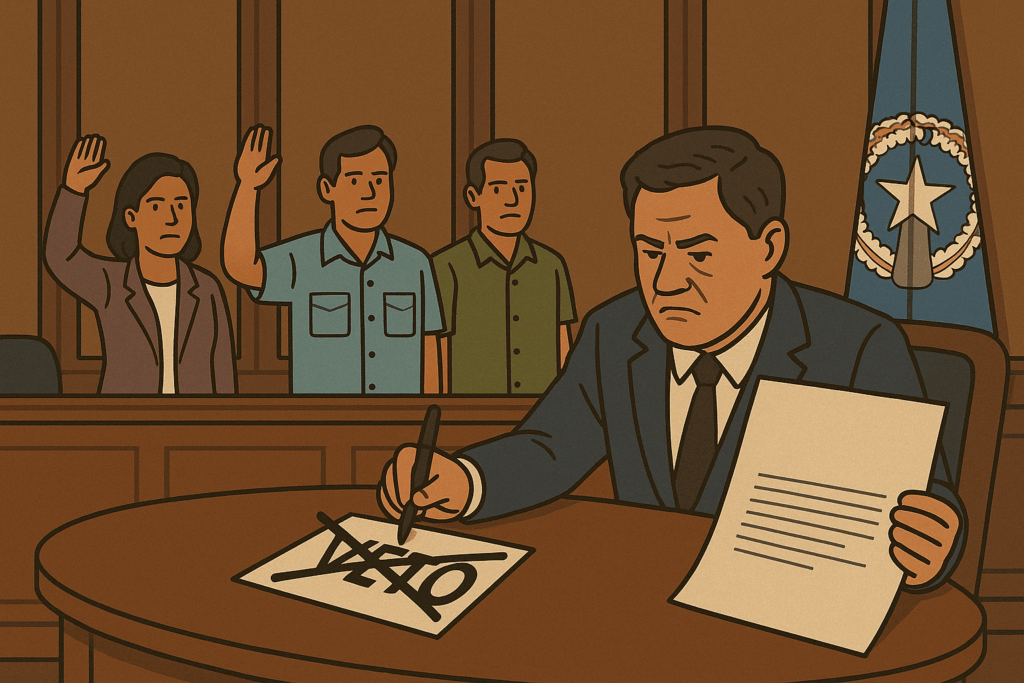

The Pacific island of Tinian could soon become the first U.S. public entity to issue a stablecoin, after the Northern Mariana Islands legislature overturned a gubernatorial veto blocking the initiative.

On May 9, the territory’s nine-member Senate voted 7-1 to override Governor Arnold Palacios’ April 11 veto of the bill. The 20-member House followed suit days later with a 14-2 vote, clearing the two-thirds majority required to pass the legislation.

The bill allows the local government of Tinian to issue licenses to internet casinos and empowers the Tinian treasurer to create, manage, and redeem a stablecoin called the “Tinian Stable Token.”

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The initiative positions Tinian — home to just over 2,000 residents — to potentially beat the state of Wyoming in becoming the first U.S. government to launch a stablecoin, with both aiming for a rollout before July.

Tinian, a municipality of the Northern Mariana Islands (a U.S. territory north of Guam), relies heavily on tourism. The stablecoin plan is part of a broader effort to revitalize its struggling economy.

Governor Palacios had cited legal and constitutional concerns in his veto letter. He warned the bill could enable gambling activity beyond Tinian’s borders and lacked adequate enforcement measures to combat illegal operations.

Backed by cash and U.S. Treasury bills, the stablecoin, officially named the Marianas US Dollar (MUSD), will be managed by the Tinian Municipal Treasury. Local tech firm Marianas Rai Corporation was selected as the exclusive infrastructure provider, and the token will run on the eCash blockchain, a network derived from Bitcoin Cash.