- Tariffs, supply chain shifts, and a retreat in Chinese demand have Apple investors looking for reassurance.

- AWS continues to drive profitability as Amazon ploughs ahead with major AI and cloud-oriented capital expenditure.

- Strong Amazon Prime Day resulted in $24.1 billion in U.S. sales, suggesting resilient consumer demand.

As the tech sector braces for a critical earnings week, Apple and Amazon are under intense scrutiny from investors eager for clarity on shifting economic headwinds and AI execution.

Apple: crucial earnings moment

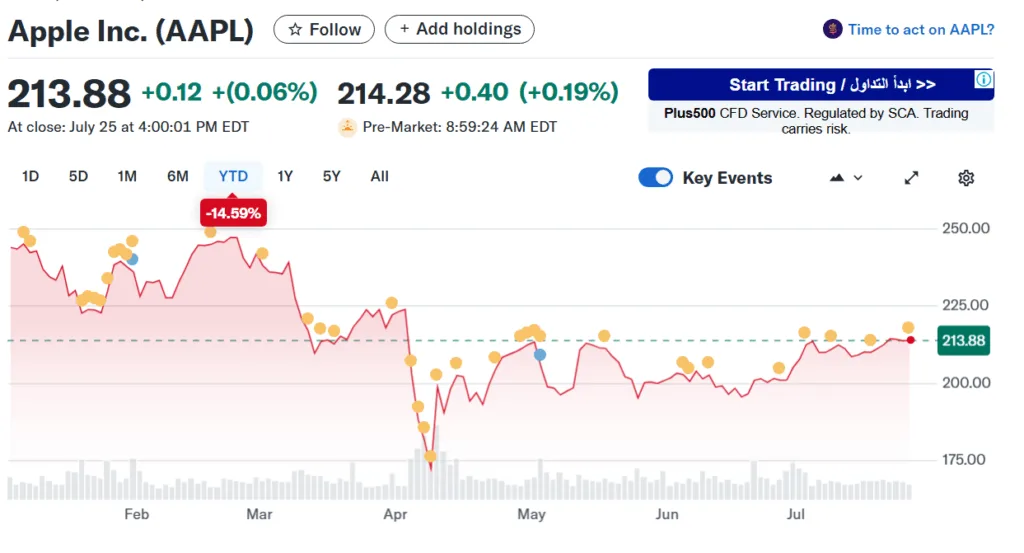

Apple’s shares are down about 15% year-to-date, heightening investor anxiety around its upcoming quarterly results. A major concern is the impact of new U.S. tariffs on China-produced devices; analysts warn that these could shave roughly $900 million off profit this quarter. In response, Apple is accelerating its production shift to India and Vietnam to mitigate exposure. With a strong 47% gross margin last quarter, the company is seen to retain pricing leverage that could absorb added costs.

Attention now turns to Apple’s artificial intelligence roadmap. At its June developer conference, the company offered only limited AI insight, fueling speculation that it may be falling behind peers. Investors expect updates on Siri enhancements, on-device AI features, or new research investments.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

eToro Market Analyst Josh Gilbert commented: “Outside of AI, product and service demand remains in focus. iPhone sales are forecast to reach around $47 billion, though ongoing weakness in China may weigh on performance.” He added that recent releases like the 11th-gen iPad and M4 MacBook Air may bolster results for Mac and iPad segments, and any hints on the upcoming iPhone 17 will be closely watched.

Amazon: Cloud dominates the narrative

Amazon’s earnings hinge on two powerhouse segments: Amazon Web Services (AWS) and its retail operations. AWS posted a hefty $11.5 billion in operating income, with nearly 40% margins. The company has committed around $100 billion in capex for 2025, focusing on expanding AI and cloud infrastructure. Analysts and the market will look for signs of rising cloud demand and capital appetite, particularly in AI-driven services.

On the retail front, Amazon’s push for efficiency is evident — cutting 27,000 jobs and restructuring its fulfillment network has raised North America retail margins to 6.2%, up from 5.8% a year prior. Automation remains central, with over 750,000 robots already deployed and more AI enhancements expected. Strong Prime Day results—$24.1 billion in U.S. sales—suggest resilient consumer demand. The key question: will Amazon sustain this momentum into the rest of the quarter?

Despite current challenges, Apple remains a major player—but may no longer be the standout of the ‘Magnificent Seven’ tech stocks. And as the world’s largest cloud provider, Amazon must show it’s not just keeping pace in the AI race, but setting the standard.