- Tokenization unlocks global access and liquidity by converting physical assets into blockchain-based tokens.

- By permitting fractional ownership of yield-bearing assets that were previously only available to institutions, it democratizes finance.

- The tokenization trend is being spearheaded by DeFi protocols, BlackRock, Franklin Templeton, J.P. Morgan, and Animoca Brands.

One of the most revolutionary developments at the nexus of blockchain and finance is tokenization. It embodies a fresh perspective on ownership, liquidity, and market accessibility that have traditionally been restricted to the most affluent individuals and institutions. Knowing what tokenization is, why it matters, and who is driving its adoption is crucial to understanding the future of finance, as the discussion surrounding real-world assets (RWAs) continues to dominate both Wall Street and Web3.

1. What is tokenization?

Tokenization is essentially the act of turning tangible assets like government bonds, stocks, real estate, or commodities into digital tokens that are stored on a blockchain. By representing a portion of the underlying asset, each token creates a digital representation of conventional financial instruments. Through this procedure, assets that were previously hard to purchase or sell in smaller amounts can now be divided, transferred, and traded on online marketplaces. For instance, an investor can hold a portion of a corporate bond or commercial property using tokens rather than paying millions to buy them. In comparison to conventional systems, tokenization significantly shortens settlement times while introducing more transparency, security, and efficiency through the use of blockchain technology.

2. Why is tokenization important?

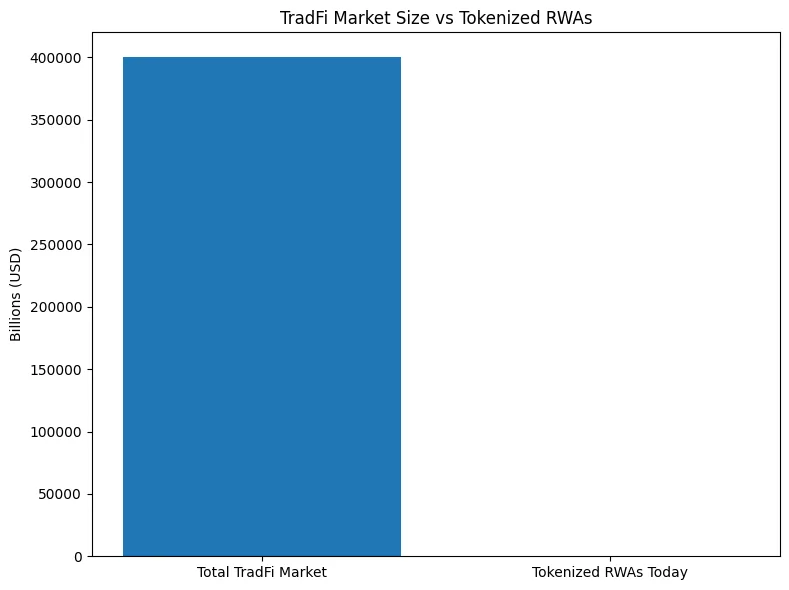

Tokenization is significant because it can democratize finance and open up liquidity. Only a relatively small percentage of the more than $400 trillion worldwide value of the traditional finance sector is readily available to regular investors. This is altered by tokenization, which permits fractional ownership, lowering entry barriers and facilitating participation in markets formerly exclusive to institutions and extremely wealthy individuals. With a few smartphone clicks, an investor in Africa could get exposure to international real estate markets, while an investor in Asia could buy a portion of a U.S. Treasury bond.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Tokenization eliminates middlemen and settles transactions on the chain, which increases efficiency beyond access. This creates an auditable path of ownership and lowers expenses for both issuers and investors. Blockchain systems’ openness may assist regulators maintain compliance, and for issuers, it creates completely new international capital pools. Additionally, tokenization facilitates 24/7 markets, something that traditional financial infrastructure has found difficult to accomplish. Most importantly, it bridges the gap between conventional finance (TradFi) and decentralized finance (DeFi) by offering a means of integrating the vast traditional asset base into blockchain networks.

