- Ether ETFs saw $2.4B inflows in 6 days vs. $827M for BTC ETFs

- BlackRock’s ETHA took in 75% of total ETH inflows

- Novogratz forecasts ETH to outperform BTC in the next 6 months

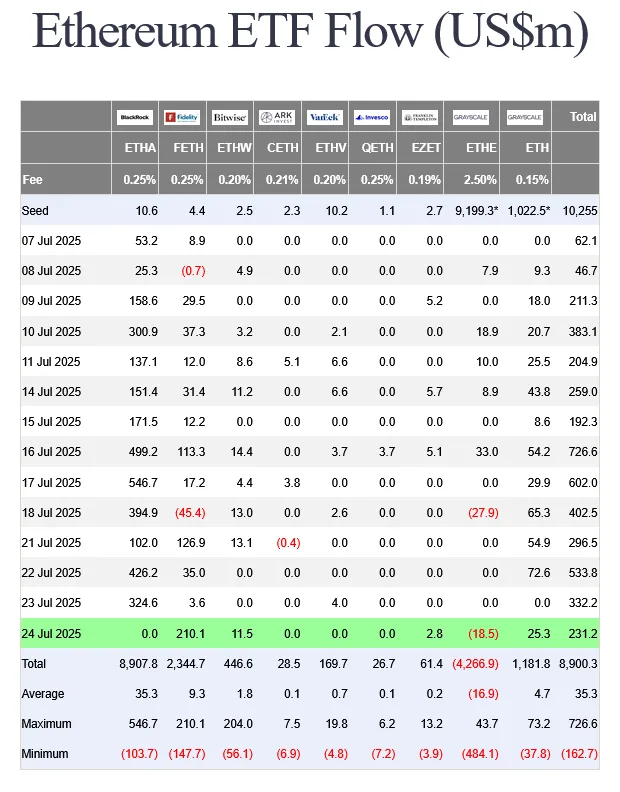

Spot Ether ETFs have officially overtaken their Bitcoin counterparts for six consecutive trading days, marking a rare flip in institutional momentum. U.S. investors poured nearly $2.4 billion into Ethereum-based ETFs over the past week—compared to just $827 million in Bitcoin ETF inflows, according to data from Farside Investors.

Source: Farside Investors.

BlackRock’s iShares Ethereum ETF (ETHA) captured the majority of this capital, attracting $1.79 billion—roughly 75% of the total ETH ETF inflows during the period. The fund has now become the third-fastest ETF in history to reach $10 billion in AUM, achieving the milestone in just 251 trading days.Meanwhile, Fidelity’s Ethereum Fund (FETH) also had a record-breaking day on Thursday, securing a $210 million net inflow—its best day ever, beating its previous high set in December 2024.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

BitMine’s $2 billion ETH grab and rising institutional confidence

Recent weeks have seen a surge in Ethereum-focused institutional strategies. BitMine Immersion Technologies led the charge, purchasing $2 billion worth of ETH in just 16 days—becoming the largest corporate holder of Ethereum.

According to Strategic Ether Reserves, companies now collectively hold 2.31 million ETH, representing 1.91% of ETH’s total circulating supply. This mounting corporate interest is reinforcing Ethereum’s appeal as a long-term institutional asset.Notably, Galaxy Digital CEO Mike Novogratz told CNBC that Ethereum (ETH) could soon hit $4,000, citing BitMine and SharpLink Gaming’s heavy ETH accumulation as potential drivers of a supply shock.

In contrast to Ethereum’s momentum, spot Bitcoin ETFs broke their 12-day inflow streak on Monday, posting a net outflow of $131 million. That marked a sharp shift from the prior 12 days, during which BTC ETFs collectively brought in $6.6 billion.

Market analysts at Swissblock Research now expect this ETH-led cycle to continue, stating:

“ETH is rotating into leadership as the next leg of the cycle unfolds.”

Source:TradingView

Ethereum rallied during the ETF inflow streak, with RSI momentum and volume confirming institutional buying pressure.