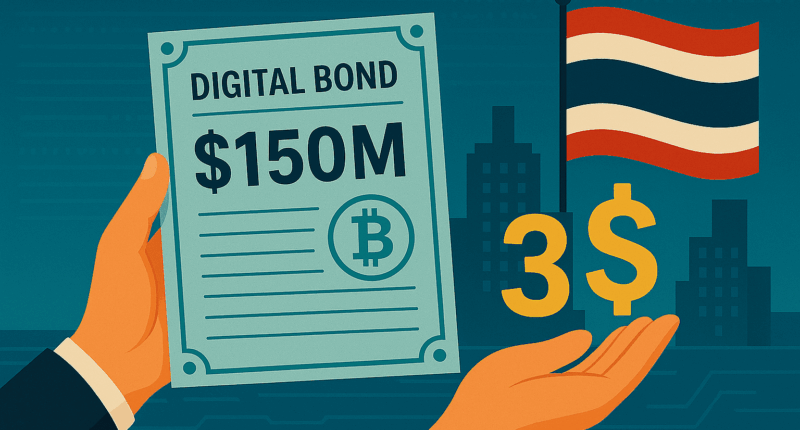

Thailand is set to democratize access to government bonds through a ground breaking initiative that will allow retail investors to buy in for as little as $3, using blockchain-based digital tokens.

According to a May 13 report from the Bangkok Post, Finance Minister Pichai Chunhavajira revealed the plan following its approval by the Thai cabinet. The Ministry of Finance is preparing to issue $150 million worth of digital investment tokens—dubbed “G-tokens”—within the next two months, marking a significant shift toward inclusive and modernized public fundraising.

Retail investment revolution

Traditionally reserved for institutions and high-net-worth individuals, Thai government bonds will now be accessible to the general public in tokenized form. Patchara Anuntasilpa, director-general of the Public Debt Management Office, emphasized that G-tokens are not conventional debt instruments, but a novel tool to engage the public in the digital economy.

“A key benefit is enabling broader participation in government bond investment,” said Anuntasilpa. “People can now start investing with just $3.”

The initiative aims to tap into the growing retail investor base, long underserved by legacy investment products. These digital bonds will be tradable on regulated digital asset exchanges, though access remains limited to Thai citizens.

Higher yields, lower barriers

Minister Pichai stated that the initial G-token offering is a pilot to gauge investor appetite. While he did not disclose exact returns, he indicated that the yields would be higher than traditional bank deposits, which currently offer a meager 1.25% interest rate for a 12-month fixed term.

Thailand’s central bank has maintained elevated policy rates in recent quarters despite mounting economic headwinds, making the new digital bonds potentially more attractive than conventional savings options.

Global context: A tokenized future

The move aligns with global trends as governments and institutions explore tokenized finance. In February, Thailand’s securities regulator also unveiled plans to develop a tokenized securities trading platform for institutional use.

Worldwide, the market for tokenized bonds is accelerating. According to RWA.xyz, a platform tracking real-world asset tokenization, the global on-chain value of tokenized bonds has doubled in 2025 alone, reaching $225 million. U.S. Treasury tokenization is also booming, with $6.9 billion in value—up 73% year-to-date.

Thailand’s venture into blockchain-backed bond issuance could mark the beginning of a broader transformation in how nations raise capital, offering a glimpse into a more accessible and digitally-driven financial future.