A crypto whale who’s come into the limelight for taking contrarian positions against Binance founder Changpeng Zhao aka ‘CZ’ is now sitting on significant gains after shorting the ASTER token. The move came shortly after CZ publicly showed support for ASTER, including on-chain wallet activity and social acknowledgment of accumulating the token. His buy-side signal fueled a short-lived rally before momentum faded on the 2nd of November.

Hyperliquid short positions surge

Instead of following the uptick, the Anti CZ whale added aggressively to short positions on Hyperliquid, a decentralized perpetual futures exchange. As ASTER retraced sharply from its local highs in the days that followed, those positions ballooned to $19.87 million in unrealized profit. According to the Whale Insider, the 2 wallets, 0x9eec and 0xbadbb have managed to amass millions in unrealized profits by building a large leveraged short.

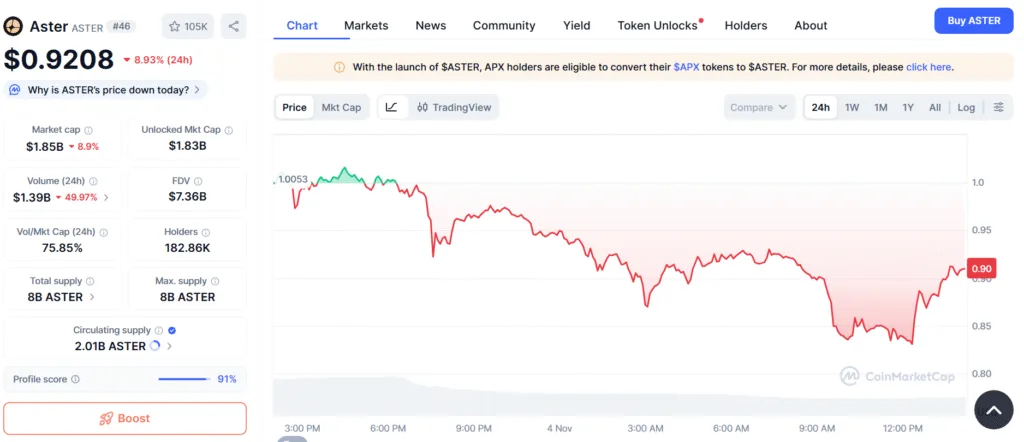

After CZ’s indicated buys, ASTER initially spiked, drawing retail momentum. However, sentiment faded as broader market liquidity tightened, sending ASTER down substantially from its peak. Currently, ASTER is trading below the $1 mark, slipping over 9% in the last 24 hours. The token has fallen by 62% from its all-time high of $2.42, which it touched in September.

Source: CoinMarketCap

$100 million in broader shorting gains

This trade is not only after ASTER; he has also been betting against Ethereum, XRP, Dogecoin, and Pepe, expecting their prices to fall. According to data from Lookonchain, by shorting, he has accumulated profits close to $100 million, often entering positions when sentiment was overwhelmingly bullish.

The total value of the crypto market has dropped by 3.75% in the last 24 hours and now stands at $3.46 trillion. Investor confidence has slipped back into the “fear” zone, with a sentiment score of 27. This downturn led to over $1.3 trillion in liquidated positions, with nearly $1.2 billion coming from traders who had bet on prices going up, according to data from CoinGlass.