Semiconductor manufacturing firm Wolfspeed has completed its financial restructuring, a move that has reduced debt on its balance sheet, extended maturities till 2030, and lowered interest costs, as per an official press release.

Specifically, the company has reduced total debt by roughly 70% and reduced annual cash interest expense by 60%.

“Wolfspeed has emerged from its expedited restructuring process, marking the beginning of a new era, which we are entering with new energy and a renewed commitment to the growth mindset and entrepreneurial spirit that have powered Wolfspeed since its inception,” said WolfSpeed

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Earlier this month, Wolfspeed said it had expected to emerge from Chapter 11 protection over the coming weeks after a proposed plan of reorganization that received court approval.

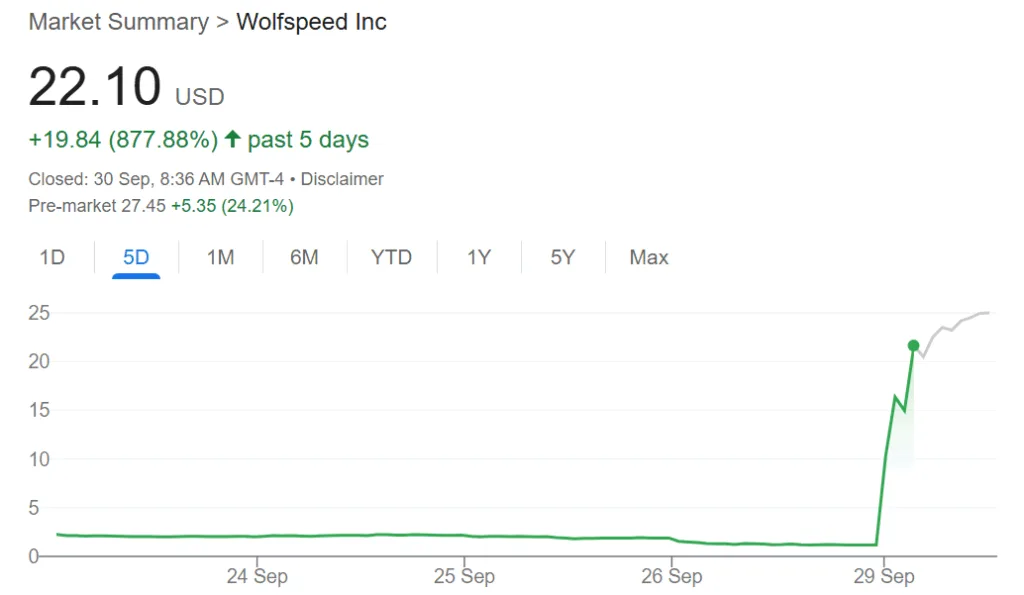

Google Finance

The company’s stock spiked up by 877.88% over the past five days, closing at $22.10 on Monday, primarily due to a voiding of old shares and issuance of a new set that diluted investors’ holdings at a rate that gave stockholders 8 new shares for 1000 old shares.

The restructuring comes after the firm declared a going concern through a 10-Q filing, due to huge losses on its balance sheet, with initial costs outstripping revenues.

Going concern is a term used in financial statements when senior management is unsure of the company’s ability to continue operations, either due to poor net income or external factors negatively impacting the business.

For Q1 2025, the company reported a total net loss of $285.5 million and a loss per share of $1.86.

Wolfspeed specializes in the manufacturing of silicon carbide and gallium nitride devices to be used for electric vehicles, 5G, renewable energy systems, and aerospace. In 2022, Wolfspeed announced a $5 billion investment in a new silicon carbide facility in North Carolina.

Formerly known as Cree Inc, Wolfspeed is the result of a rebranding process in 2021 after the company sold its LED and lighting business to focus on manufacturing semiconductors for a new set of applications.