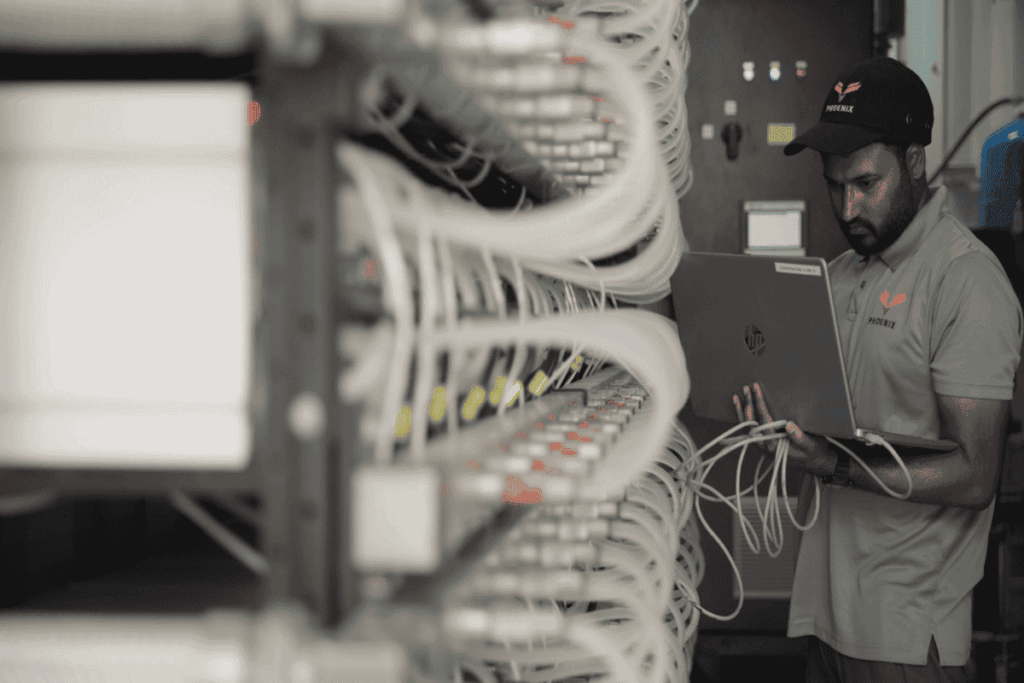

One of the top ten global bitcoin miners, Phoenix Group announced its financial results for the first quarter of 2025, with consolidated revenues coming in at $31 million. The company also mined 350 Bitcoins in Q1, including 222 Bitcoins that were self-mined. The results reflect the company’s ongoing strategic transition toward self-mining operations and a reduction in hosting and trading activities compared to prior periods.

The digital asset infrastructure company’s gross mining margins improved to 30%, up from 24% in Q4 2024, this was supported by operational efficiencies and energy optimization initiatives. The company reported gross profit of $6.3 million, while operating expenses totaled $9 million, reflecting increased costs associated with scaling operations globally. They also reported an unrealized EBITDA loss in Q1, driven by a decline in digital asset prices and global macroeconomic factors.

The group has also reiterated its commitments towards global expansion, by energising a new 20-megawatt mining facility in Texas. This takes its global operational capacity to over 500 MW across five countries. This site in Texas benefits from high-quality energy infrastructure as well as favourable regulatory conditions, it has been built over 4.3 acres and energized within three months, adding 3,990 hydro-cooled miners that contribute approximately 1.2 EH/s to Phoenix’s hash rate.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Speaking about the new facility and the group’s future endeavors, Munaf Ali, CEO and Co-Founder of Phoenix Group said that the move not only strengthens their operational base in North America but also reinforces their mining infrastructure efforts.

“Texas is one of the most mining-friendly jurisdictions in the U.S. and our progress there builds on the operational momentum we’ve delivered recently following our expansion in Ethiopia. We remain committed to scaling efficiently, maintaining cost leadership, generating value and positioning Phoenix to capture opportunities as market dynamics evolve,” he added.

Phoenix Group is a global technology leader headquartered in Abu Dhabi and was founded in 2017. It is one of the world’s top ten Bitcoin miners and operates multiple mining facilities in the UAE, the U.S., Canada, Oman, and Ethiopia. It is the first crypto and blockchain conglomerate in the region to be listed on the Abu Dhabi Securities Exchange (ADX).