- Ethereum turns 10: From smart contracts to decentralized finance, it reshaped how value is created and exchanged.

- Institutions join in: JPMorgan and Société Générale are now settling real-world assets and issuing stablecoins on Ethereum.

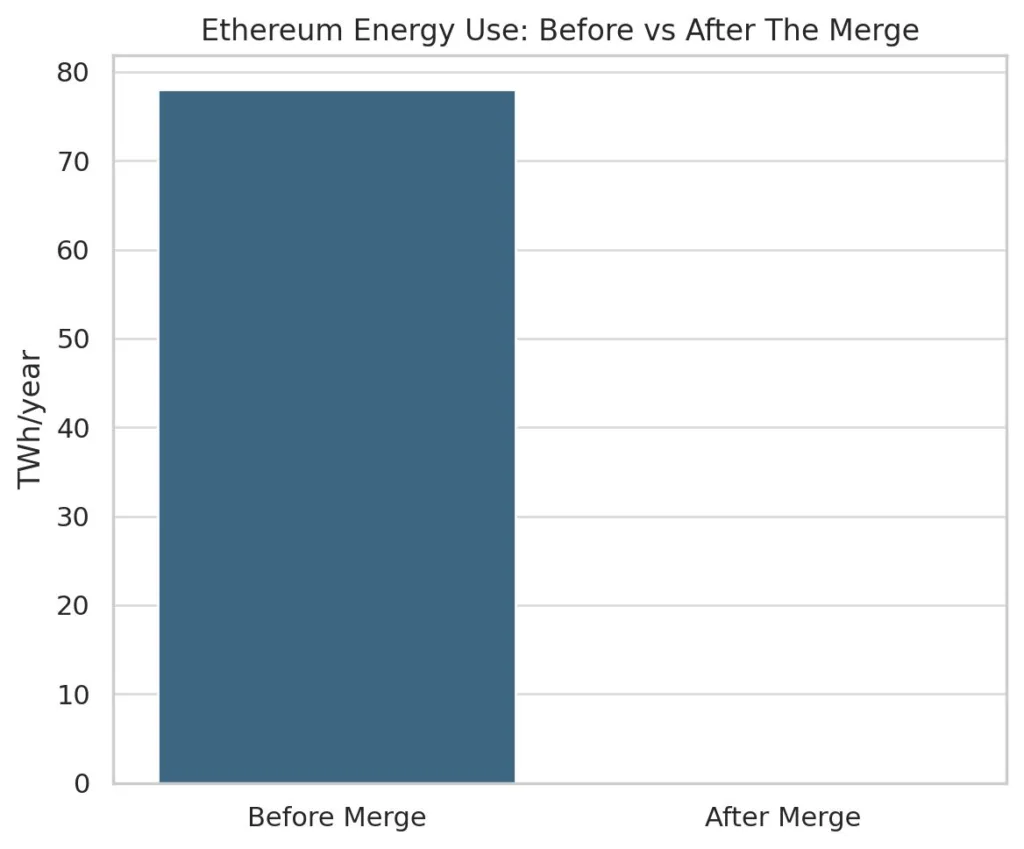

- Green and scalable: Ethereum cut energy use by 99.9% and powers billions in activity via Layer 2 networks like Polygon.

In 2015, Ethereum launched with a bold proposition: what if the internet could be more than just a platform for transmitting data? What if it could facilitate trust, execute agreements, and operate financial systems without middlemen?

A decade later, Ethereum stands as one of the most transformative technologies of the 21st century. It powers billions of dollars in decentralized transactions, supports programmable financial infrastructure, and enables the next generation of internet-native business models.

Ethereum isn’t just a blockchain it’s a movement. A living, evolving platform that has redefined digital trust, ownership, and automation.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

As Ethereum celebrates its tenth anniversary, here are 10 big ideas it introduced—each already reshaping the way the world works.

1.Smart Contracts: Self-Executing Business Logic

Ethereum introduced the concept of smart contracts lines of code that execute automatically when predefined conditions are met. These contracts remove manual steps, reduce administrative costs, and eliminate the need for trusted third parties.

