- The U.S. cryptocurrency market experiences a deficiency in legislative clarity, pushing businesses overseas.

- Regulation based on enforcement has supplanted policy, resulting in fear and fragmentation.

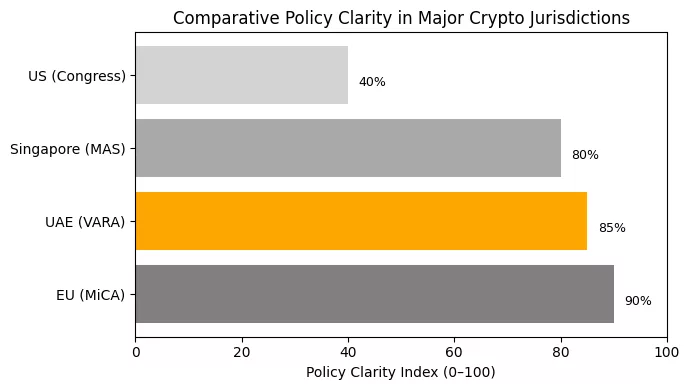

- Global entities such as the EU and UAE have progressed with defined frameworks.

- Market liquidity in U.S. exchanges persists in decreasing due to legal ambiguity.

- Without bold measures, the U.S. could forfeit its position as the hub of financial creativity

For years, the worldwide cryptocurrency industry has sought one thing from Washington: transparency. Instead, it has encountered a deadlock. With the U.S. Congress stuck between conflicting perspectives on digital asset security versus commodities, innovation versus consumer protection, the gap has widened. The lack of thorough legislation hasn’t merely stalled projects; it has transformed the very landscape of crypto influence.

As Europe rolls out the Markets in Crypto-Assets (MiCA) framework and Hong Kong welcomes back digital asset companies, the United States persists with inconsistent enforcement and judicial interpretations. For founders, this isn’t a strategy; it’s a gamble. Every SEC lawsuit or CFTC announcement establishes a precedent in one area of the market while opposing another, generating a confusion where innovation is stifled not by intention but by unpredictability.

The outcome is an exodus of talent. Web3 firms that could have opted for Delaware or New York are establishing their headquarters in Paris, Dubai, or Singapore instead. The message to American business owners is straightforward: create innovations in other locations. Without defined boundaries, compliance turns into speculation, and investment seeks transparency.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Enforcement as policy

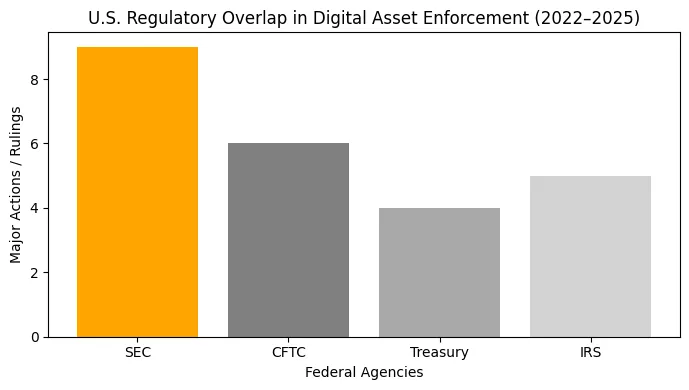

As Congress remains gridlocked, regulators have stepped in, yet their interpretations frequently clash. The SEC has maintained that the majority of tokens qualify as securities based on the Howey Test, while the CFTC argues that digital commodities, such as Bitcoin and Ethereum, are within its jurisdiction. Treasury departments concentrate on combating money laundering and enforcing sanctions, whereas the IRS primarily considers cryptocurrency in terms of taxation.

This disjointed strategy implies that one protocol may be examined by four distinct federal agencies, each applying regulations designed for a different era. The strategy of “regulation by enforcement” has generated a chilling effect.

The 2023–2025 series of lawsuits involving Ripple, Coinbase, and Uniswap highlights the price of uncertainty. Even when companies succeed, they squander important time, investors, and momentum. Rather than establishing standards via legislation, the U.S. has permitted the courts to serve as the effective regulators of a trillion-dollar market.

In contrast, smaller jurisdictions have adopted a fundamentally different approach: establish codes initially, amend afterwards. In 2024, the Virtual Assets Regulatory Authority (VARA) of the UAE established comprehensive licensing processes and sandbox frameworks that drew in numerous crypto companies. Europe’s MiCA framework, while not flawless, provides predictability, a scarce asset in international finance

.

