- Bitcoin hit a new all-time high of $126,223 during U.S. trading hours on October 6th, but pulled back to $124k levels by Tuesday.

- The overall cryptocurrency market capitalization reached an all-time high of $4.4 trillion, driven by Bitcoin’s performance.

- Bitcoin-related stocks like Hive Digital surged 23%, followed by Bitfarms with a 14% gain, and Riot Platforms up 10% in trade.

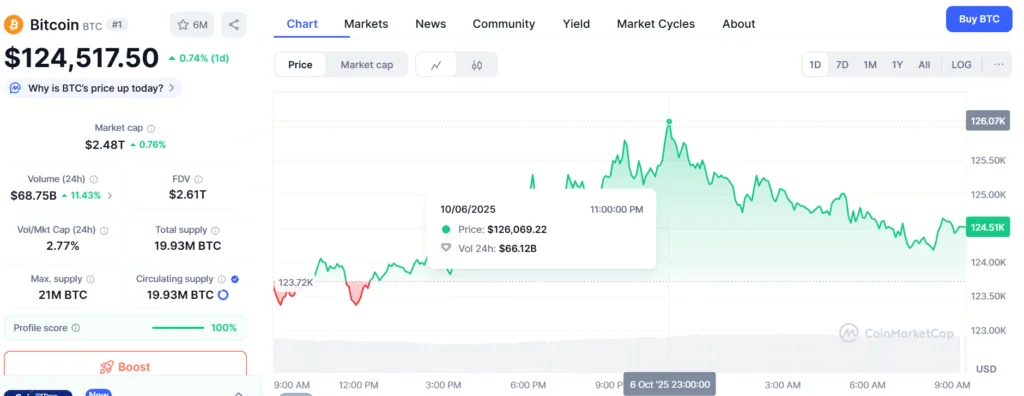

After briefly touching $125,000 on Sunday before pulling back, Bitcoin regained its momentum on Monday to hit a new all-time high of $126,223 during U.S. trading hours. The largest cryptocurrency is up over 0.69% in the last 24 hours and is consolidating around the $124,600 levels on Tuesday morning.

Source: CoinMarketCap

This surge has been attributed to factors such as institutional interest, favorable macroeconomic conditions, and a weakening U.S. dollar. Analysts are closely monitoring Bitcoin’s price action, noting key resistance levels around $125,000. Some forecasts suggest that if Bitcoin can maintain its momentum, it could reach as high as $145,000, based on historical patterns and on-chain data.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Industry experts are expressing optimism about the current market conditions. Anthony Pompliano, a prominent crypto investor, noted that the recent surge in Bitcoin’s price is indicative of a broader institutional adoption trend. He his X video, he speaks of how Bitcoin and Gold will be the biggest beneficiaries of ‘Debasement Trade’. Adding that the ‘next 12 weeks are bitcoin’s time to shine’.

Breakout fuels a surge in Bitcoin mining stocks

And it’s not Bitcoin alone that is soaring high. With BTC touching $126,000, it pumped up shares of Bitcoin-related firms across the board. Hive Digital led the pack with a 23% jump, trailed by Bitfarms at 14%, Riot Platforms at 10%, and both MARA and CleanSpark up roughly 7% on Monday.

While the bullish BTC momentum has taken them so far, stronger fundamentals in the mining space are making investors greedy for more. Companies like Hive, Marathon, and CleanSpark have recently scaled up their hashrate and grown their bitcoin reserves. MARA and CleanSpark now hold over 52,000 BTC and 13,000 BTC, respectively, while Hive notched fresh monthly production records.

Crypto M-cap reaches record levels

The cryptocurrency market capitalization also hit a new record, reaching $4.4 trillion. This growth is largely driven by Bitcoin’s performance, but other major cryptocurrencies have also seen significant gains. Ethereum, for instance, has made its own ATH, reaching a high of $4,735.04, a three-week high. Analysts are projecting a potential rise towards $5,000, with some even forecasting a climb to $7,500 by the end of 2025. Strong ETF inflows and bullish technical patterns support this upward journey for Ethereum.

XRP has also shown resilience, maintaining a steady price above $2.95. It has gained +0.67% in the last 24 hours. Analysts are closely monitoring breakout patterns here. Keeping resistance levels around $3.05.

Solana is trading cautiously ahead of its big week of upgrades. Currently trading at $234.15 with gains of over 2% in the last 24 hours, the network’s scalability and low transaction fees continue to attract interest. Even though it’s currently 20% below its all-time high, analyst have raised their price target to $300 for Solana as Remittix growth is expected to exceed 5,000% in Q4.

Dogecoin is the standout star, witnessing the biggest rally with gains of over 5.5% in the last 24 hours. The rise could be attributed to increased trading volumes and renewed interest in meme coins. Analysts suggest that DOGE could break through the $0.30 level in the coming weeks, fueled by rising open interest and whale activity.