-

VanEck submitted an application for a JitoSOL ETF, providing access to staking rewards.

-

Grayscale is pursuing SEC authorization to transform its Avalanche Trust into an ETF.

-

Canary Capital filed for two ETFs: one linked to Official Trump (TRUMP) and another, the American-Made Crypto ETF (MRCA), aimed at U.S.-based initiatives.

Bitwise Asset Management has made a record by being the first entity to submit a filing for a spot exchange-traded fund (ETF) tied to Chainlink (LINK), the primary token of the top blockchain oracle network. The submission to the U.S. Securities and Exchange Commission (SEC) on Tuesday indicates that the proposed Bitwise Chainlink ETF will utilize Coinbase Custody as its custodian.

ETF structure and market impact

The fund intends to provide in-kind creation and redemption, enabling investors to exchange ETF shares directly using LINK tokens instead of only cash transactions. Although Bitwise hasn’t revealed specifics like the ticker symbol, listing exchange, or management fees, this action indicates a growth of altcoin-centric ETFs in the U.S. market.

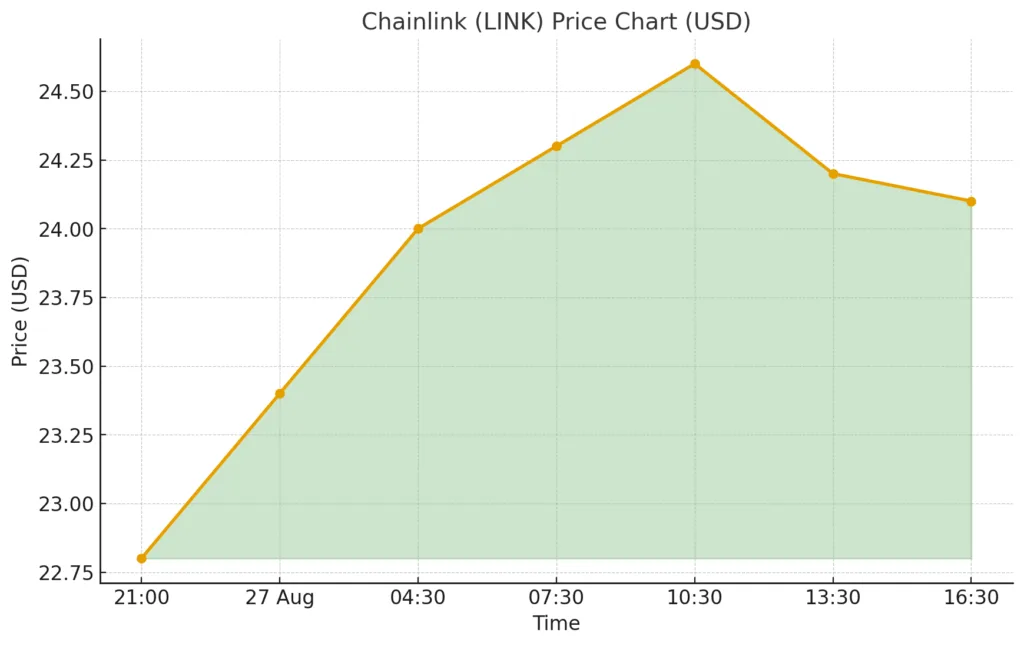

After the filing, LINK’s price surged 4.2% to reach $24.18, adding to a 26% increase over the last 30 days, although it is still significantly lower than its peak of almost $53 in May 2021.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

LINK price surged by 4.2% to $24.18 after Bitwise filed for a Chainlink ETF, continuing its 30-day increase of 26%.

Growing interest in Altcoin ETFs

The application comes amidst a spike in ETF inquiries as providers seek to capitalize on the Trump administration’s growing support for cryptocurrency. Bitwise presently manages thriving ETFs associated with Bitcoin ($2.26B AUM) and Ethereum ($460 Million AUM), according to Farside Investors.

VanEck has recently filed with the SEC for a JitoSOL ETF designed to provide investors with access to staking rewards. Meanwhile, Grayscale is seeking approval to convert its existing Avalanche Trust into an ETF. Canary Capital has also joined the competition by submitting two ETFs this month: one associated with Official Trump (TRUMP) and the other called the American-Made Crypto ETF (MRCA), designed to offer exposure to cryptocurrencies created, mined, or operated in the United States.

Industry Outlook

If approved, the Bitwise Chainlink ETF would mark an important milestone for the altcoin ETF space, probably drawing institutional investments in Chainlink and enhancing the credibility of crypto oracle technology in conventional finance.

Rita Dfouni

Rita Dfouni