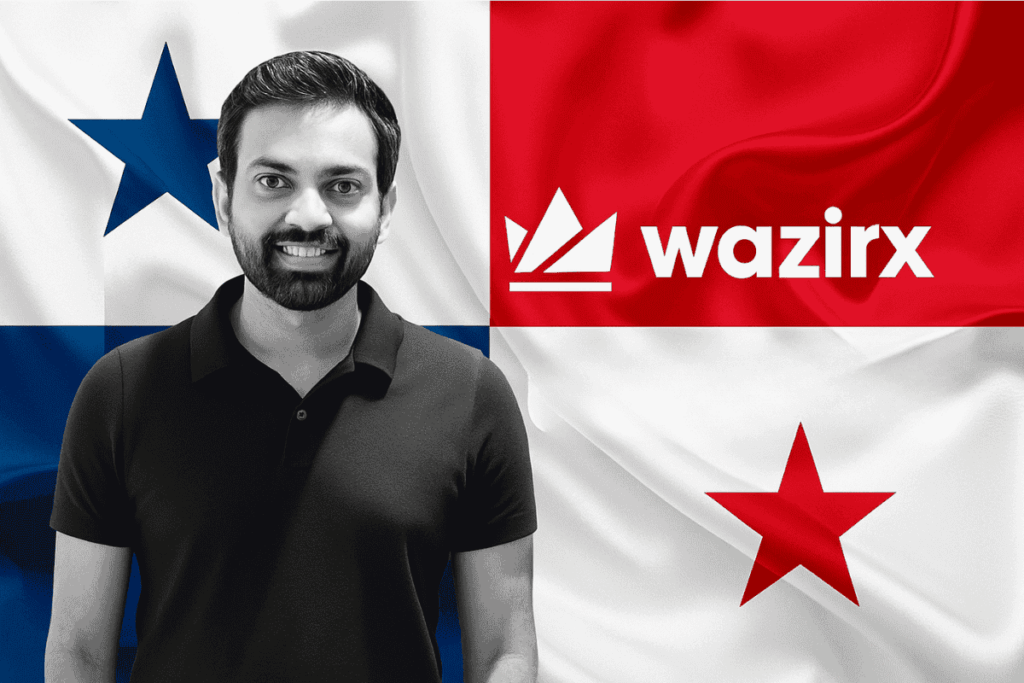

Infamous Indian crypto exchange WazirX, whose parent entity was based in Singapore, has decided to rebrand itself as Zensui and move operations to Panama. The move comes in response to Singapore’s new regulation that has ordered crypto firms to halt overseas operations by June 30 else face hefty fines.

To avoid regulatory hurdles, WazirX is choosing to relocate to Panama, allowing it to operate under more relaxed rules in order to maintain business continuity. WazirX, now Zensui, may see this move as another chance to start afresh, even though it continues to struggle in the aftermath of the largest crypto hack, costing it ₹2,000 crore or $234.9 million of investors’ money.

Since then, WazirX has approached the Singapore High Court with its team seeking creditors’ approval for a new restructuring plan. The plan had proposed an 85% recovery of lost funds by mid-2025. According to the exchanges last X post, on May 14, regarding the court proceeding, it said that no final orders were made, however, the court did extend the existing moratorium to 6 June 2025. In the next hearing, the Court went on to dismiss Wazirx’ application for moratorium, alleging that the company may be trying to hide important information from the Court.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

The Fall of WazirX

It is believed that hackers, allegedly linked to North Korea’s Lazarus Group, on July 18, 2024, exploited a vulnerability in WazirX’s multi-sig wallet. The modus operandi was such that the alleged hacker first gained access to WazirX exchange through fake credentials and then drained cryptocurrencies from a hot wallet of WazirX, which prompted the management to use one of their cold wallets to refill the former. At this point, the hacker(s) gained access to a multi-signature cold wallet of WazirX and just like that, Rs 2000 cr siphoned off.

Indian users left in a lurch

This was perhaps the final straw, as even before this exploit, WazirX had run into trouble with Indian regulators. Back in 2021, India’s top financial crime investigative agency, the Enforcement Directorate (ED), accused WazirX of laundering ₹2,790 crore through suspicious transactions linked to Chinese loan apps. WazirX had to pay a penalty of ₹64.67 crore, and its funds were frozen.

Whether this rebranding and relocation will bring closure to Indian investors remains to be seen. The news didn’t go down well with some on X (formerly Twitter). One user asked if — WazirX would refund users this month? Another user called @TodayCryptoRj said—Users deserve answers, not excuses.

Meanwhile, Sumit Gupta of CoinDCX said—What is happening with WazirX is unfortunate. It highlights why India urgently needs crypto regulations.