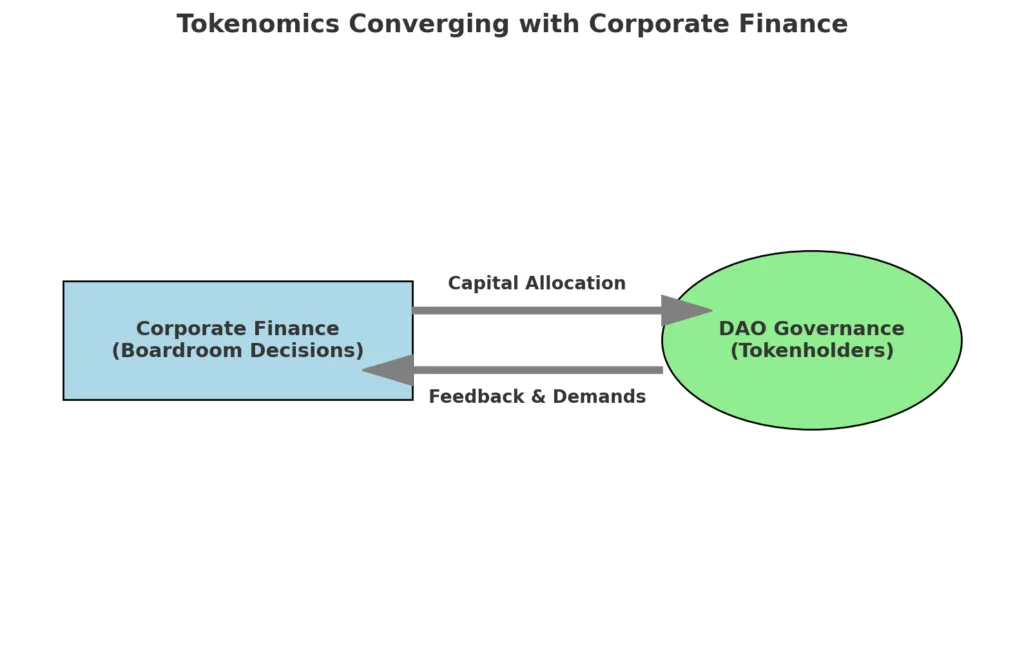

- The discussion surrounding reinvestment versus capital returns has expanded beyond boardrooms and is now influencing the future of DeFi tokenomics.

- Transparent communication and uniform dashboards will be essential for trust as protocols implement capital allocation similar to that of shareholders.

- The merging of tokenomics and corporate finance indicates the advancement of cryptocurrency, where viability relies not on excitement but on tangible cash flows.

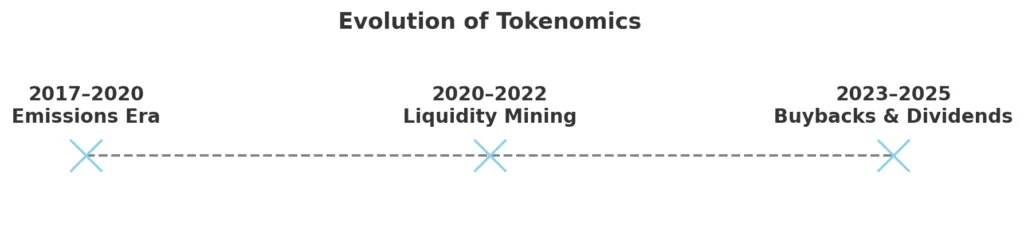

For a large part of crypto’s past, tokenomics primarily referred to emissions timelines. Projects issued tokens to draw in liquidity, allocated them to early users, and anticipated that speculative interest would maintain momentum. The outcome was a cycle of opportunistic capital: funds flowed in for quick gains and vanished once the incentives faded. The token frequently turned into an inflationary burden instead of representing the genuine strength of a project.

