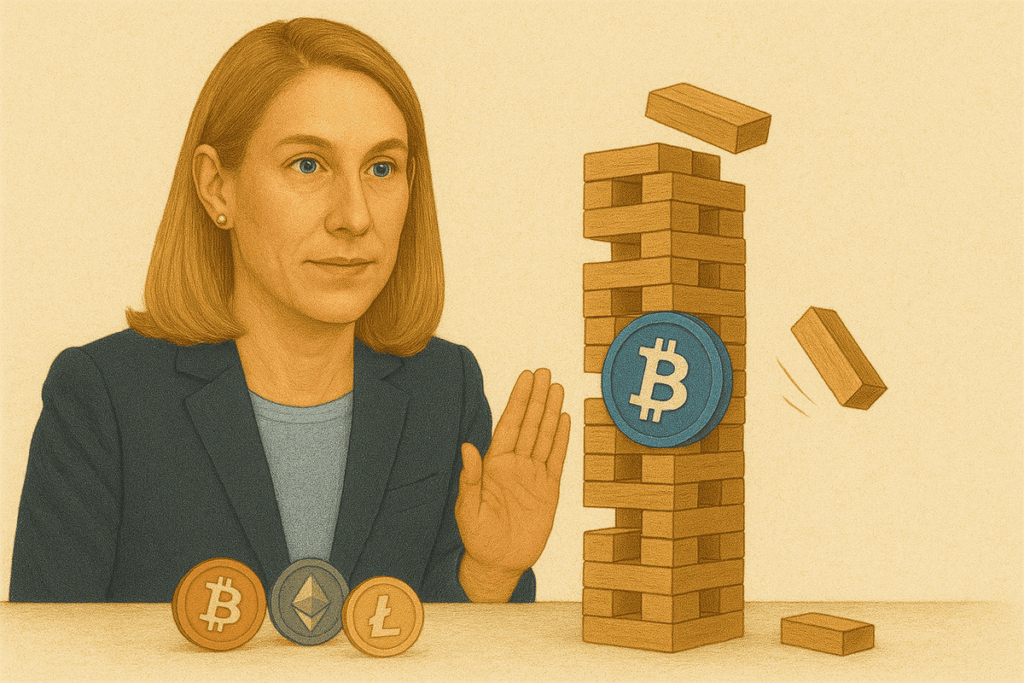

U.S. Securities and Exchange Commission (SEC) Commissioner Caroline Crenshaw, the agency’s lone Democrat, has criticized what she describes as a dangerous regulatory pivot on cryptocurrency—likening the agency’s recent moves to a precarious game of “regulatory Jenga.”

Speaking at the SEC Speaks event on May 19, Crenshaw warned that dismantling long-established but interconnected market rules—particularly those involving the crypto sector—could destabilize the regulatory framework built over years. She compared the stability of the financial markets to a carefully constructed Jenga tower, cautioning that removing foundational rules could send the whole structure toppling.

Crenshaw also highlighted concerns over the erosion of regulatory integrity. She claimed that the SEC has been issuing informal staff guidance that effectively reverses existing rules without proper analysis or soliciting public feedback—particularly on matters related to crypto. “Our statements on these crypto-related issues are the equivalent of a wink and a nod,” she said, suggesting the agency has selectively relaxed enforcement rather than applying the law uniformly.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

She emphasized the troubling trend of “regulation by non-enforcement,” alleging that enforcement actions, especially those involving crypto markets, are being abandoned. “I am deeply troubled by the Commission’s abandonment of swaths of our enforcement program,” Crenshaw stated.

Crenshaw underscored the broader implications of the SEC’s “about-face,” warning that it could weaken the agency’s standing in court, damage its credibility, and throw established legal precedents into question. She also cited the 2022 collapse of FTX as a stark example of how devastating crypto failures can be, urging for continued vigilance. “Those risks have not gone away, but the calls for serious regulatory scrutiny are a lot quieter these days,” she remarked. “Failing to appreciate and address these risks and complexities destines us to repeat hard lessons with high stakes as crypto becomes increasingly entangled with traditional finance.”

In contrast, Republican commissioners at the SEC expressed support for the agency’s recent approach to the crypto space.

SEC Chair Paul Atkins said the crypto sector had been “languishing in SEC limbo for years,” arguing that the agency should not suppress innovation within the industry.

Commissioner Hester Peirce, who heads the SEC’s Crypto Task Force, criticized past approaches under the Biden administration for bypassing established regulatory principles. She asserted that most crypto assets are no longer tied to securities law. “Even if a broad swath of the crypto assets trading in secondary markets today were initially offered and sold subject to an investment contract, they clearly are no longer bought and sold in securities transactions,” she said. “Many of these crypto assets are functional.”

Commissioner Mark Uyeda echoed this sentiment, urging that the SEC must ensure that “regulation by enforcement” does not become a tool for policymaking moving forward.