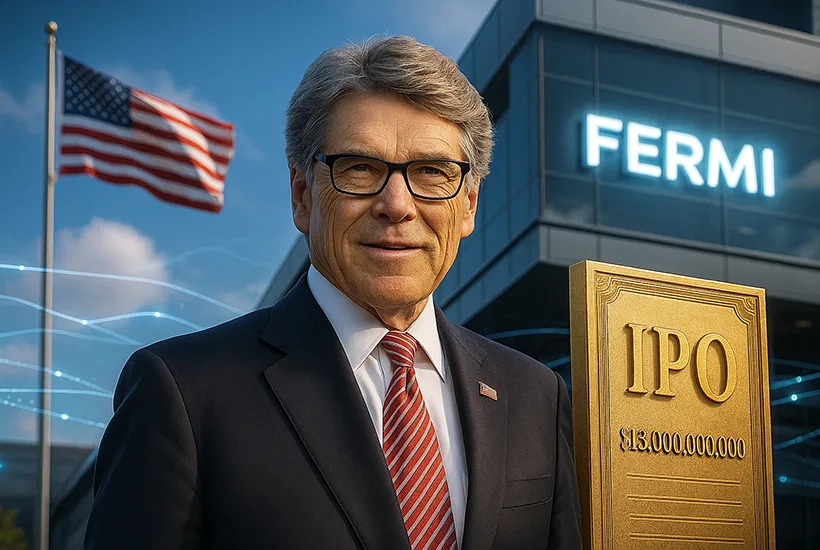

Fermi, a data center REIT co-founded by former U.S. Energy Secretary Rick Perry, is targeting a valuation of $13.16 billion in its initial public offering. The company plans to raise up to $550 million by issuing 25 million shares priced between $18 and $22 each. The IPO is expected to list on Nasdaq under the ticker “FRMI.”

According to its SEC filing, the firm recorded a net $6.4 million loss through June 2025, driven by share-based compensation and administrative expenses. The company is still in the developmental stage and has not yet generated revenue. However, the firm recently secured $350 million in financing from Macquarie and others to support its early development.

What is Project Matador?

Founded in January 2025, Fermi aims to build the world’s largest energy and data complex, powered by nuclear, natural gas, and solar energy.

The centerpiece of its strategy is Project Matador, an ambitious energy and data infrastructure campus in Amarillo, Texas. The campus sits on more than 5,200 acres and aims to deliver 1 gigawatt of data center capacity by the end of 2026, scaling toward an 11-gigawatt energy-driven data campus by 2038. The power mix is intended to combine nuclear, natural gas, solar, and battery storage to support high-demand data infrastructure.

Valuation built on forward-looking assumptions

Fermi’s lofty valuation has people questioning. It does have Rick Perry, who served as Governor of Texas for 15 years, spearheading it. But can he make this pivot into infrastructure and data center after serving as U.S. Energy Secretary under President Trump? A project of this magnitude has many risks, as it is capital-intensive, can run into delays and cost overruns, and regulatory issues surrounding nuclear power, which can work against it.

If successful, Fermi would join a growing list of AI-infrastructure plays entering public markets. Data center operators CoreWeave and WhiteFiber tapped the public markets this year.