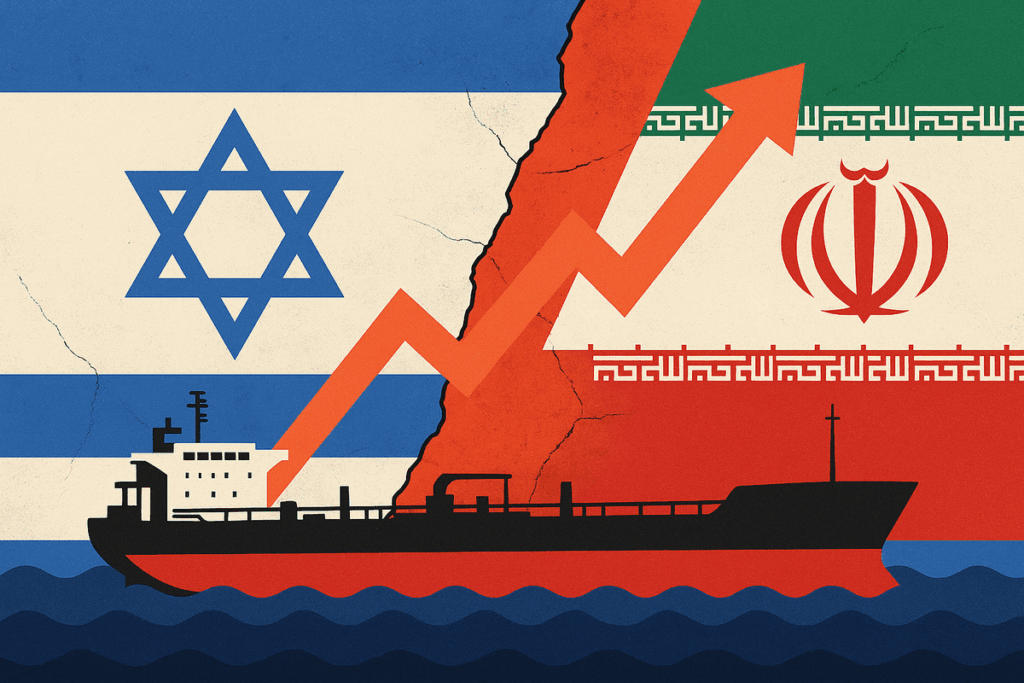

The share prices of prominent shipping companies got a boost as Israel-Iran tensions heat up after Israel targeted multiple sites in Iran, including a uranium enrichment site in Natanz. Key military commanders and high-profile nuclear scientists were targeted in the attack as well.

In India, Shipping Corporation of India Ltd. and GE Shipping Ltd. both rose by as much as 13% and 7%, respectively. In Europe, Maersk’s share price increased by 3.5%, and Hapag Lloyd increased by 0.92%. The rally in shipping stocks could be in anticipation of a spike in shipping costs, especially along critical oil routes, which may see disruptions given the ongoing tensions. Oil prices, too, rose by as much as 9% on Friday.

Iran occupies the northern side of the Strait of Hormuz, a route through which much of its oil and the oil of Middle East producers passes. U.S. investment bank J.P. Morgan classified the possibility of Iran closing the Strait as retaliation for the Israeli attacks as a low-risk event.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

“The closure of Hormuz is a low-risk event as Iran would be damaging its own position, both economically and politically, by irritating its main customer,” said J.P. Morgan.

This upward shift in oil was accompanied by a rise in gold prices, as investors and traders park more funds in safe-haven assets.

The Israeli military launched a coordinated set of strikes on Friday as part of Operation Rising Lion. The Revolutionary Guards confirmed that its Chief Hossein Salami was killed in the attacks. The Chief of Staff of Iran’s Armed Forces, Major General Mohammed Bagheri, was also killed.