Gold continues to climb in public markets, reaching an all-time high of $3,900 per ounce on Monday as investors opt for the safe-haven asset class amid uncertainty due to the U.S. government shutdown and the possibility of further rate cuts, as per a Reuters report.

Alongside the rise in price of gold, silver has also hit an all-time high of $48.64 per ounce, according to Whale Insider.

Bitcoin has been on a surge as well, briefly crossing the $125,000 mark before retreating on the same day.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

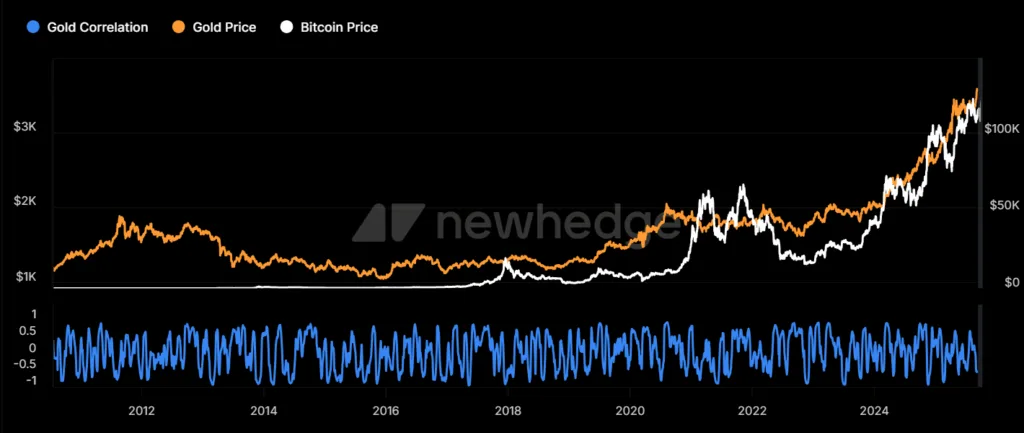

Typically, gold and Bitcoin have exhibited different price behaviors, where the price of the digital asset would often move in a volatile manner, while the commodity price would shoot up in times of uncertainty. A chart by newhedge.io shows that since 2024, the price of Bitcoin and Gold have both been increasing.

Source: newhedge.io

A note by JP Morgan analysts suggested that while Bitcoin could touch $165,000 by the end of the year, it still remains undervalued when compared to gold after adjusting for volatility, according to The Manhattan Times.

The U.S. government shutdown began on October 1st, 2025, after a stopgap funding bill failed to pass through Congress. Public sector employees will be working without pay for the duration of the shutdown, impacting hundreds of thousands of roles.

“When the government shuts down, key economic data does not release. This increases uncertainty. Uncertainty leads to demand of safe haven assets and gold is a prime example and hence it should lead to a price increase. Essentially, a data vacuum by a government shutdown creates a flight to safety due to heightened uncertainty,” said capital markets professional Jimeet Gandhi.