Global equities rebounded over the weekend after a dramatic sell-off on Friday, when President Trump threatened to impose an additional 100% tariff on goods from China. The move, announced via a Truth Social post, reignited U.S.–China trade tensions and rattled markets.

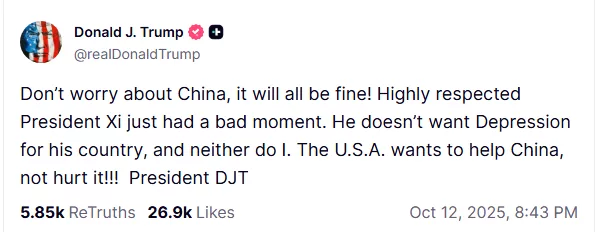

But by Sunday, leadership from both sides appeared to dial back the heat. It started with China’s commerce ministry offering to ‘strengthen dialogue’ and consider exemptions in its rare earth export controls. In turn, Trump softened his tone by posting on his Truth Social stating, “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment.”

Markets continue to feel the heat

The calmer language from both sides came as a market relief, as U.S. equity index futures popped over 1 %. Analysts interpreted the shift not as a retreat but as a negotiation posture. On Monday morning, however, Asia-Pacific markets fell, with Hong Kong’s Hang Seng index declining 2.22%, while mainland China’s CSI 300 traded 2.73% lower, according to CNBC.com.

Meanwhile, European markets are said to open higher, brushing off the U.S.-China trade spat. Most major indices in Europe, like the FTSE, CAC and DAX, are indicating a positive start to the week according to data from IG.

Simon Peters, market analyst, commented:

“Friday’s reaction shows the crypto market is extremely sensitive to geopolitical developments, but the resilience of institutional investors highlights growing maturity in the market. While retail traders were heavily impacted, ETFs like IBIT show that professional money is holding steady, which bodes well for recovery.”

From trade war to rhetorical truce

The U.S. and China have long traded escalating tariffs and counters in a broader strategic rivalry over tech, supply chains, and economic dominance. Earlier in 2025, Trump introduced sweeping “Liberation Day” tariffs across many trading nations. Then China hit back with retaliatory duties, and tensions flared.

By mid-2025, the U.S. and China struck a tentative truce: tariffs on Chinese goods were cut to ~30%, and China reduced tariffs on U.S. goods to ~10%, set to hold for 90 days.

The most recent flare was sparked by China’s export restrictions on rare earth minerals, critical inputs in tech, defense, and green energy supply chains. The U.S. responded with new tariff threats and controls on ‘critical software.’

What the softening rhetoric might mean for US-China ties

Now by softening its stance, China is hinting it might ease some of its export rules and is open to talks. It shows that it wants to calm tensions with the U.S. without giving up its key advantages. Meanwhile, Trump’s friendly message could be a smart move to boost the markets before the November 1 deadline.

Some analysts view this as classic ‘shock and negotiate’ strategy. Still, neither side is stepping away from core demands just yet. Many are seeing this as a matter of who will bend first. Market observers will keep their guard up, trying to avoid another major crash like that of October 10.