- August 15 marks a critical deadline in the Ripple vs. SEC lawsuit, possibly triggering a final resolution phase.

- Analyst Zach Rector believes XRP is undervalued due to widespread disbelief within the community.

- A legal resolution combined with potential ETF approval could push XRP to $10–$20 within a year.

After nearly five years of legal back-and-forth, the Ripple vs. SEC lawsuit may be entering its final phase. On August 15, 2025, both parties are scheduled to file status updates related to their appeals. According to legal observers, this procedural step could mark the beginning of a final resolution especially if both sides signal a willingness to settle or withdraw.

Former SEC attorney Marc Fagel confirmed in a recent statement that the appeal process is “nearing its end,” reinforcing the belief that the legal overhang on XRP may soon be lifted. If appeals are dropped or dismissed, it would close one of the most closely watched regulatory cases in crypto history.

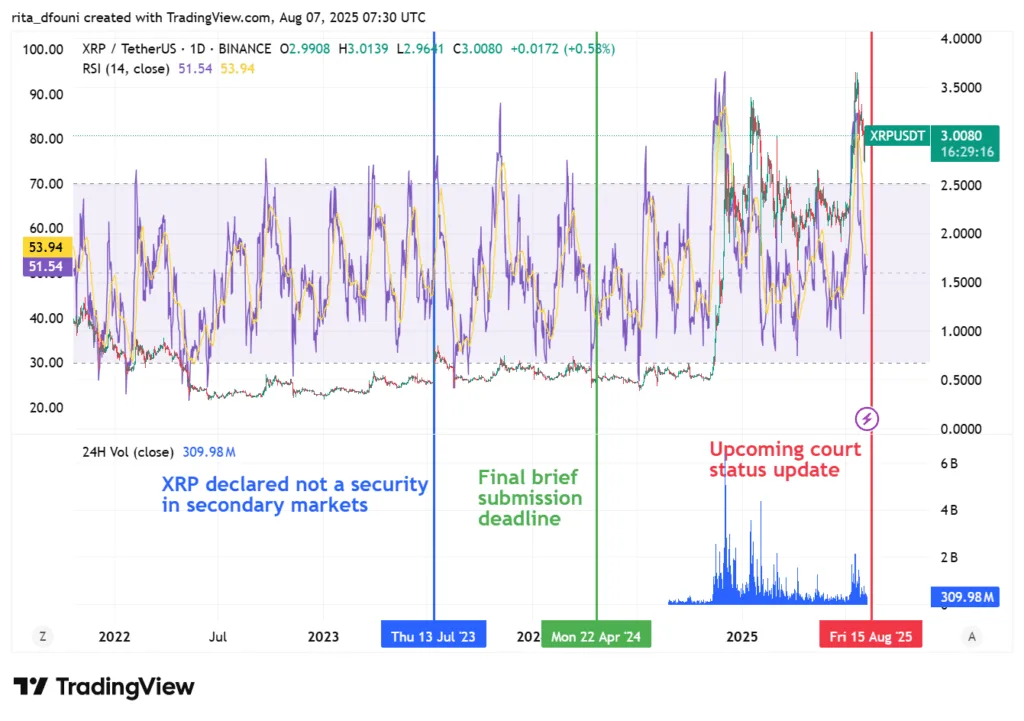

XRP/USDT daily chart with RSI and volume overlays. Historical legal events such as the July 2023 ruling and April 2024 filing deadline have corresponded with increased market activity. The August 15 update could represent the next major inflection point.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Community disbelief creates “market disconnect”

Despite the weight of this upcoming legal milestone, many XRP holders remain skeptical that a resolution is near. This widespread doubt, according to crypto analyst Zach Rector, has created what he calls a “market disconnect” a gap between investor expectations and the true potential impact of the Ripple vs. SEC lawsuit.

While XRP price surged in recent weeks, the RSI remained relatively flat indicating a possible bearish divergence. The highlighted stagnation zone reflects trader indecision ahead of the August 15 court status update.

In a recent post on X, Rector stated: “SEC vs Ripple/XRP Case Conclusion is NOT priced in. Everyone is in disbelief that it could actually end…” This, he argues, presents a rare opportunity for early movers. The fact that “XRP is still trading below $3”, he adds, “doesn’t reflect what’s potentially around the corner,” particularly as the August 15 status update could mark a pivotal moment in the nearly five-year legal battle.

A full resolution could finally remove the regulatory cloud that has weighed on XRP for years. Legal clarity would not only benefit Ripple but also set precedent for how other digital assets are treated under U.S. law potentially clearing a path for new products and institutional engagement.

Bullish outlook: could XRP reach $10–$20?

Based on current market analysis, XRP could potentially surge to $10–$20 over the next 12 months, contingent on two major catalysts: the legal resolution of the SEC case and the possible approval of a spot XRP ETF. These events are expected to unlock institutional capital, trigger renewed retail interest, and elevate XRP’s legitimacy within the broader financial system.

This projection is supported by technical indicators, sentiment patterns, and historical price behavior, all of which suggest a significant undervaluation in the current market. To reinforce this assessment, we will include detailed price action graphs and trend analyses that clearly illustrate the opportunity forming beneath the $3 mark.