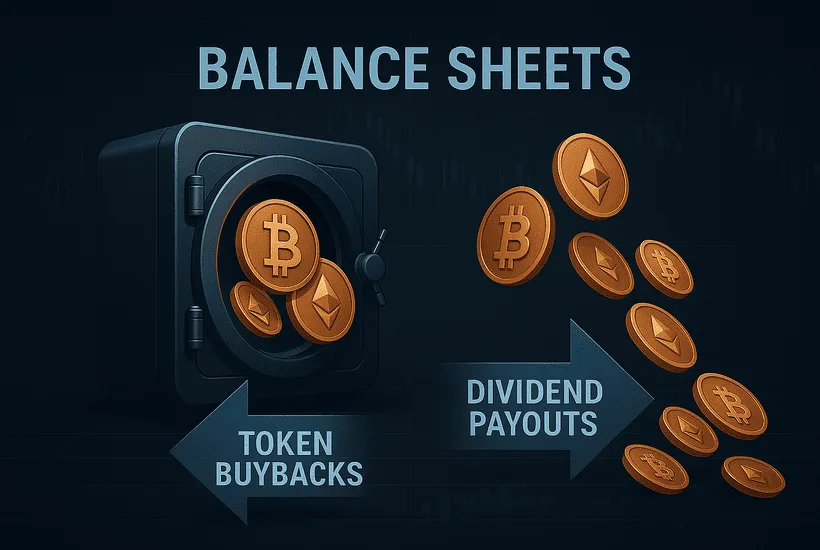

That model is revealing its outdatedness. A new wave of protocols is incorporating concepts directly from corporate finance. Rather than inundating markets with tokens, they are currently buying them back on the open market, destroying them to lessen supply, or allocating a portion of revenues directly to holders. In other terms, they are behaving less like startups focused solely on aggressive growth and more like publicly traded firms distributing earnings among reinvestment, dividends, and stock repurchases.

The action is significant because it redefines tokens not merely as speculative assets but as tools linked occasionally through programs to actual operating cash flows. Trading fees, launchpad earnings, and transaction expenses are no longer merely revenue for a protocol’s treasury. They are being reintegrated into the token economy, providing investors with something concrete to appreciate. Notable case studies include Hyperliquid, the high-speed derivatives exchange, and Pump.fun, the Solana launchpad that transformed memecoins into a production line. Each demonstrates a distinct method, yet collectively they emphasize how tokenomics is evolving from promotional tactics to corporate-like capital return approaches

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

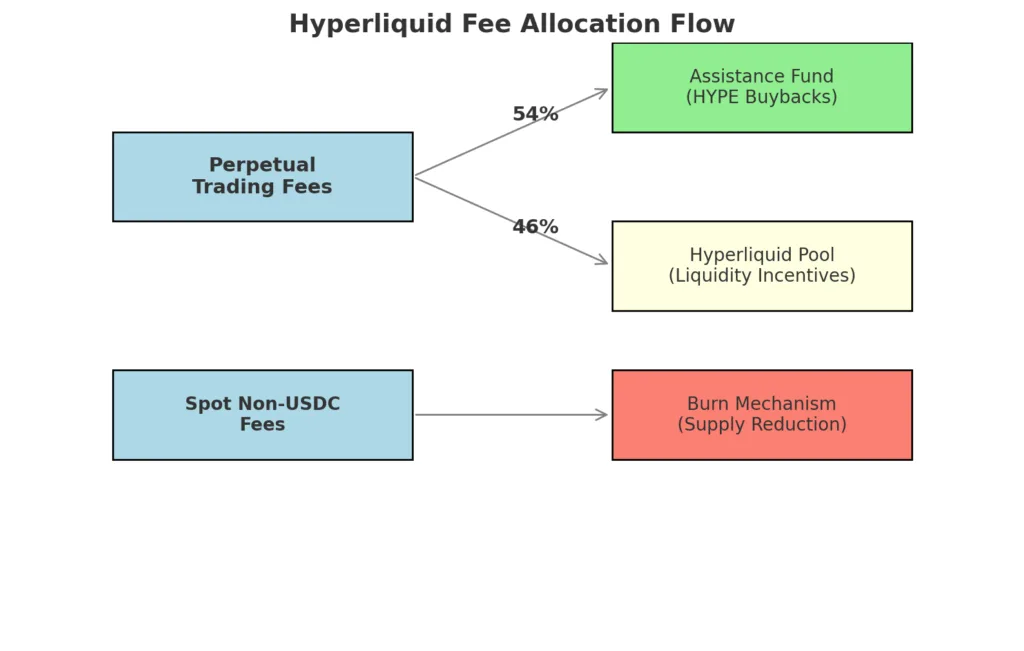

Hyperliquid’s fee flywheel

Hyperliquid has surfaced as one of the most daring attempts to convert raw trading volume into direct token worth. Engineered as a high-efficiency on-chain derivatives marketplace, it provides perpetual futures and spot trading with latency and depth typically associated with centralized platforms. However, it is the token framework that distinguishes Hyperliquid. Rather than allowing fees to accumulate in a treasury or trickle into unclear incentive schemes, the protocol allocates a significant portion of its earnings to repurchase HYPE tokens from the public market.

The system is rooted in what Hyperliquid refers to as its Assistance Fund. Each transaction on the platform incurs fees, and a set percentage of those fees is automatically allocated to the fund. Over fifty percent of all ongoing trading fees are directed into it, while the rest benefits liquidity providers via the Hyperliquid Pool. Spot fees in non-USDC pairs are occasionally burned completely, reducing the token supply directly. Gradually, the Assistance Fund builds a substantial reserve of tokens acquired from the secondary market, generating ongoing buy-side pressure and indicating to holders that the protocol is a key counterparty in its market.

