A brilliant mind, a flawed dream

Sam Bankman-Fried, commonly known as SBF, was more than just a crypto titan: he was a young man whose ambition once seemed boundless. Rising to fame as the wunderkind behind FTX exchange, he embodied the promise of a new financial frontier, where technology and innovation could rewrite the rules. But behind the headlines and the hype was a person whose story would become one of soaring success and devastating collapse.

The genesis of SBF: early years and influences

Born into an academic family in Stanford, California, to two law professors, Samuel Bankman-Fried was raised in an environment that valued intellectual pursuits. His early education was marked by a keen interest in mathematics, attending the prestigious Canada/USA Mathcamp. He continued his academic journey at the Massachusetts Institute of Technology (MIT), where he pursued physics and mathematics, graduating in 2014.

During his time at MIT, SBF became deeply involved with the philosophy of effective altruism, a movement emphasizing the use of reason and evidence to maximize positive impact. This philosophy significantly shaped his worldview and career aspirations, initially envisioning a path of “earning to give” – accumulating wealth to donate to impactful causes.

The ‘effective altruist’ billionaire: shaping an image

As SBF’s crypto ventures gained traction, he consciously cultivated an image aligned with his effective altruist ideals. He often spoke of prioritizing impact over personal gain, a narrative that resonated with many and contributed to his widespread acceptance within both the crypto and mainstream financial spheres.

From idealist to empire builder

SBF’s journey began with a simple idea: exploiting price differences in Bitcoin markets. What started as a clever arbitrage strategy grew into Alameda Research, a trading firm that funded his next venture: FTX. Launched in 2019, the exchange quickly became a powerhouse, attracting traders worldwide and securing high-profile sponsorships. SBF, with his trademark messy hair and casual demeanor, became the unlikely face of crypto’s future.

Yet, beneath the success, cracks were forming. FTX and Alameda were deeply intertwined, a relationship that would later prove disastrous.

The unraveling: trust, panic, and a run on the bank

In late 2022, whispers about Alameda’s shaky finances turned into shouts. Customers, fearing the worst, rushed to pull their money from FTX. The exchange, unable to meet the flood of withdrawals, spiraled into a liquidity crisis. A potential lifeline from Binance vanished, exposing what prosecutors would later call a staggering misuse of customer funds.

Overnight, the empire crumbled. FTX filed for bankruptcy, leaving billions in losses and countless investors in shock. The man once celebrated as a genius was now a symbol of recklessness.

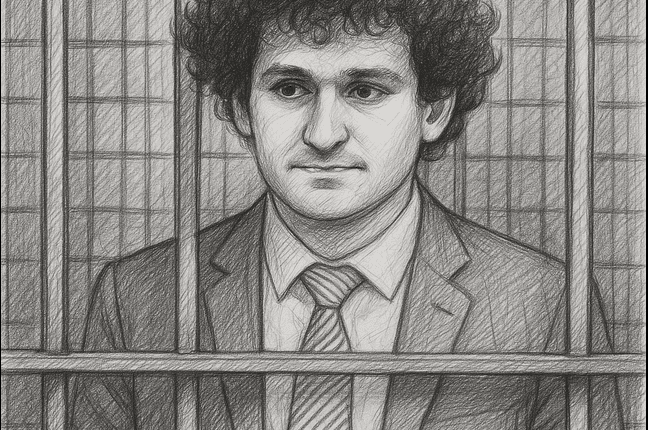

The trial: pride, regret, and the weight of consequences

The courtroom stripped away the myth, revealing a more complicated figure. Prosecutors painted SBF as a fraudster who gambled with others’ money; his defense argued he was an overwhelmed entrepreneur who made catastrophic mistakes. Testimonies from former allies, some heartbroken, some furious, laid bare the human cost of FTX’s collapse.

In November 2023, the verdict came: guilty on all counts.

A 25-year sentence: the aftermath of ambition

March 2024 brought the final blow — a 25-year prison sentence. No more private jets, no more billionaire philanthropy. Instead, SBF found himself in Victorville Medium II, a federal prison far removed from his former life.

Yet, even behind bars, he fights. An appeal is pending. Rumors swirl of a desperate bid for a pardon. Whether it’s defiance or delusion, the man who once seemed invincible is now clinging to the last threads of hope.

The human cost of the crypto gold rush

SBF’s story isn’t just about fraud or finance — it’s about how quickly brilliance can turn to hubris, how trust can be broken, and how real people pay the price when empires fall. Employees lost jobs, investors lost life savings, and true believers lost faith.

It’s a cautionary tale, yes — but also a deeply human one. A reminder that behind every boom and bust, there are dreams, mistakes, and lives forever changed.