Real-world example: In 2025, Etherisc provides automated crop insurance to over 15,000 farmers in Kenya and Zimbabwe. Payouts are triggered by weather data no paperwork, no disputes. Similarly, Arbol offers climate risk insurance using Ethereum and Chainlink to serve industries like agriculture and energy.

2.DeFi: Open Access to Financial Services

Ethereum unlocked Decentralized Finance (DeFi) a system of global, non-custodial financial tools that run without banks or brokers. With DeFi, anyone with internet access can borrow, lend, and trade assets 24/7 through transparent smart contracts.

Real-world example: In 2025, Société Générale launched a USD-pegged stablecoin, CoinVertible, on Ethereum and Solana. The bank had already issued tokenized green bonds and ESG-linked assets on Ethereum. Meanwhile, protocols like Aave and Compound continue to facilitate tens of billions in loans without any traditional financial intermediaries.

3.Programmable Governance & DAOs

Ethereum enables Decentralized Autonomous Organizations (DAOs) communities governed by code and collective voting. These DAOs manage treasuries, make proposals, and allocate funds without needing a centralized boardroom.

Real-world example: Gitcoin funds open-source development via DAO voting, and Uniswap’s governance controls protocol upgrades and treasury usage.

4.Tokenization of Real-World Assets

Ethereum has made it possible to represent physical assets as tokens from real estate and bonds to carbon credits and luxury goods making them more liquid, divisible, and tradable.

Real-world example: Real estate platforms tokenize property shares, while firms like Centrifuge bring off-chain assets into DeFi by tokenizing invoices and trade receivables.

5.On-Chain Identity and Reputation

Ethereum-based identity systems allow users to build decentralized digital identities and reputations without relying on big tech platforms. These identities are portable, privacy-preserving, and verifiable on-chain.

Real-world example: Projects like Lens Protocol and ENS (Ethereum Name Service) are building the foundations of decentralized social and identity infrastructure.

6.NFTs and Digital Ownership

Ethereum gave rise to Non-Fungible Tokens (NFTs), allowing creators to prove digital ownership, monetize content, and form new creator economies.

Real-world example: In-game assets, art, music rights, and collectibles are now being bought and sold globally with provenance and royalties programmed into smart contracts.

7.Layer 2 Scaling and Modular Architecture

To scale Ethereum without compromising security, developers introduced Layer 2 solutions like Optimism, Arbitrum, and Polygon. These networks process transactions more cheaply and quickly, then anchor data back to Ethereum.

Real-world example: In 2025, Polygon processes nearly two-thirds of Ethereum Layer 2 activity, supporting gaming apps, loyalty programs, prediction markets, and more.

8.Institutional Adoption in Regulated Markets

Ethereum has moved from experimentation to real integration into global financial systems. Enterprises are using Ethereum for tokenized assets, on-chain settlement, and regulated digital instruments.

Real-world example: JPMorgan settled tokenized U.S. Treasuries on a public Ethereum network for the first time in 2025, marking a significant milestone in institutional blockchain adoption. The bank also piloted a USD deposit token on an Ethereum Layer 2.

9.Sustainable Blockchain Infrastructure

In 2022, Ethereum completed “The Merge,” transitioning from proof-of-work to proof-of-stake. This move reduced Ethereum’s energy consumption by over 99.9%, transforming it into one of the world’s most eco-friendly digital infrastructures.

Real-world impact: Analysts compared the energy drop to removing a country the size of Ireland from the global power grid. Ethereum now serves as a model for sustainable tech.

10.Modular Innovation and Plug-and-Play Finance

Ethereum’s evolving ecosystem now supports modular development developers can combine pre-built components like wallets, oracles, smart contracts, and data feeds to launch new financial products faster.

Real-world example: In 2025, Circle is building modular payment applications using Ethereum Layer 2s for speed, Layer 1 for finality, and smart contracts for automation reducing cost and time-to-market.