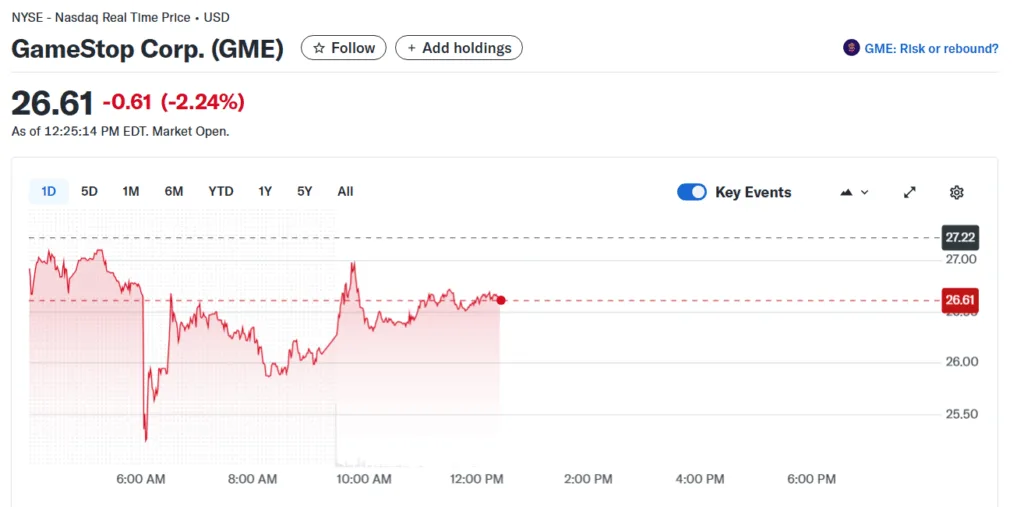

- GameStop’s stock fell by over $2 to ~$26.66 as investors grew wary about the upcoming special dividend in the form of warrants.

- The company plans to distribute ~59 million warrants to shareholders on October 7, 2025, for those holding shares as of October 3.

- Each warrant gives the right to buy one share at $32 until October 30, 2026.

GameStop surprised many in its last quarter by reporting stronger-than-expected revenue, largely propelled by a Pokémon-style promotional event that drew foot traffic and boosted sales. The momentum around collectibles managed to give it a revenue beat, but is Wall Street convinced by its overall strategy? The stock has come under pressure on Friday, mostly because of the upcoming dividend payout expected next week. GameStop stock was down over 2$ at $26.22.

Source: Yahoo Finance

On or around October 7, 2025, GameStop plans to distribute up to ~59 million warrants to shareholders who held shares as of the record date, October 3, 2025. These “special dividends” are in the form of warrants, giving shareholders the right to buy more stock at $32 per share. While this is intended as shareholder-friendly, it introduces concerns about dilution. If the stock rises above $32 and many warrant holders exercise, new shares could be issued, diluting existing ownership.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

After the distribution, these warrants are expected to be tradable on the NYSE under the ticker “GME WS” without needing any action from shareholders. If all warrants are exercised, GameStop could raise gross proceeds of up to $1.9 billion, which the company said it would use for “general corporate purposes.”

GameStop’s crypto pivot still questionable

Moreover, GameStop recently filed a mixed securities shelf registration with the SEC, which gives the company flexibility to issue new debt or equity in the future. That has spooked the market, as investors interpret it as a signal of potential future dilution or capital raise.

Additionally, in earlier quarters, GameStop unveiled large convertible notes or debt offerings aimed in part at funding Bitcoin purchases, which also raised skepticism about its strategy and risk profile. This strategic shift in GameStop’s business model has added uncertainty about where the core retail operations will fit in the long term.

The market is divided on whether the valuation premium is sustainable. Investors are left weighing whether the current share price already reflects much of the upside, or whether there’s still room for revaluation.