- DeFiLlama has removed Aster’s perpetual futures volume data due to suspicious trading patterns mirroring Binance’s volumes.

- The delisting has led to a 10% drop in Aster’s native token, ASTER, reflecting investor concerns.

- Upcoming airdrop events and whale activity may influence Aster’s market dynamics.

Aster, a decentralized exchange (DEX) that has rapidly gained traction in the perpetual futures market, is under scrutiny. This comes on the back of DeFiLlama’s decision to delist its perpetual futures volume data, due to concerns about potential wash trading. The move has raised questions about data integrity and transparency in the decentralized finance (DeFi) ecosystem.

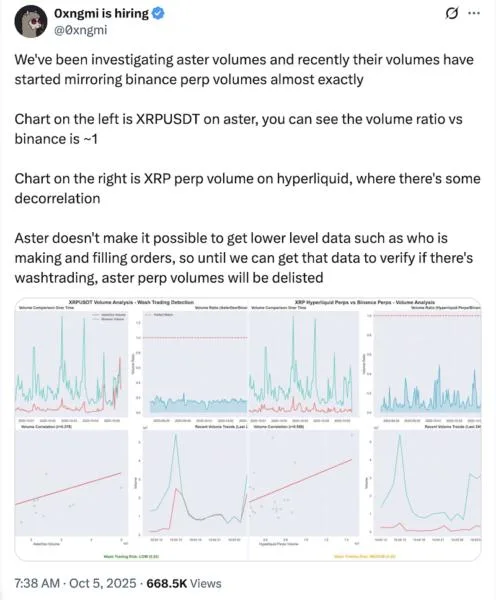

Wash trading involves executing trades that cancel each other out to create misleading market activity. DeFI Llama’s pseudonymous founder, who goes by the Twitter handle 0xngmi, pointed out that there was a striking correlation between Aster’s trading volumes and those of Binance’s perpetual futures markets. He highlighted that trading pairs like XRP/USDT and ETH/USDT on Aster exhibited near-identical volume patterns to Binance’s, suggesting potential wash trading or synthetic replication.

The mirror effect

He pointed to the lack of transparency as Aster’s platform doesn’t provide detailed order-level data, making it challenging to verify the authenticity of the trading volumes. He also rubbished rumours that the analytics platform was paid to list or delist anything. He went on to clarify that he has ‘never held any position (long or short) on either HYPE or ASTER’

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This is also not the first time that Aster has misrepresented data. In an earlier instance, Aster’s revenue data didn’t exclude rebates given to users, which had led to inflated numbers. That’s why DeFiLlama had delisted them silently, but it led to conspiracy theories that the analytics firm had gotten ‘some backroom deals’. What is even more concerning is that Aster counts Changpeng “CZ” Zhao, the Binance co-founder, as one of its advisors, making the issuer more murkier.

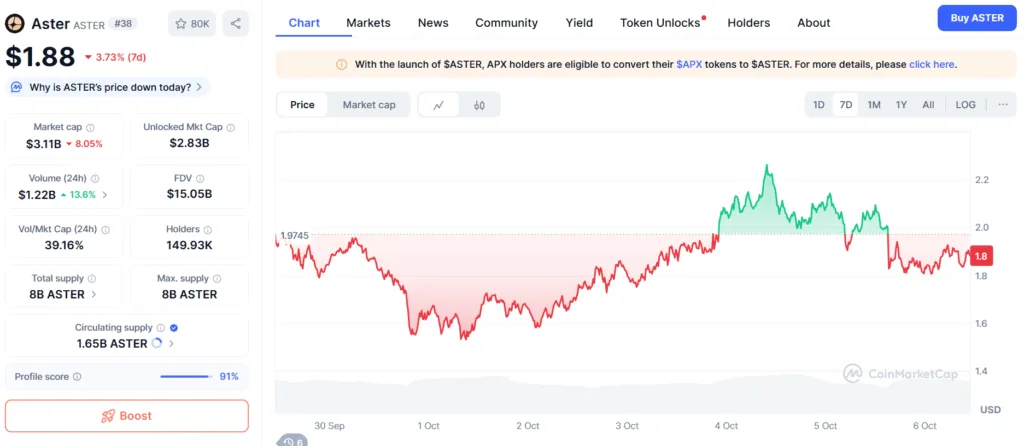

Aster’s token drops 10% after delisting Perp data

Following the delisting, Aster’s native token, ASTER, experienced a significant decline, dropping over 10% to approximately $1.92. The downturn reflects investor apprehension regarding the authenticity of Aster’s trading volumes and its market credibility.

But despite the challenges, Aster is set to launch its Stage 3 (Aster Dawn) upgrade, introducing new reward mechanisms. Additionally, an upcoming airdrop event will release 4% of Aster’s total supply (320 million tokens) without a vesting period, potentially influencing market dynamics and investor sentiment.