- A true altseason will not come until new cryptocurrency ETFs are introduced, according to Bitfinex, despite a 6% decline in Bitcoin dominance in the last month.

- Although inflows are positive, the current market’s risk appetite is modest and significantly lower than it was during the previous bull cycle.

- While Solana, XRP, and other ETF certifications are still pending, Coinbase and others anticipate an altseason change in September.

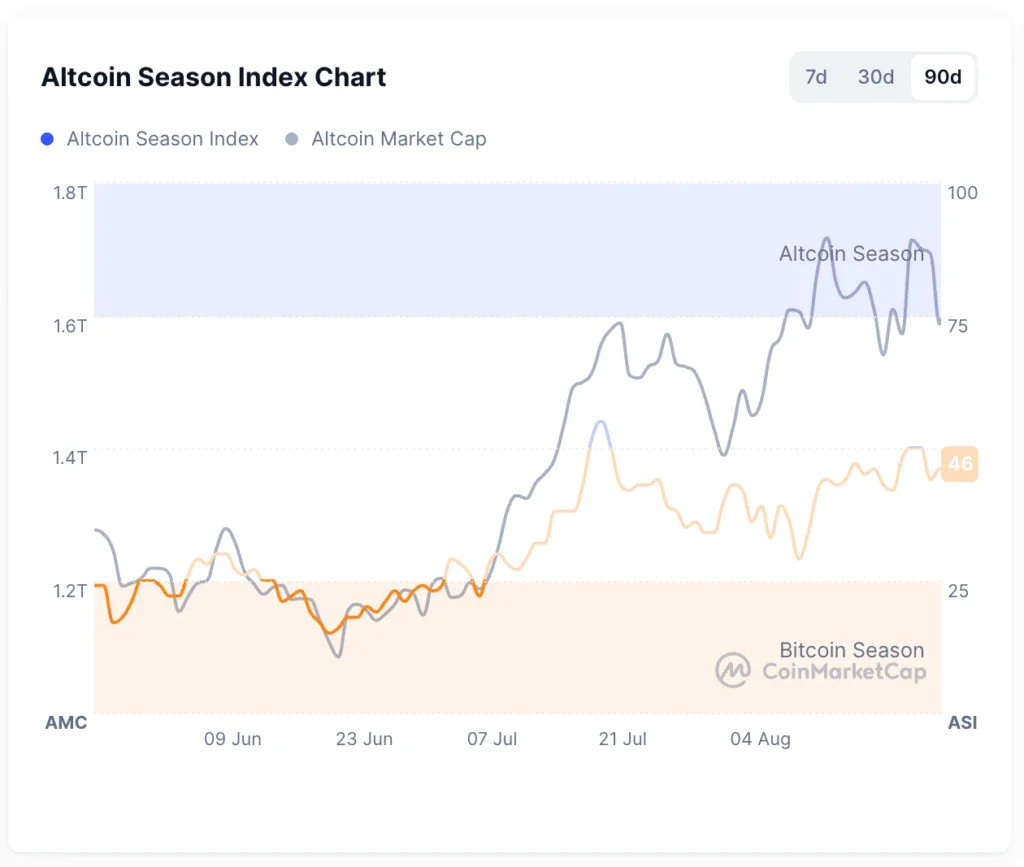

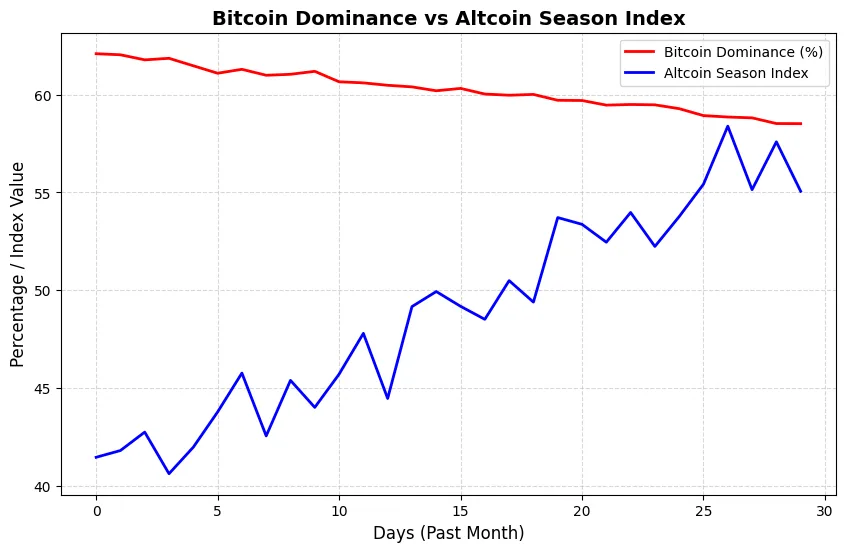

According to Bitfinex analysts, the long-awaited “altseason” in the cryptocurrency market, when altcoins perform better than Bitcoin, might not start until new exchange-traded funds (ETFs) are introduced. Analysts are still hesitant to forecast a broad altcoin rise in the near future, despite the fact that Bitcoin dominance has decreased by 6% over the last 30 days, indicating some capital rotation.

Bitfinex analysts emphasized in their most recent market comments that they do not anticipate a “rising tide lifts all boats” scenario until later this year. The launch of altcoin-focused ETFs may be the true driver of long-term demand, they clarified, even though Bitcoin ETFs are still drawing inflows. According to the research, these goods will enable a wider re-rating throughout the digital asset industry by generating price-agnostic buying pressure.

The cryptocurrency market is currently on a “muted trajectory.” The intensity that characterized previous bull markets and all-time high leaps is absent, even though total capital inflows are still healthy. In contrast to the speculative fervor that once drove sharp price increases, this cautious approach reflects a more risk-averse investor base.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Contradictory opinions and ETF speculation

Over the past month, the Altcoin Season Index has increased while Bitcoin dominance has decreased, indicating the market’s increasing speculation on altcoins. Whether ETFs will be the real catalyst for an entire altseason is still up for debate among analysts.

Bitfinex’s perspective is not shared by all analysts. According to David Duong, head of research at Coinbase Institutional, changes in liquidity dynamics and a decline in Bitcoin’s dominance might pave the way for a full-scale altcoin season as early as September.

The U.S. Securities and Exchange Commission’s (SEC) examination of a number of ETF applications is being keenly monitored by industry watchers in the meantime. The Bitcoin-Ethereum ETF from Truth Social, the Core XRP Trust from 21Shares, and the Solana products from Bitwise and 21Shares are among of the pending proposals. Although there are still strong hopes for final approvals, permission delays show the cautious regulatory attitude.

In June, Bloomberg ETF expert Eric Balchunas added to the discussion by stating that there is a “very strong probability” that the market would someday see an ETF that only invests in memecoins, with 2026 as a potential date. “A wave of actively managed crypto ETFs is expected to pave the way before such niche products materialize,” he added.

Rita Dfouni

Rita Dfouni