- Revolut is among the first fintech companies to obtain a complete EU crypto license under MiCA.

- The authorization permits cross-border cryptocurrency services in all 27 EU countries.

- Retail participation increases as 20% of Revolut’s users trade digital assets.

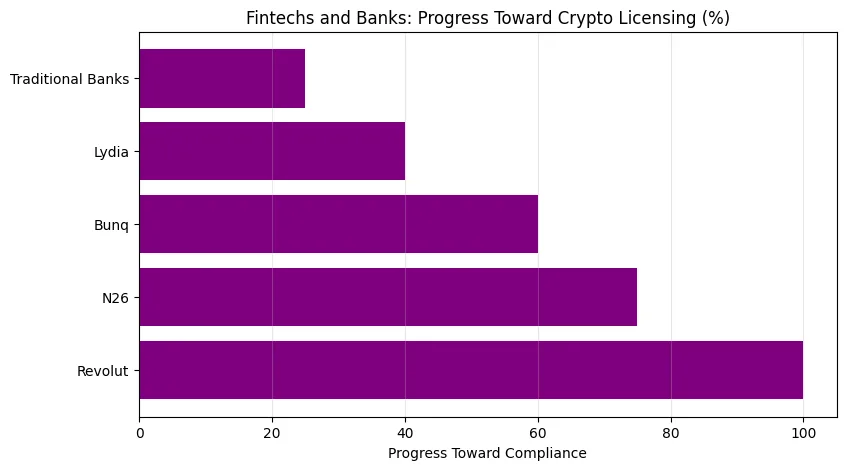

- Rival companies and banks are competing to adopt the regulatory approach that Revolut initiated.

- This milestone signifies the transformation of cryptocurrency from a speculative frontier to established, regulated finance.

The moment traditional finance meets crypto regulation

Revolut has officially obtained a European Union crypto-asset service provider (CASP) license from Lithuania’s central bank, transforming the delivery of digital assets to the public. It’s not merely another fintech endorsement; it’s a sign that the barrier between traditional finance and crypto is starting to break down.

Revolut currently serves more than 40 million users throughout Europe and elsewhere, establishing itself as one of the most reliable financial applications worldwide. This license allows it to legally provide crypto trading, custody, and exchange services throughout the European Economic Area (EEA), effectively making it one of the first fully regulated, borderless digital asset providers in the EU.

In contrast to the speculative transactions that previously characterized the crypto landscape, Revolut’s route to obtaining a license under the EU’s Markets in Crypto-Assets (MiCA) regulation establishes it as a compliant entry point. The application that disburses salaries and allows stock trading will shortly support tokenized asset buying and regulated stablecoin transactions.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The significance of this endorsement is substantial: the next phase of crypto may not be determined by crypto-native companies, but by fintechs that excel in regulation. Revolut isn’t just entering the crypto realm; it’s bringing crypto into the financial mainstream.

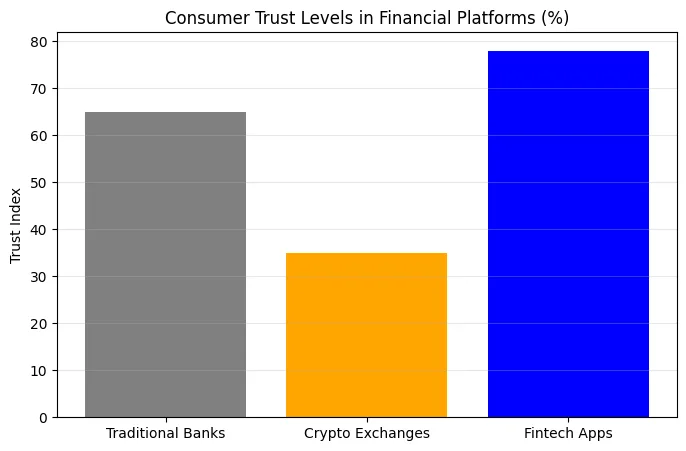

Source:Trust in fintech applications such as Revolut now surpasses that of conventional banks and cryptocurrency exchanges, altering how users perceive security in managing digital assets.

Within the license — MiCA and the fresh regulations of the game

Revolut’s license represents more than a corporate milestone; it underscores how MiCA’s structure will influence Europe’s cryptocurrency evolution. MiCA provides certainty in a market once defined by uncertainty and enthusiasm. Under this regulation, companies must meet capital reserve requirements, implement strict anti-money-laundering (AML) procedures, and guarantee full transparency concerning the safeguarding and management of customer assets.

