- RAKBANK’s YTD profit before tax reached AED 2.3 billion, up 23% year-on-year.

- In H1, the bank reported profit before tax of AED 1.5 billion, up 26% from a year ago.

- The robust growth was driven by fee income diversification, improving credit metrics, and expanding deposit base.

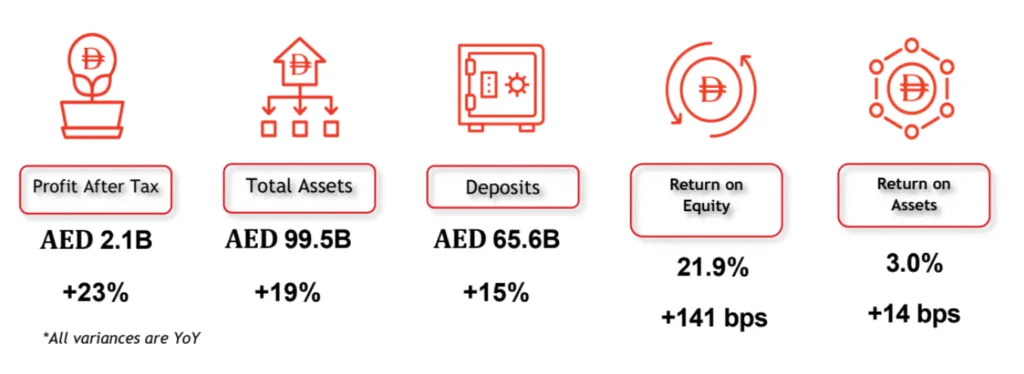

RAKBANK has announced a year-to-date profit before tax of AED 2.3 billion, marking a robust 23% increase year-on-year (YoY). This highlights the bank’s momentum in the UAE’s competitive banking sector.

RAKBANK’s results are being driven by growing non-interest income, improved asset quality, and strategic expansion of its loan book. The bank’s net interest margin saw a rise of 4.3% while a 32% (YoY) growth in non-interest income. The NII was driven by wealth management, FX, and trading momentum. The bank’s balance-sheet growth and high CASA ratio of 66% also supported its robust performance.

The bank also noted that its impairment loan ratio has improved to 1.7% from 2.2% for the same period last year, and CAR ratio remains at 19.6%, well above regulatory requirements. Moreover, shareholder returns have improved, with return on equity at 21.9% up from 20.5% and return on assets at 3.0% up from 2.9% for the 9 months of 2025

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Rakbank’s recurring robust quarterly performance

Interestingly, in the first half of 2025, RAKBANK delivered a profit before tax of AED 1.5 billion, up 26 % compared with the same period in 2024. This latest YTD figure reflects continued strength across both its retail and wholesale banking operations, building on the solid foundation already laid earlier in the year.

The bank’s strong YTD result reflects confidence in the UAE’s economic outlook and RAKBANK’s diversified business model. Recently, they introduced UAE’s first crypto brokerage for everyday users, and are rolling out their own AI-powered digital assistant soon. As it advances through the remainder of the year, RAKBANK will look to sustain the momentum, while being mindful of potential headwinds such as global monetary-policy shifts and regional macro risks.