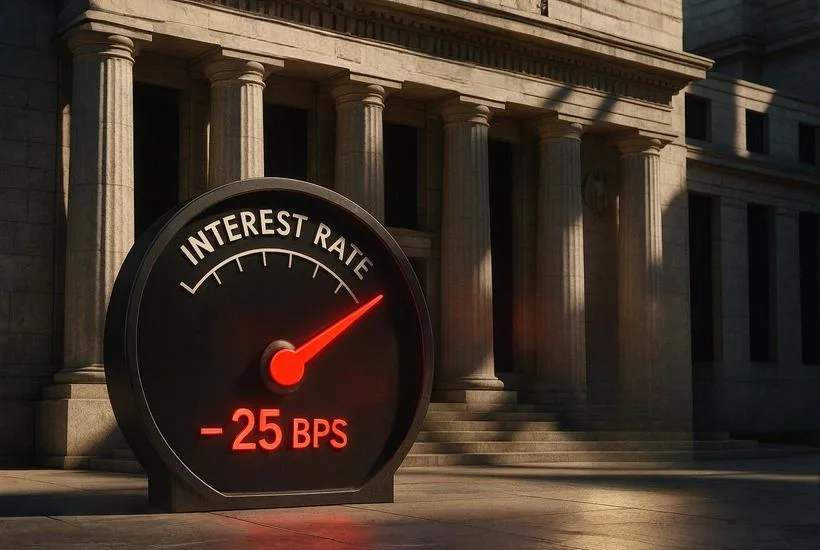

The U.S. Federal Reserve made its first interest rate cut of the year, lowering the federal funds rate by 25 basis points. In an 11:1 vote that signaled less dissent than Wall Street had anticipated, the Federal Open Market Committee lowered its benchmark overnight lending rate to a target range of 4.00%–4.25%. Fed Chair Jerome Powell and the FOMC also projected two further quarter-point rate cuts before the end of 2025, a shift from an earlier, more cautious stance.

Wall Street brushes off rate cut relief

Stock markets reacted swiftly, even though the cut was broadly anticipated. Dow Jones added 300 points post the announcement, but the S&P 500 and Nasdaq continued to languish in the red. Chairman Powell did speak of the softening labor market, adding that job gains have slowed and the unemployment rate has edged up

Inflation remains elevated, above the 2% target, and the Fed estimates that inflation will end the year around 3%. Fed officials judged that downside risks to employment have risen, which led to the shift in policy direction. The only dissenting vote came from newly installed Governor Stephen Miran, who was advocating for a larger half-percentage-point cut.

Only one cut in 2026, a dampener

Markets had been hoping for more aggressive easing. Treasury yields partially moved higher on expectations of slower cuts and continued inflation pressures. Some risk assets saw initial gains as lower rates tend to support valuations, but those retreated, too.

But the tempered forward guidance of only two cuts this year dampened enthusiasm in other segments, particularly where borrowing costs are sensitive. The central bank has two policy meetings left for the year, one in October and one in December. Moreover, the Federal Reserve is projecting only one rate cut in 2026, fewer than expected, according to its median projection.

Most cryptocurrencies continued to retreat, post-Powell’s announcement. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin or Ethereum, so some investors buy into crypto with hopes of greater upside. But signals of only modest easing may cause crypto to whip around based on macro data. At the time of publishing, Bitcoin was trying to hold on $115,000 levels, down 1.35% while Ethereum was lower by 0.91% trading around $4440.