Viewed through the lens of corporate finance, this resembles a public company implementing an extended buyback initiative. The impact is two-pronged. Initially, it establishes a demand baseline that constricts the float. Additionally, it creates an insurance-like buffer, as the Assistance Fund can liquidate its assets in exceptional situations, similar to a balance sheet safeguard. This dual role obscures the distinction between tokenomics and risk management, indicating that buybacks are essential to the protocol’s financial structure rather than merely superficial.

The approach has not escaped attention. Research companies monitoring Hyperliquid have emphasized the rapid growth of the fund, noting that millions of HYPE have been taken from the market. Analysts observe that the combination of trading activity and buy pressure converts token ownership into a stake in platform success, similar to how equity holders witness share value increase when a company invests profits into buybacks. The comparison isn’t flawless tokens don’t grant legal ownership rights but the impact on market behavior is strikingly alike.

At the same time, the model raises familiar questions. Is it sustainable to allocate such a large share of operating revenue to buybacks rather than reinvestment? Does the insurance function dilute the deflationary impact if tokens can eventually be reintroduced into circulation? And without standardized disclosure of triggers and thresholds, do holders really know how much capital is committed at any given time? These tensions mirror the debates in corporate finance itself, where investors push for transparency and balance between capital returns and growth spending.

What is clear is that Hyperliquid has taken a decisive step away from the inflationary models of the past. By linking fees directly to buybacks, it has tethered token value to platform usage with a clarity rare in crypto. For traders, that means every contract opened or closed contributes to demand for HYPE. For observers, it offers a glimpse of what a crypto-native company balance sheet might look like in practice.

Pump.fun’s Buyback-Plus-Dividend Experiment

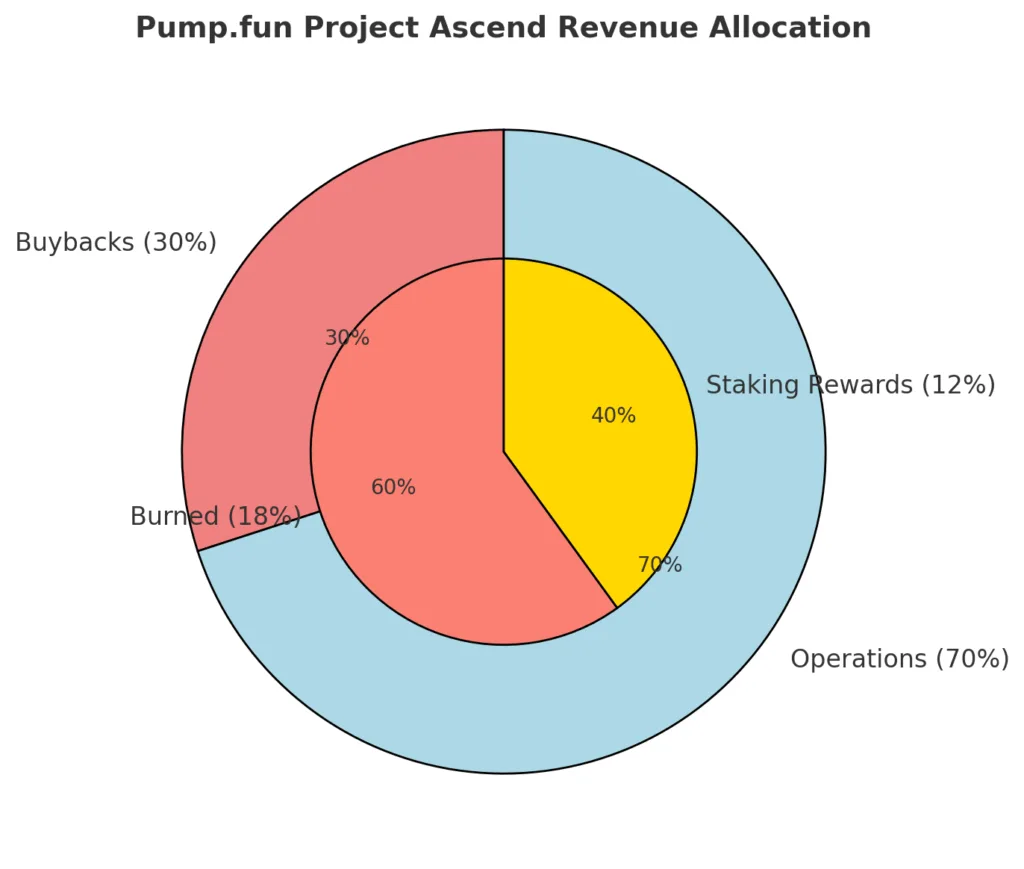

Pump.fun industrialized token launches on Solana, but its biggest innovation came not from memecoins but from its native token economics. Through Project Ascend, the platform committed thirty percent of its revenues to buybacks of PUMP. Of those repurchased tokens, sixty percent are permanently burned while forty percent are distributed to stakers. The effect mirrors a hybrid of share repurchases and dividends, rewarding holders with both scarcity-driven appreciation and a steady yield.

