- Retail investors are absorbing ETH losses, showing growing confidence in the $100–$1,000 USDT range.

-

ETH ETFs attract $21.85B in uninterrupted inflows, reinforcing strong institutional interest despite resistance near $4,000.

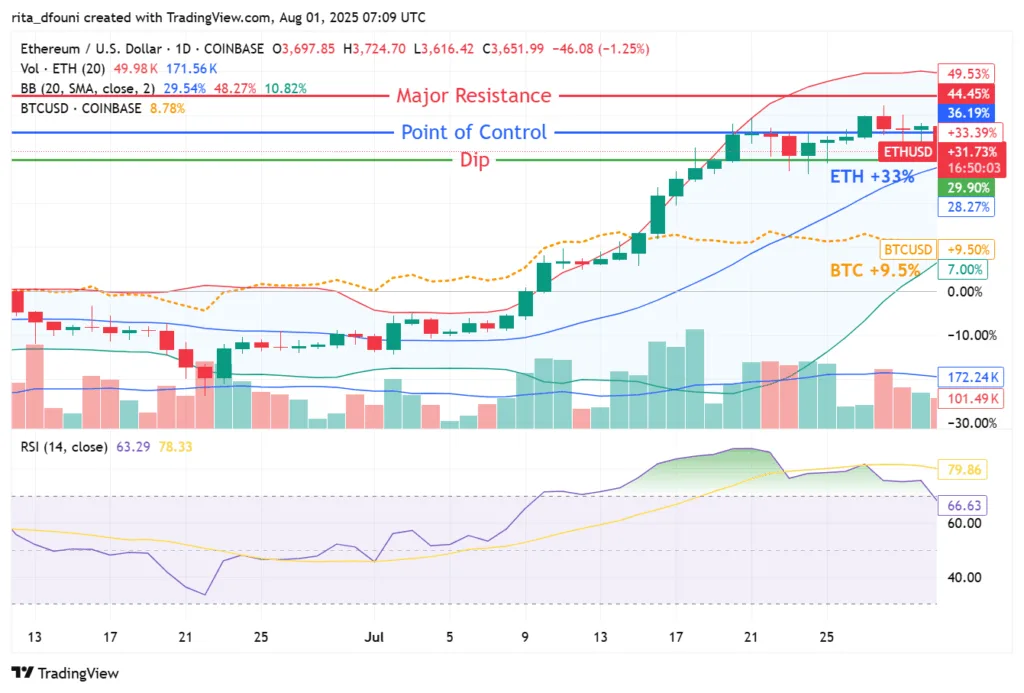

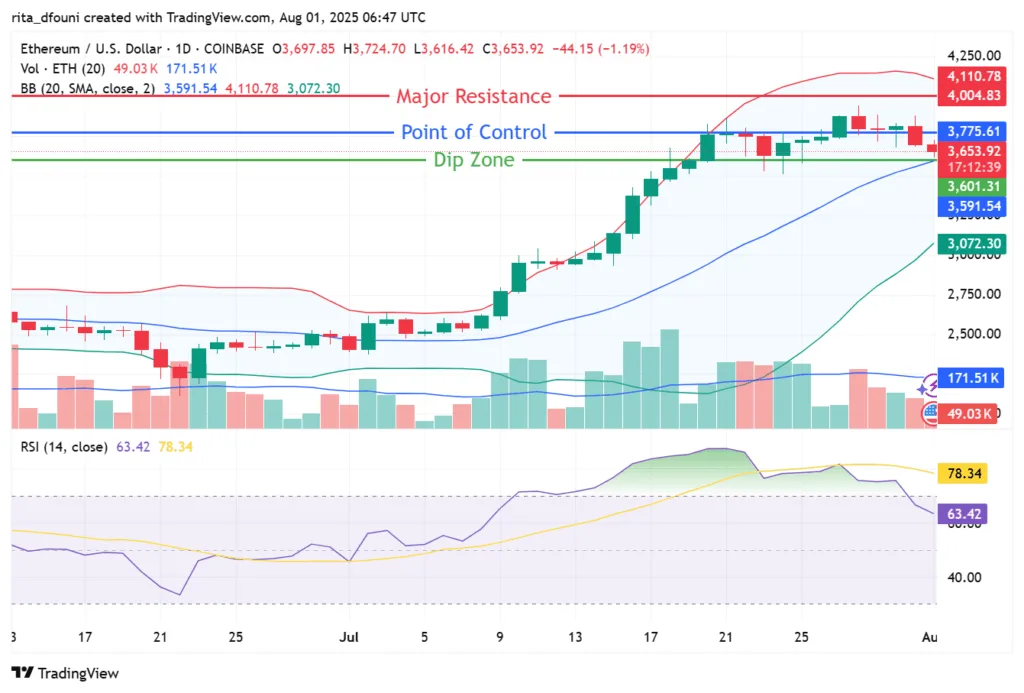

- Ethereum shows breakout potential, with price hovering near the $3,775 control level as Bitcoin lags behind.

Ethereum’s price recovery is showing unexpected resilience compared to Bitcoin, even as ETH continues to face consistent selling pressure near the psychologically and technically significant $4,000 level. At the time of writing, Ethereum is trading at $3,674 while Bitcoin struggles at $115,480, well below its recent highs. The divergence in recovery trajectories has caught the attention of investors and analysts alike, particularly given the sharp selling that followed President Trump’s announcement of new tariffs targeting key U.S. trade partners including Canada, Taiwan, South Korea, and Vietnam.

Ethereum has surged over 33% in recent weeks, significantly outpacing Bitcoin’s 9.5% gain. This highlights ETH’s growing momentum fueled by retail demand and ETF inflows.

Following the geopolitical news, Bitcoin came under immediate pressure and failed to hold above $116,000. Ethereum, while initially dragged lower, dipped to $3,600 and then showed signs of a swift rebound as buying interest emerged. Notably, Thursday’s drop brought ETH into contact with a significant long liquidation level, triggering a wave of forced selling. According to Hyblock’s liquidation heatmap data, this liquidation zone was concentrated around the $3,600 level and was primarily populated by overleveraged retail traders.

The sell-off resulted in $115.8 million in long liquidations for ETH within a span of just five hours. More importantly, the aggressive correction drove the aggregated funding rate for Ether into negative territory for the first time since June 25. This development is being closely monitored by market participants, as historically, negative funding rates for Ethereum and Bitcoin are often interpreted as contrarian buy signals, indicating potential for short-term rebounds.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Retail traders absorb losses as Ethereum regains strength

Despite the turmoil, data from TRDR.io suggests that ETH is regaining strength. On-chain breakdowns of cumulative volume delta across trade size segments show that retail investors, trading in the 100 to 1,000 USDT range, absorbed much of the losses. In contrast, larger players — operating in 10,000 to 1 million USDT buckets — were relatively less impacted during the sell-off. This reinforces signals from other indicators that point to retail traders being net long and increasingly willing to buy the dip at these levels.

Ethereum’s robust market fundamentals continue to underpin this recovery. The past 19 days have seen uninterrupted inflows into spot ETH ETFs, with total holdings now reaching $21.85 billion. Additionally, strategic Ethereum reserves currently hold $10.16 billion worth of assets. These figures were widely expected to help ETH break decisively above $4,000 resistance, but the sell pressure continues to stall that momentum. Nevertheless, the price is now approaching the $3,775 point of control, suggesting that bullish attempts to regain dominance are underway.

Ethereum’s price stalls below the $4,000 resistance despite strong ETF inflows. Retail investors remain active in the $3,600 dip zone. Chart via TradingView.