- AI agents are changing crypto from responsive trading into self-sustaining economic ecosystems.

- Autonomous systems currently oversee liquidity, carry out trades, and enhance portfolios without human intervention.

- Blockchain offers a clear framework for AI agents to engage in transactions and conduct audits on one another.

- Regulation finds it challenging to establish accountability in finance powered by AI.

- The future could be dominated by autonomous machine economies driven by blockchain technology.

The growth of automated intelligence in finance

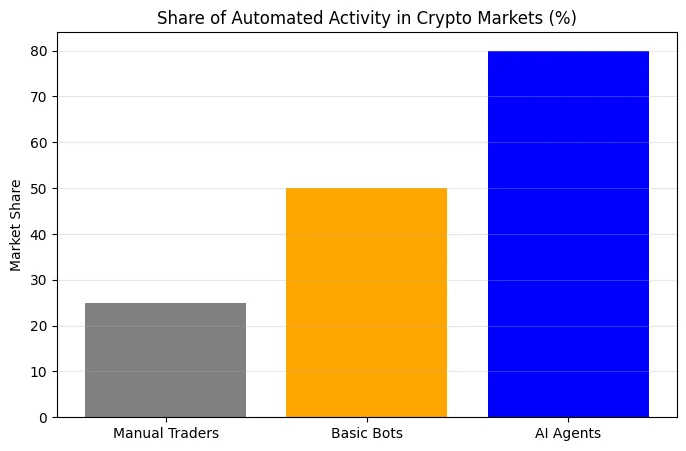

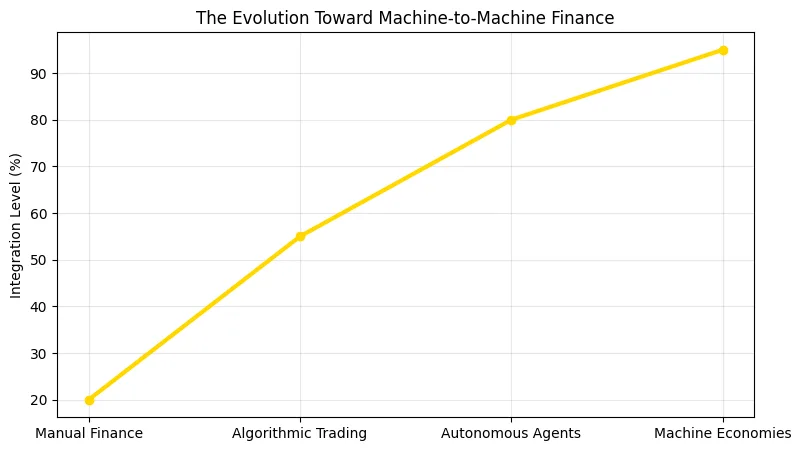

In the early days of crypto, automation was straightforward trading bots that carried out arbitrage or momentum tactics. By 2025, those scripts have transformed into self-sufficient intelligent agents: AI systems that assess market conditions, conduct transactions, and modify portfolio strategies independently of human involvement.

These agents not only comply with commands; they also make choices. Leveraging blockchain technology, they engage with smart contracts, retrieve decentralized data via oracles, and employ machine learning to forecast liquidity changes or pricing discrepancies.

The distinction is crucial early bots responded, today’s agents analyze. Initiatives such as Fetch.ai, Autonolas, and SingularityNET lead this transformation, building digital economies in which AI agents function as autonomous entities. They exchange, bargain, and also compensate for data or computing resources utilizing on-chain tokens.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This marks the beginning of machine-to-machine finance, in which code serves as both capital and intelligence

How AI agents are reshaping market dynamics

In conventional finance, algorithmic trading accounts for over 70% of U.S. equity transactions. In the realm of cryptocurrency, AI agents are extending that limit even more. Since blockchain markets function around the clock, these systems are always active.

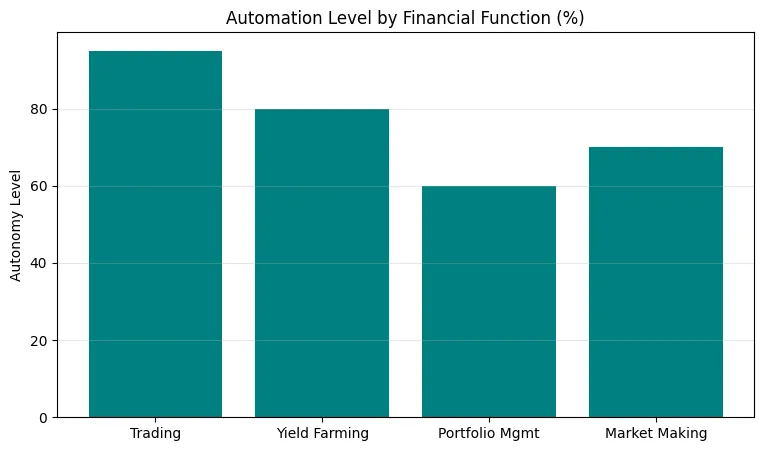

AI agents currently analyze numerous tokens instantaneously, assess sentiment changes from on-chain and social information, and modify exposure autonomously. Some also participate in cross-protocol arbitrage, transferring assets among decentralized exchanges to take advantage of small price differences entirely without human intervention.