The market fallout

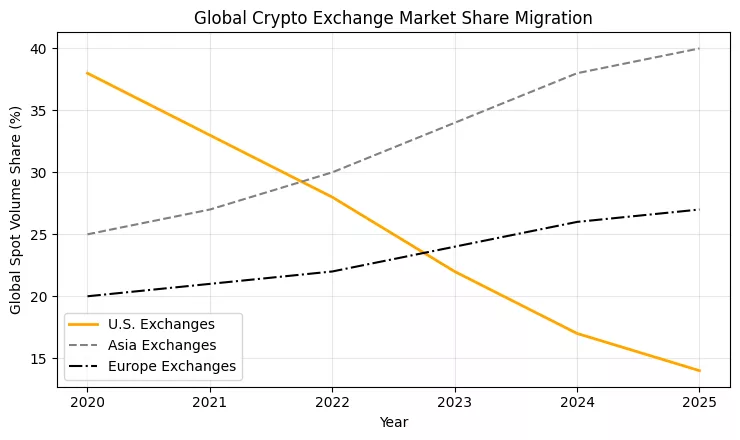

Markets fear uncertainty more than regulation alone. With U.S. policy stalemate persisting, liquidity in exchanges based in the U.S. has consistently diminished. A 2025 study by Kaiko revealed that the share of global spot volume for U.S.

Institutional investors have modified their tactics as well. Rather than waiting for clarity from Congress, they have redirected their investments to tokenized treasuries, regulated stablecoins, and offshore funds. The emergence of organizations such as BlackRock’s BUIDL fund and Tether’s substantial U.S. debt investments illustrates a paradox: the most secure assets in crypto presently are not supported by American policy but by private firms working around it.

Conversely, retail investors encounter a disjointed environment. In the absence of defined registration or custody regulations, U.S. exchanges tend to either remove tokens from their listings or restrict staking and yield services to avoid enforcement issues. The outcome: American users face limited choices, increased costs, and slower advancements.

The irony is evident; the nation that originally developed the Internet now risks marginalizing itself from Web3. Nonetheless, Washington continues to be caught up in political drama. Hearings attract attention, yet no legislation becomes law.

Global ripple effects

The U.S. standstill resonates throughout international markets. Dollar-backed stablecoins, for example, continue to serve as the foundation of worldwide crypto liquidity. However, the firms behind them Tether, Circle, and PayPal now function under increasing global scrutiny since U.S. lawmakers are unable to reach a consensus on how to regulate them domestically.

This has prompted nations such as Singapore, the UAE, and Switzerland to take action. By creating distinct legal definitions for stablecoins and DeFi platforms, they have established themselves as impartial refuges for liquidity. Capital, talent, and compliance teams that previously focused on Silicon Valley are now heading east.

The result is not merely a change in geography but also a shift in philosophical perspectives. The U.S. remains focused on cryptocurrency in terms of protecting investors and managing systemic risk, whereas Asia and Europe regard it as a tool for enhancing competitiveness. As this gap expands, the international market faces the danger of fragmentation, a scenario where cross-border token transfers are regulated not by global agreement but by local understanding.

Decoding Web3: The internet’s latest revolutionDecoding Web3: The internet’s latest revolution

If there’s one constant in technology, it’s that innovation doesn’t wait for permission. And as Congress stalls, code continues to evolve. Layer-2 rollups, DeFi protocols, and tokenized RWAs (real-world assets) have outpaced the very definitions regulators are arguing about. The U.S. now faces a critical inflection point: either legislate and lead, or hesitate and watch others dictate the standards.

Signs of optimism are emerging as bipartisan initiatives such as the Financial Innovation and Technology for the 21st Century Act (FIT21) and the Lummis-Gillibrand Responsible Financial Innovation Act have come back into conversation. Still, these proposals face the danger of being overshadowed by politics due to the dominance of partisan priorities during election seasons.

Currently, the market has adjusted. Developers have distributed their teams, legal structures, and governance frameworks to stay “jurisdiction-neutral.” Firms in the U.S.

But the price of delay is rising. Every month without clarity cements the U.S.’s reputation as a regulatory laggard a jurisdiction where innovation must defend itself in court before it can serve users in the market.

However, the cost of postponement is increasing. Each month of uncertainty solidifies the U.S.’s image as a regulatory laggard, a place where innovation must fight legal battles before being able to serve users in the marketplace

The worldwide cryptocurrency landscape is changing, not due to ideology but through momentum. The U.S. continues to possess the financial structure, venture funding, and intellectual resources to lead, but leadership today demands legislative bravery instead of legal conflicts.Until that time, the future of finance will persist in shifting offshore, driven by algorithms that acknowledge no legislative body.