- Letitia James calls for stablecoin issuers to be regulated like banks with FDIC insurance

- Says current crypto bills lack necessary safeguards against fraud and systemic risk

- Renews criticism of CLARITY Act, warning of loopholes that could aid bad actors

New York Attorney General Letitia James has called on Congress to tighten oversight measures in pending federal crypto and stablecoin legislation, warning that the current versions fail to adequately protect investors and the financial system.

In a letter sent Tuesday, James criticized two major proposals the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act arguing they do not contain the necessary guardrails to protect the American public.

The GENIUS Act, which passed the Senate in a bipartisan vote last month, and the STABLE Act, which advanced through a House committee in April, both seek to create federal regulatory frameworks for stablecoins. However, James contends the bills lack enforcement mechanisms to prevent illicit activity and leave gaps that could threaten national security.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Push for bank-level oversight and identity requirements

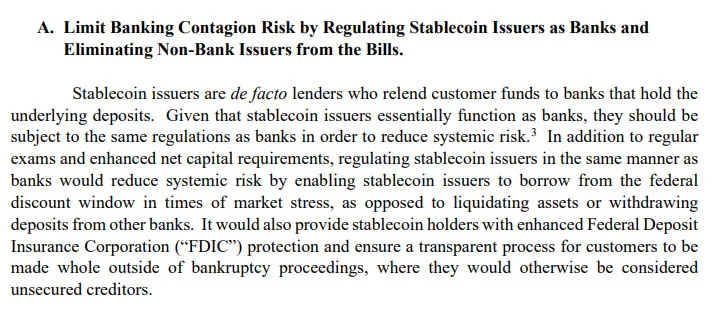

A key concern raised by James is that stablecoin issuers currently operate outside traditional banking rules, despite functioning in a similar capacity. She urged lawmakers to treat issuers like banks, requiring them to comply with capital requirements, audits, and supervision to limit systemic risks.

Source: New York AG

She also recommended that issuers offer FDIC insurance for deposits and implement digital identity technology to prevent anonymous transactions citing the risk of their use in fraud, terrorism financing, and money laundering.

James further warned that without these protections, stablecoins could gain an unfair edge over local community banks, which are already struggling.

Ongoing scrutiny of crypto legislation

James also took aim at the Digital Asset Market Structure Clarity (CLARITY) Act, criticizing the bill in a previous letter for shielding anonymous actors and weakening long-standing investor protections.

The bill creates a technology-specific loophole that upends almost one hundred years of securities laws.

This is not James’ first foray into crypto policy. In April, she urged lawmakers to ban retirement fund investments in crypto, citing concerns over volatility and lack of intrinsic value. Her office has also filed lawsuits against several crypto firms, reinforcing her position as one of the most active regulators in the digital asset space.