Canadian digital asset firm, SOL Strategies, has officially filed the Form 40-F registration, seeking to list on the Nasdaq Capital Market. The company, which currently trades on the Canadian Securities Exchange, aims to have its common shares listed under the ticker “STKE” on Nasdaq.

The listing follows Sol Strategies’ announcement that it owns more than 420,000 SOL tokens, making it one of the larger institutional investors in Solana’s native cryptocurrency. In its filing, the company pointed to Solana’s expanding role in asset tokenization and digital asset infrastructure as key reasons for expecting continued growth.

In May, SOL Strategies filed a preliminary shelf prospectus in Canada to raise up to $1 billion. While there’s no immediate plan to raise money, this move gives the company financial flexibility as it looks to grow within the Solana ecosystem.

Earlier in April, the company secured a $500 million convertible note deal from ATW Partners. The funds will be used to buy and stake SOL tokens on the company’s own validators. These notes pay interest in SOL and are tied to performance, aligning with Solana’s staking system.

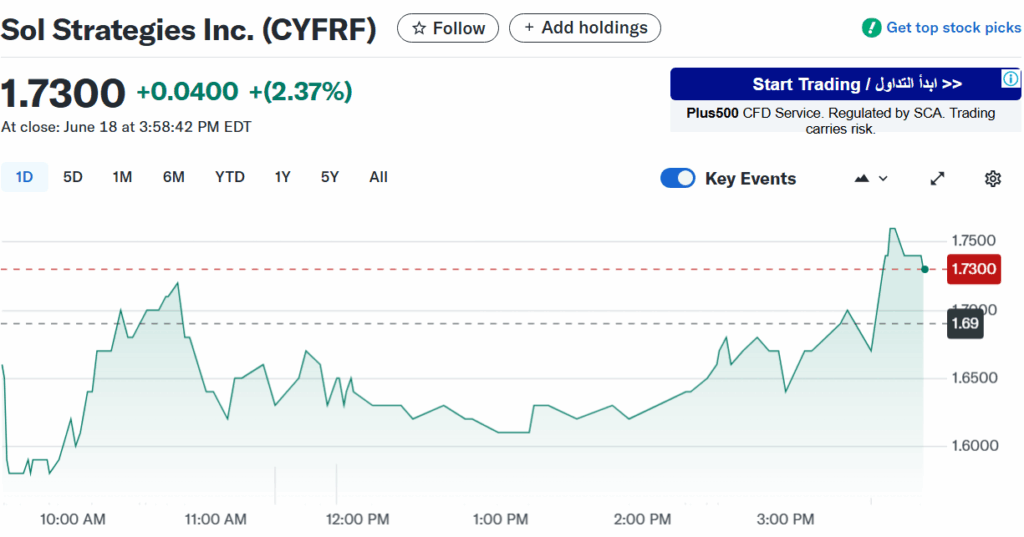

Following the SEC filing, Sol Strategies’ stock saw a spike of 4.39% to finally settle at 1.73 Canadian dollars