- Tesla’s global deliveries fell 13.5% year-over-year in Q2 to 384,122 units, missing analyst expectations.

- eToro analyst sees Q2 revenue drop of 11% and EPS down 20% but will also look out for cost-cutting measures, and long-term vision.

- Investors to raise concerns about CEO Elon Musk’s growing political ambitions and efforts to fund xAI using Tesla resources.

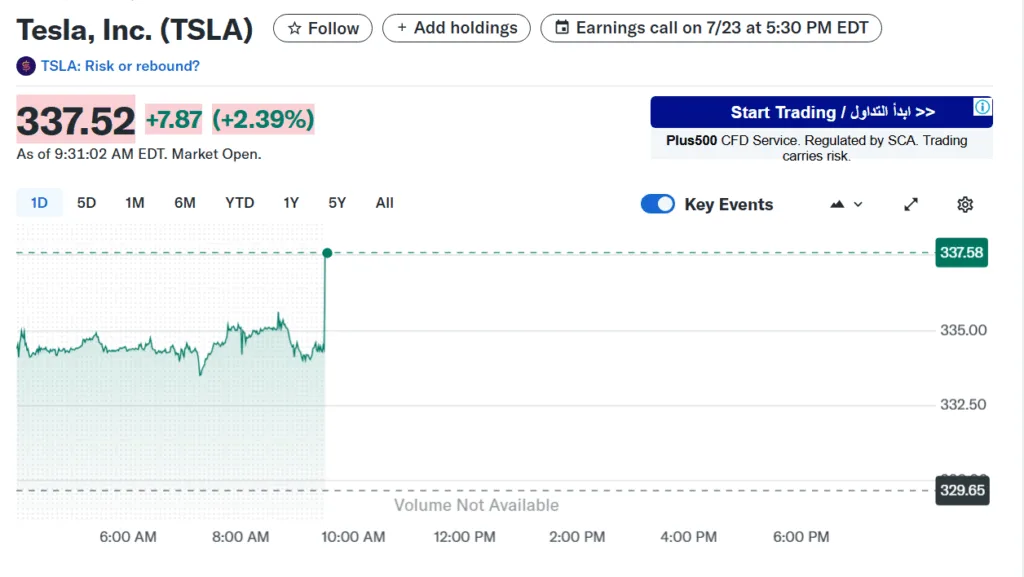

Tesla is getting ready to report its second-quarter earnings this Wednesday (July 23), but expectations are low. Investors are worried about slowing car sales, unclear business direction, and CEO Elon Musk’s growing list of distractions, lamented Josh Gilbert, Market Analyst at eToro.

“Even if Tesla delivers a solid set of numbers, it’s unlikely to escape heavy scrutiny when it reports earnings,” said Gilbert. “The optimistic scenario is that cost-cutting efforts and developments in AI and autonomy provide some relief. But realistically, expectations are low.”

Dwindling sales a worry

Even if the earnings look decent, the company is unlikely to avoid tough questions. Tesla’s car deliveries dropped 13.5% from last year, totaling 384,122 vehicles, which didn’t meet analysts’ predictions. The Cybertruck, once hyped, has now seen three straight quarters of falling sales, hitting a one-year low.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Musk’s side ventures stir doubts

Another concern is Elon Musk himself. Once seen as Tesla’s biggest asset, his growing political involvement and interest in other ventures—like funding his AI startup xAI using Tesla’s money—are making investors uneasy. “His recent moves toward founding a U.S. political party and attempts to tap into Tesla’s cash reserves to fund his private AI company, xAI, may not sit well with investors seeking more stability and focus at the helm,” Gilbert noted.

That said, Tesla still leads the electric vehicle market and continues to invest in self-driving technology, especially through its Robotaxi project, a key part of its future vision. However, progress has been slow, and investors are losing patience with repeated delays.

And if you were to consider Tesla stock performance, it is expensive compared to other automakers, valued at 20x that of General Motors. Without strong results, this high valuation becomes harder to justify.

Despite the challenges, Tesla remains one of the most popular stocks among everyday investors, ranking second globally on eToro. Analysts expect Q2 earnings of $0.44 per share, down 20% from last year, and $22.8 billion in revenue, an 11% drop.

As Gilbert puts it, “Tesla’s still solid, but this earnings call could be critical. Elon Musk needs to bring his A-game to restore confidence.”