On-chain data shows that Pump.fun has already routed tens of millions of dollars into this mechanism. At times, it has even used more than its daily revenue to accelerate buybacks, a maneuver akin to an opportunistic corporate tender offer. The system provides a floor for PUMP in turbulent markets and sets clear expectations: as long as the platform generates fees, tokenholders share in the upside. Yet the design is not immune to volatility. If the memecoin pipeline slows, the engine weakens. And while the dividend-like distributions attract yield seekers, they may also invite regulators to view PUMP as an income-bearing security.

Buybacks vs. dividends in Crypto clothing

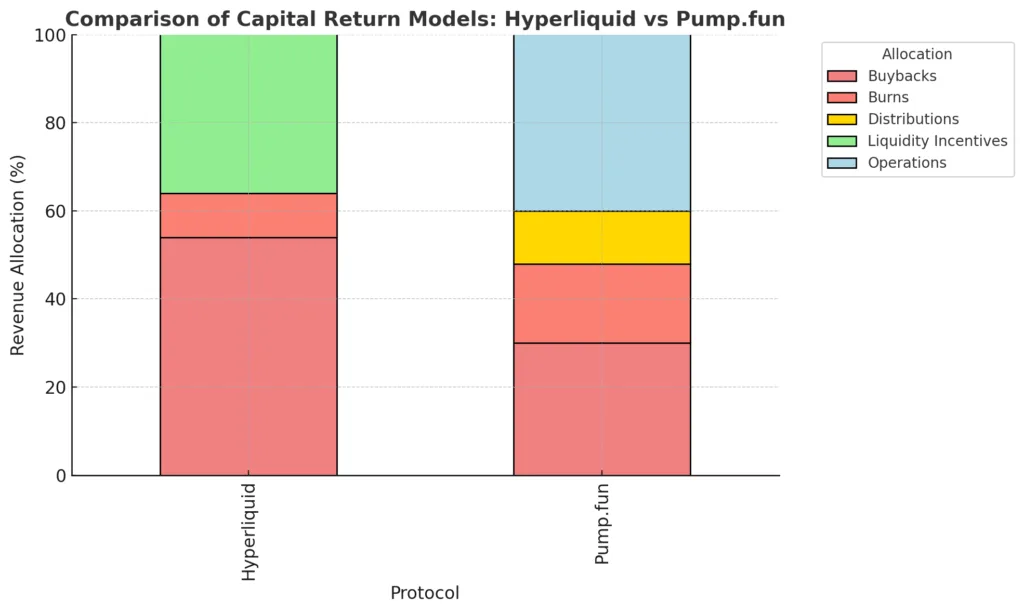

Hyperliquid and Pump.fun showcase two extremes of a spectrum. Hyperliquid directs almost all excess into buybacks, creating an insatiable repurchase engine. Pump.fun chooses a dual model that combines burns with continuous rewards. Both methods substitute the inflationary token issuance of previous times with systems based on real cash flows.

The effects reach further than their tokens. Consistent repurchases establish a fundamental bid support, changing market microstructure. Payouts resembling dividends create yield-driven behavior, influencing investor anticipations. Similar to corporate finance, a conflict arises between compensating current holders and investing for future growth. For crypto protocols, these decisions are not just technical. They establish brand identity and regulatory stance. A project highlighting dividends indicates maturity but invites scrutiny of securities. A project that purchases and incinerates may evade that classification but concentrates risk in fluctuating earnings.

The road ahead

The importance of this change lies not only in its mechanics but also in its story. Crypto tokens, once regarded as speculative assets, are being redefined as semi-equity instruments linked to operational outcomes. Hyperliquid’s flywheel demonstrates how trading volumes result in ongoing buying pressure. Pump.fun’s hybrid approach demonstrates that holders can gain real benefits, rather than merely facing dilution. Both demonstrate that tokenomics is aligning with corporate finance, with the central issue remaining consistent: how to optimally distribute capital between growth and shareholders.

The upcoming challenge will be transparency and uniformity. Investors will require dashboards that detail the exact amount of revenue allocated, the number of tokens burned, and the total distributed. In its absence, the comparison to corporate finance fails. However, with this, protocols could achieve the same level of credibility as publicly traded companies, with their tokens valued not only on speculation but also on quantifiable cash flows.

In this convergence, the industry reaches maturity. The market will keep discussing whether buybacks or dividends benefit tokenholders more. However, the more significant narrative is that tokenomics has ultimately entered the financial sector it has long asserted it would transform. It is no longer reliant on emissions. It relies on income.