The UAE continues to attract global attention for its dynamic investment landscape. Recent research by eToro highlights the nuanced differences and surprising similarities between investors in Dubai and Abu Dhabi. While the two emirates exhibit distinct investment behaviors, one unifying theme emerges: confidence in the UAE economy and optimism about its growth sectors.

Diversified strategies in Dubai, focused preferences in Abu Dhabi

The survey of 1,000 UAE investors revealed crypto as the most popular asset across both cities. Beyond that, Dubai investors display a marked appetite for diversification, spreading their investments across commodities, foreign stocks, currencies, and alternatives. Abu Dhabi investors, meanwhile, show a stronger preference for local stocks and traditional hedges such as gold and cash.

What’s striking is Dubai’s appetite for diversification, with stronger participation across commodities, foreign stocks, currencies, and alternatives. Although Abu Dhabi investors are more likely to invest in crypto, when asked what asset is most resilient in a volatile market, Dubai investors lean toward crypto, while Abu Dhabi investors show a stronger preference for gold and believe cash is king, explains George Naddaf, Managing Director at eToro (MENA).

Sector allocations reflect shared confidence

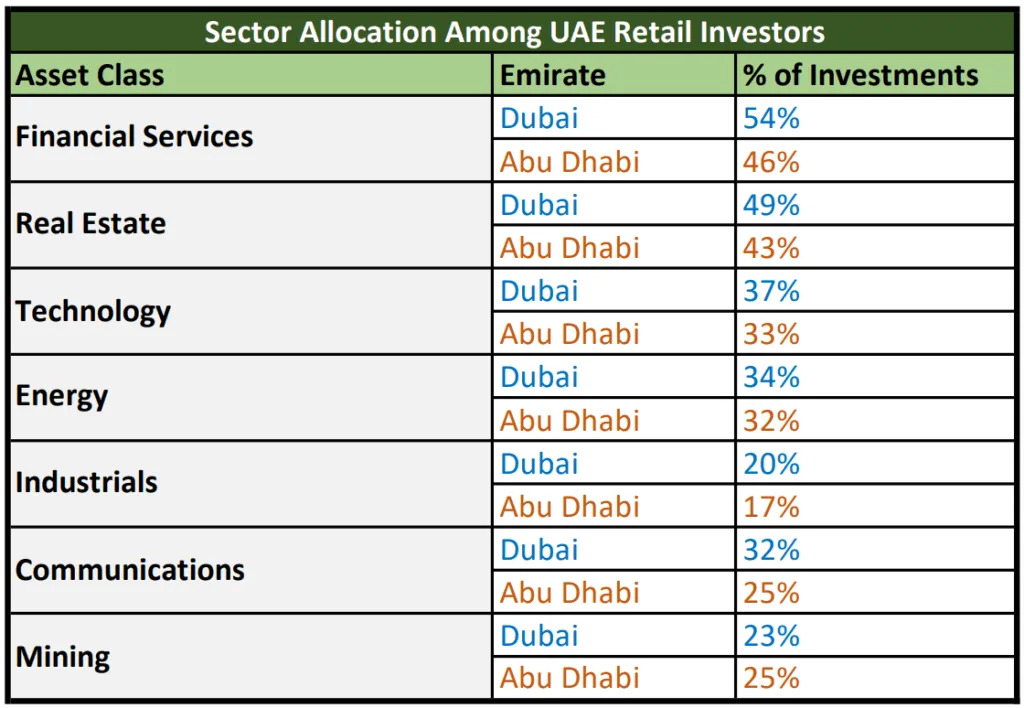

Both investor groups favor high-growth sectors like financial services, real estate, and technology. However, Dubai investors tend to spread their allocations across a wider array of sectors, including energy, industrials, and communications, while Abu Dhabi investors show a unique tilt toward mining.

Despite these differences, home bias remains strong: Dubai investors favor DFM-listed stocks, while Abu Dhabi investors lean toward ADX, though more of them hold both markets’ shares.

Sector-wise, investors in both cities are heavily weighted toward rapidly growing sectors in the UAE, but Dubai portfolios show broader sector spread with more allocating across energy, industrials, and communications. This paints a picture of two investor groups who are confident in the same growth engines, but express it through different strategies, notes George Naddaf.

Portfolios and priorities: Balancing growth and security

Portfolio values differ as well, with Dubai investors more likely to hold high-value portfolios exceeding AED 1 million. Across both emirates, the top three investment priorities are consistent: achieving financial independence, securing long-term stability, and supplementing income.

The divergence appears in personal motivations: Abu Dhabi investors are more focused on retirement, mortgages, and their children’s education, while Dubai investors often target early retirement and financial independence. Yet even in Abu Dhabi, a small but notable segment invests “for fun,” showing a willingness to explore beyond conventional strategies.

Shared optimism in UAE growth sectors

Where Dubai and Abu Dhabi investors truly align is in their confidence in the UAE economy and its growth drivers. Real estate, technology, financial services, and energy are seen as the engines of growth over the next 12 months.

When you look at the bigger picture, the message from investors in both emirates is clear. Retail investors see the UAE as a market that offers both resilience and opportunity and that’s a powerful foundation for sustained growth. As local sectors like real estate, technology, and energy continue to grow and attract capital from retail investors, individuals are actively shaping the UAE’s trajectory as a resilient, next-generation investment hub, concludes George Naddaf.

Dubai and Abu Dhabi investors may take different routes, but both share an unwavering confidence in the UAE’s economy. While strategies differ with Dubai favoring diversification and Abu Dhabi showing a more focused approach the optimism about key sectors highlights a unified belief: the UAE is a resilient and promising investment destination.

George Naddaf is Managing Director, eToro Middle East