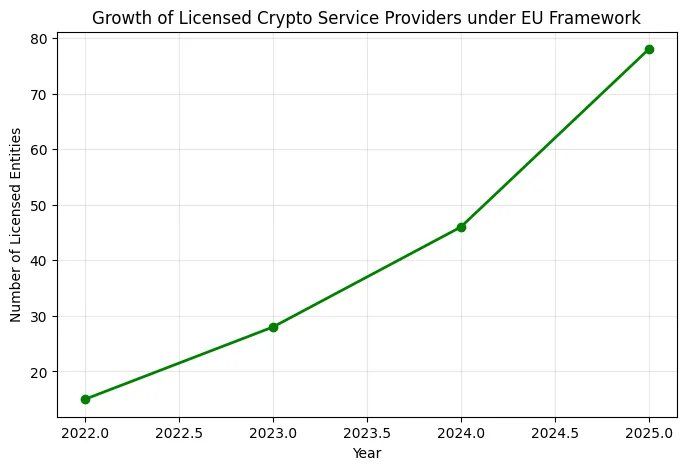

This transforms crypto operations into a format similar to traditional finance that is verified, standardized, and legally accountable. Revolut, through Lithuania’s regulatory authority, now joins a restricted but swiftly growing collection of entities that meet MiCA’s standards. It’s not just about following rules; it’s a strategic benefit.

Once MiCA is fully enforced in 2025, Revolut’s unified authorization will enable it to offer services throughout all EU countries. This indicates a conclusion to national separation, the abolishment of local reapplications, and the resolution of legal ambiguities concerning cross-border users.

In contrast, crypto-native leaders like Binance have faced prohibitions or partial restrictions in several European markets. While exchanges grew swiftly, Revolut is promoting sustainability via structure. The emerging rivalry isn’t about who offers the most coins; it’s about who can stay compliant with the law.

Retail access — The ultimate gateway for everyday users

Revolut’s license most significantly impacts consumers. For years, accessing the crypto space has been riddled with challenges such as complex wallets, KYC hurdles, and unstable exchanges. Revolut removes that inconvenience. Users can buy, hold, or exchange assets directly through the same platform they use for saving and stock trading.

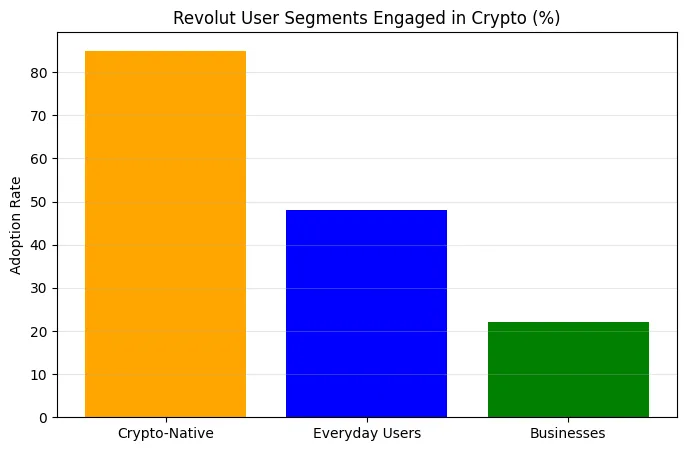

This integration transforms cryptocurrency into a shared experience rather than an expert-only pursuit. Revolut aims to attract everyday Europeans rather than seasoned traders: young professionals receiving salaries, freelancers managing international payments, and small businesses exploring blockchain billing.

According to the company’s internal data, more than 20% of active Revolut users have participated in cryptocurrency trading, with most transactions valued under €200. This implies a steady uptake instead of a fervent speculation. The average user is experiencing exposure to Bitcoin, Ethereum, or stablecoins alongside euros and dollars.

With straightforward regulations, Revolut is now able to expand beyond fundamental trading. It can analyze tokenized equities, global currency transfers, and blockchain-based reward systems while remaining under EU regulation. For the first time, mainstream fintech and cryptocurrency employ the same compliance language.

The competitive ripple effect

Revolut’s early compliance gives it the ability to scale across the EU just as other players are starting their applications. Traditional banks, too, are paying attention. Many have long resisted direct crypto offerings, citing risk and volatility. But as Revolut begins merging deposits and digital assets under one umbrella, banks risk appearing outdated if they don’t follow.

This regulatory clarity could unlock a new form of institutional participation. In the same way neobanks transformed consumer banking, licensed fintechs could redefine what it means to “own” crypto a process less about speculation and more about integration into daily finance.

The wider signal transitioning from compliance to trust

Revolut’s endorsement isn’t just a victory for the firm; it signifies a shift in perspective. The worldwide view of cryptocurrency has been harmed by exchange collapses, scams, and unclear regulations. At present, one of the leading financial applications in Europe is bringing back a sense of trust and order.

This updated model signifies a reassessment of confidence. By integrating crypto within a regulated fintech environment, Revolut transforms it from a separate realm into a conventional financial framework. This indicates that tokenized assets and fiat money can exist together in one portfolio, analyzed under the same regulatory scrutiny.

Source:Generated with Python,revolut’s compliant strategy reflects the transition to “embedded finance” a system where crypto and fiat function effortlessly within a single regulated framework.

The wider significance is that the mainstream adoption of crypto will not arise solely from decentralization; it will emerge from regulated gateways that securely connect both realms. Revolut’s license represents not only a commercial success but also a psychological triumph: it signifies that crypto has developed sufficiently to coexist within the same application as your salary.

The future of digital assets in Europe may be shaped not by groundbreaking innovation, but by dependable accessibility and the seamless incorporation of crypto via applications that millions are already accustomed to.