In addition to trading, agents also serve as liquidity managers. They invest assets in yield protocols during times of increased volatility and exit positions when funding rates become negative. This degree of self-governing control is creating an additional layer of market efficiency while also introducing unpredictability.

An analyst pointed out, “The next flash crash may not stem from panic but from an overreaction by AI.” Although these agents are smart, they function based on probabilistic models that can increase volatility when several systems align on the same decision-making logic.

Autonomous finance when code manages capital

The real breakthrough occurs when AI agents start overseeing not only individual trades but also complete portfolios. By means of reinforcement learning, agents can enhance strategies focusing on long-term outcomes instead of immediate rewards.

Decentralized funds are currently testing this approach. Asset managers leveraging smart contracts utilize AI algorithms to rebalance tokens, modify risk exposure, and reallocate among DeFi protocols independently of central authority. Essentially, the code is now the portfolio manager.

This results in both effectiveness and moral challenges. Who bears responsibility if a fund driven by AI causes market instability? How do regulators assess an algorithm that learns and evolves on its own?

The European Union and the U.S. SEC are starting to explore new structures for accountability of AI in financial systems. However, blockchain introduces complexity these agents are frequently open-source and internationally dispersed, lacking a single authority or operator for regulation.

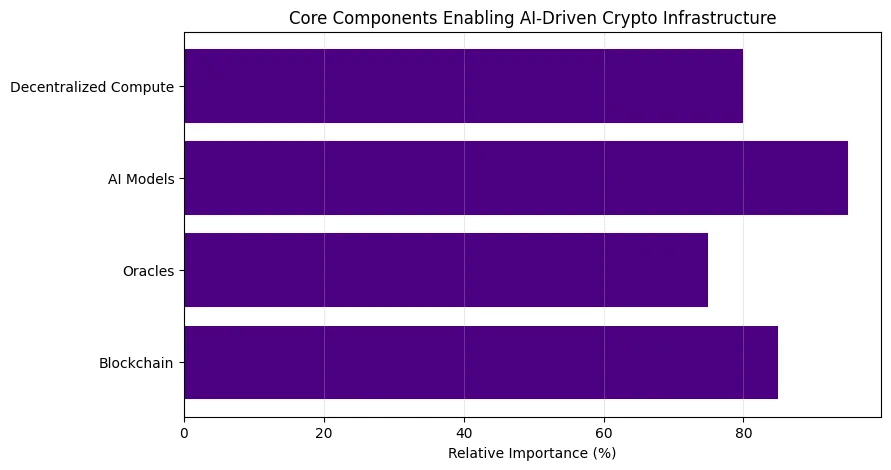

The framework of smart markets

Intelligent agents depend on a linked infrastructure comprising data, computing power, and on-chain accessibility to operate effectively. Oracle networks such as Chainlink supply real-time data to AI models, while decentralized computing platforms like Render or Akash offer the processing power needed to train and implement them.

Simultaneously, blockchain functions as both a ledger and a legal framework documenting every action performed by an AI while implementing regulations via smart contracts. The integration creates a self-regulating framework in which AI agents exchange transparently and unchangeably.

The collaboration is also financial: AI agents compensate one another in crypto tokens for services like data analysis or model inference. This establishes a new marketplace for machine economies, where digital entities trade value as independently as humans.

What started as “automated trading” is transforming into a dynamic network of smart economic agents each playing a part in an economy that no individual entirely governs.

The incoming age of machine-to-machine finance

What occurs when countless AI agents oversee vast amounts of value trading, lending, and insuring without the need for human signatures? The consequences extend beyond markets.

Finance between machines could facilitate entirely self-sufficient supply chains, where AI logistics agents transact with one another for energy, bandwidth, or materials. It might transform insurance, as AI systems would adjust risk pricing in real time based on current data.

However, alongside that assurance arises a significant obstacle: confidence in the purpose of machines. As these systems become increasingly intricate, even those who developed them might not completely grasp every decision executed on-chain. Transparency will arise not from supervision, but from behavior that is verifiable and encoded.

Crypto started as an initiative for monetary independence. The subsequent stage could involve a balancing act between human control and algorithmic autonomy merging feelings with calculations.

As intelligent agents transition from bots to bankers, the issue is not whether they will engage in the markets, but rather how much of the market will be theirs.