3. Who is leading tokenization?

Tokenization is being pushed into the mainstream by a few major companies. By introducing tokenized funds and aggressively investigating blockchain as a settlement layer, BlackRock, the biggest asset manager in the world, has garnered media attention. For example, their BUIDL fund showed institutional and individual investors how real-world assets may be included into tokenized products. By launching tokenized mutual funds and demonstrating that traditional asset managers are committed to using blockchain technology, Franklin Templeton has also been a trailblazer. By creating blockchain-based settlement infrastructure and tokenized deposits through its Onyx division, J.P. Morgan has given tokenized financial products a solid institutional foundation.

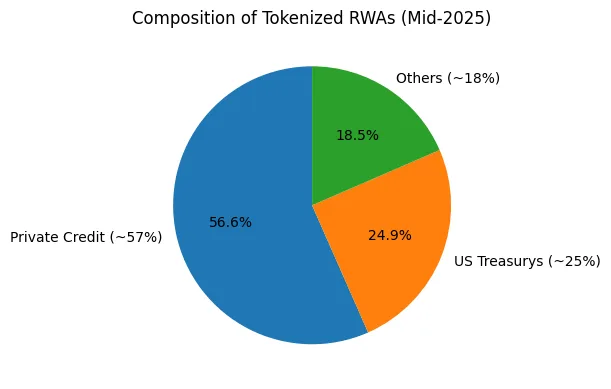

It is not just Wall Street that has momentum. By creating tokenized marketplaces like NUVA, which concentrate on linking real-world assets and digital property rights, businesses like Animoca Brands are adopting a different strategy in the Web3 environment. In the meanwhile, yield-bearing products and tokenized credit markets are seeing the emergence of DeFi protocols such as Maple Finance, Centrifuge, and Ondo Finance. In the tokenization race, these platforms are showing how decentralized ecosystems can both rival and enhance established financial institutions. Collectively, these initiatives show that tokenization is a fundamental change that both centralized and decentralized actors are actively seeking rather being merely a fad.

4. The road ahead

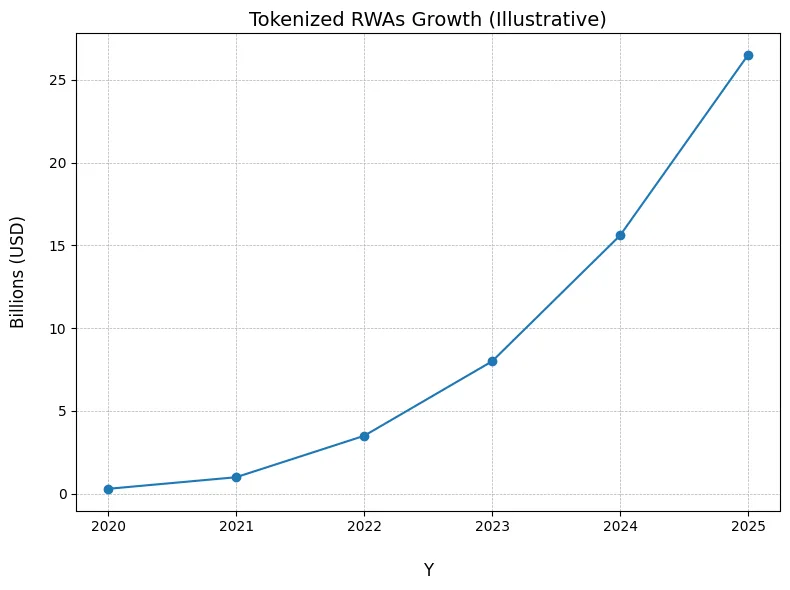

Tokenization seems to have an almost endless future. According to analysts, tokenized RWAs could eventually be worth billions of dollars, but as of right now, they only make up about 26 billion dollars of the worldwide addressable market. There is a huge growth runway. More asset types, including as commodities, stocks, carbon credits, and alternative investment funds, will be added to the chain as technology advances and regulatory clarity increases.

Tokenization gives investors access to previously unattainable prospects. It offers institutions a more effective means of accessing international markets and managing funds. Additionally, it might be the most important breakthrough for the larger financial system since the emergence of exchange-traded funds. More than a simple technological advancement, tokenization is a rethinking of financial infrastructure that has the potential to completely alter the way value is produced, held, and traded in the twenty-first century.

Rita Dfouni

Rita Dfouni