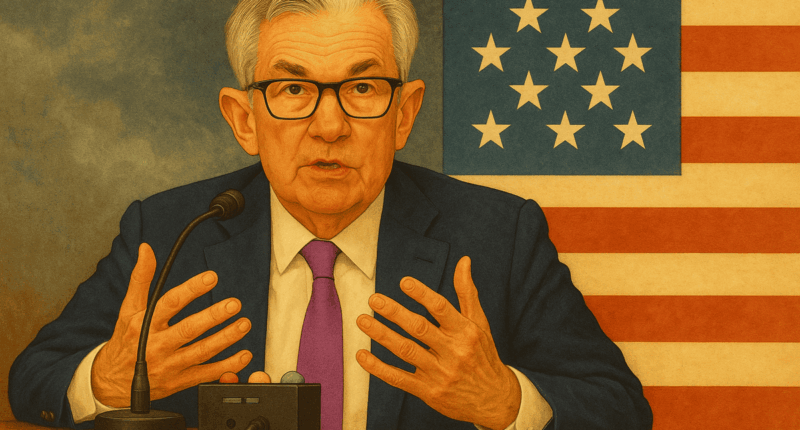

Federal Reserve Chairman Jerome Powell addressed journalists at a press conference after the Federal Open Market Committee concluded its policy meeting. He informed that the FOMC will leave rates unchanged. Powell referred to various indicators in his speech, such as the unemployment rate, change in real GDP, and growth in consumer spending.

These rates have held steady since December 2024, the last cut being 25 basis points. The federal funds rate is currently in the 4.25%-4.5% range, but the Federal Reserve still has two rate cuts marked to take place in 2025. The U.S. annual inflation rate was 2.4% in May, up from 2.3% in April, the highest in 4 months, according to Trading Economics.

The Federal Funds rate is a critical benchmark for banks to decide on interest rates for lending to customers. The common metric used among banks is the prime interest rate, which is derived from the Federal Funds rate. This, in turn, affects consumer inflation and business investing.

“In support of our goals, today the Federal Open Market Committee decided to leave our policy interest rate unchanged. We believe that the current stance of monetary policy leaves us well-positioned to respond in a timely way to potential economic developments,” said Powell.

Bitcoin and Ethereum prices hold steady while Trump comments on federal rates

The price of Bitcoin remained roughly flat during the hours following the announcement at a price level of $104,683, according to Coingecko. Ethereum held steady at a price level of $2,515.

Ahead of the press conference, U.S. President Donald Trump spoke about tariffs, the federal rate. He was also critical of Jerome Powell and said he expects him not to cut rates.

“So we have a stupid person…frankly, at the fed, he probably won’t cut today. Europe had ten cuts and we had none,” said Trump.