- Coinbase is set to introduce its Mag7 + Crypto Equity Index Futures on September 22, 2025, expanding its derivatives offerings.

- The index combines the “Magnificent 7” tech stocks plus Coinbase’s own COIN and 2 major crypto ETFs.

- Each of the 10 components will have 10% weightage and quarterly rebalancing.

In an attempt to blend traditional finance with the growing world of digital assets, Coinbase has announced the upcoming launch of its Mag7 + Crypto Equity Index Futures. Set to debut on September 22, 2025, this new offering from Coinbase Derivatives aims to provide traders with a unified tool. The hybrid investment product will capture the performance of both high-growth equities and cryptocurrency exchange-traded funds (ETFs).

Index composition

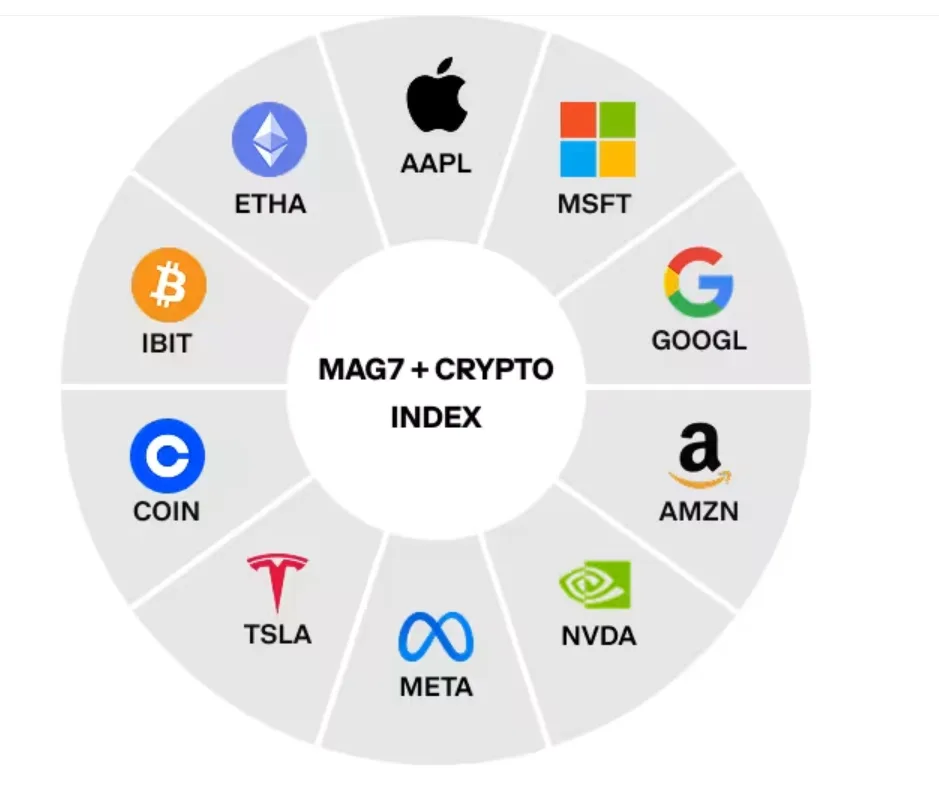

The Mag7 + Crypto Equity Index Futures represent a first-of-its-kind contract that combines exposure to the so-called “Magnificent 7” stocks. For the uninitiated, these include Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla. The index will also feature Coinbase’s own stock (COIN) and leading crypto ETFs, including the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA).

Courtesy: Coinbase

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

This even-weighted index, where each of the 10 components starts at 10%, will be rebalanced quarterly to maintain balance, with MarketVector serving as the official index provider. By packaging these assets into a single futures contract, Coinbase is addressing the growing demand for diversified, theme-based investments focused on innovation and blockchain technology.

Traders to benefit from diversified exposure

Traders will be interested in this product as it offers them thematic access to transformative technologies and growth-oriented assets, which otherwise would have to be added to portfolios separately. It’s built to promote built-in diversification, allowing investors to manage risks across asset classes more effectively and hedge portfolios with greater capital efficiency.

Initially available through partner platforms, Coinbase plans to extend access to retail users in the coming months. This will be monthly, cash-settled contracts valued at $1 times the index level.

As regulatory environments continue to adapt, products like the Mag7 + Crypto Equity Index Futures could redefine how investors approach multi-asset portfolios. It will bring with it the stability of blue-chip stocks with the high-potential upside of cryptocurrencies.