- Crypto infra company Talos acquires Coin Metrics in a deal valued at over $100 million.

- The deal creates an all-in-one solution for hedge funds and asset managers, combining execution, data, and portfolio tools.

- Talos is preparing to support tokenized traditional assets like equities and private credit soon.

New York-based crypto infrastructure firm Talos has acquired blockchain analytics provider Coin Metrics in a deal exceeding $100 million. The acquisition brings together Talos’ institutional-grade trading and portfolio management infrastructure with Coin Metrics’ deep expertise in on-chain and market data analytics.

Founded by Wall Street veterans Anton Katz and Ethan Feldman, Talos has built a robust platform for hedge funds and asset managers to trade digital assets like Bitcoin and Ethereum. Coin Metrics is known for its comprehensive blockchain data and index products, which will now be fully integrated into Talos’ operations. In the future, Talos is preparing to support tokenized traditional assets like equities and private credit.

Unified platform combining execution and data

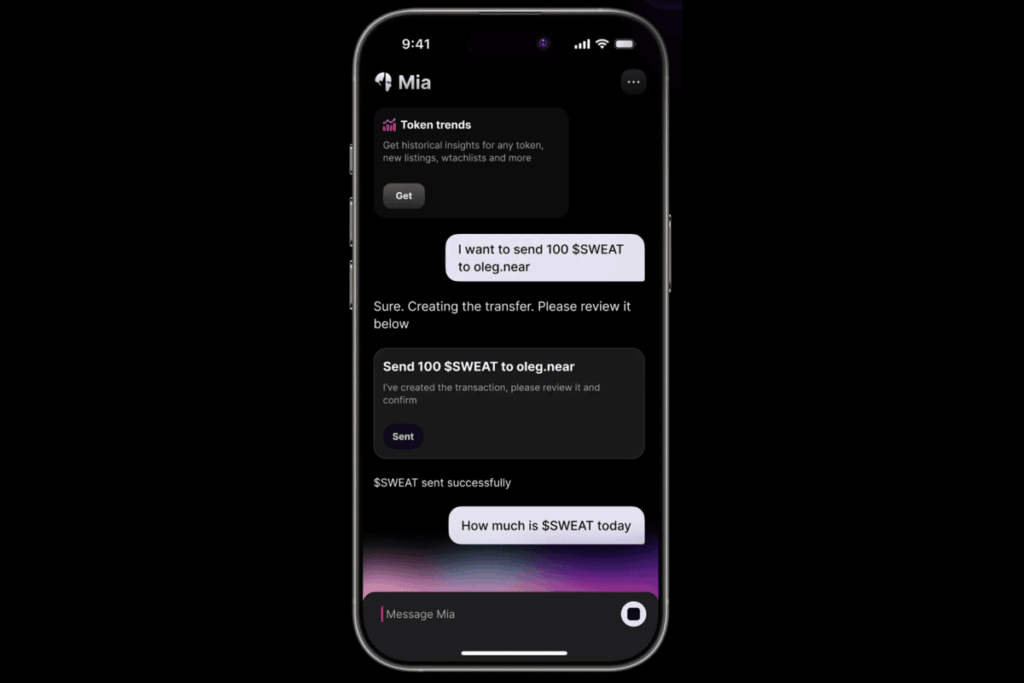

This merger enables Talos to offer a one-stop solution for institutional clients, combining execution, data, and portfolio tools under one roof. Katz emphasized that while Talos already captures pricing data from liquidity providers, Coin Metrics adds historical depth, on-chain transparency, and superior client servicing capabilities. The timing aligns with a thawing regulatory climate and rising institutional interest in crypto.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Talos’ journey began with a vision to make digital assets an institutional asset class, a goal that has attracted substantial venture investment, including a $40 million round in 2021 led by Andreessen Horowitz and a $105 million round in 2022 that valued Talos at $1.25 billion. Other notable investors include PayPal, Fidelity, Citi, and BNY. Talos is also reportedly in active discussions with major financial institutions, positioning itself to support the next wave of digital asset adoption.

IPO plans in the works

Although acquisitions frequently signal a move toward going public, Anton Katz indicated he’s not making any definitive plans yet, even with many crypto firms submitting IPO filings to the SEC. However, he didn’t rule it out entirely. “It’s definitely something we’re thinking about,” he told Fortune, adding, “Talos holds a strong spot in today’s market landscape.”