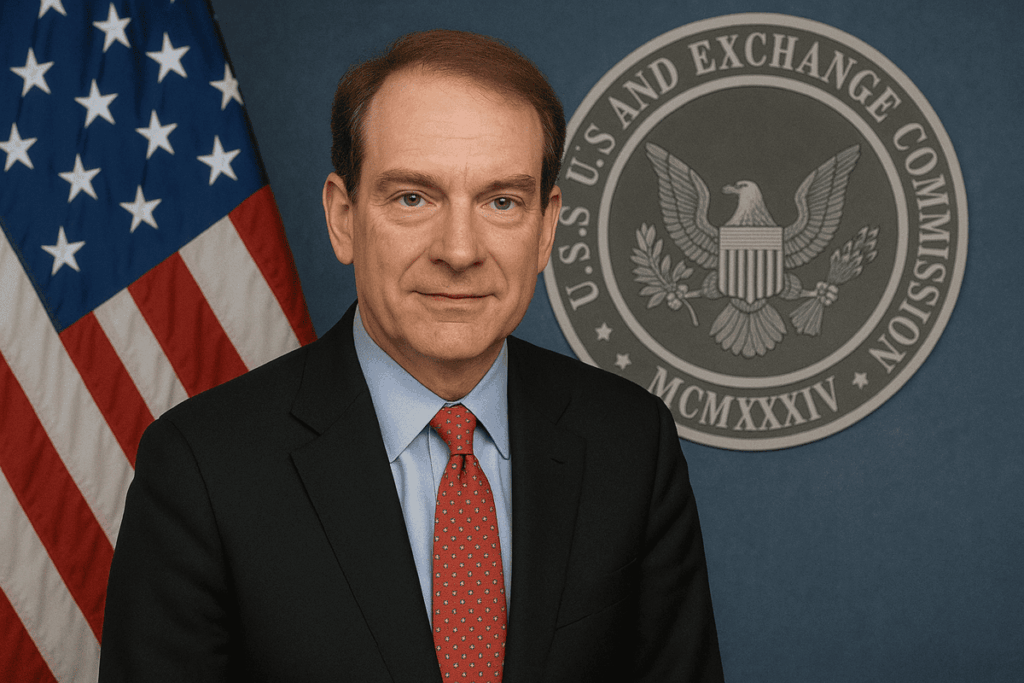

- SEC Chair Paul Atkins makes it clear that any change in how often public companies report earnings should not be dictated.

- President Trump has proposed that public companies be allowed (or required) to report earnings twice a year instead of quarterly.

- Atkins says that the next step is to propose amendments or rule changes, gather feedback, and consider them carefully.

Investors and banks are likely to help set any new timeline for public company reporting as regulators press ahead on President Donald Trump’s bid to end quarterly reports, U.S. Securities and Exchange Commission Chairman Paul Atkins told CNBC on Friday.

“For the sake of shareholders and public companies, the market … can decide, you know, what the proper cadence is,” Atkins said in an interview following Trump’s comments earlier this week.

“Investors … will demand that sort of information at the cadence that’s appropriate to what the company’s doing and what it’s up to,” he said, adding that banks also “will have something to say” for companies with debts, issuances and other similar issues.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Atkins did not lay out any timeline for the change, which would be a major shift for corporate America.

“In principle, I think… to propose change and what our rules are now, I think would be a good way forward, and then we’ll consider that and move forward after that,” he told CNBC.

Trump previously pushed the change to earnings reports in 2018 during his first White House term and renewed his call in a post on his social media platform on Monday.