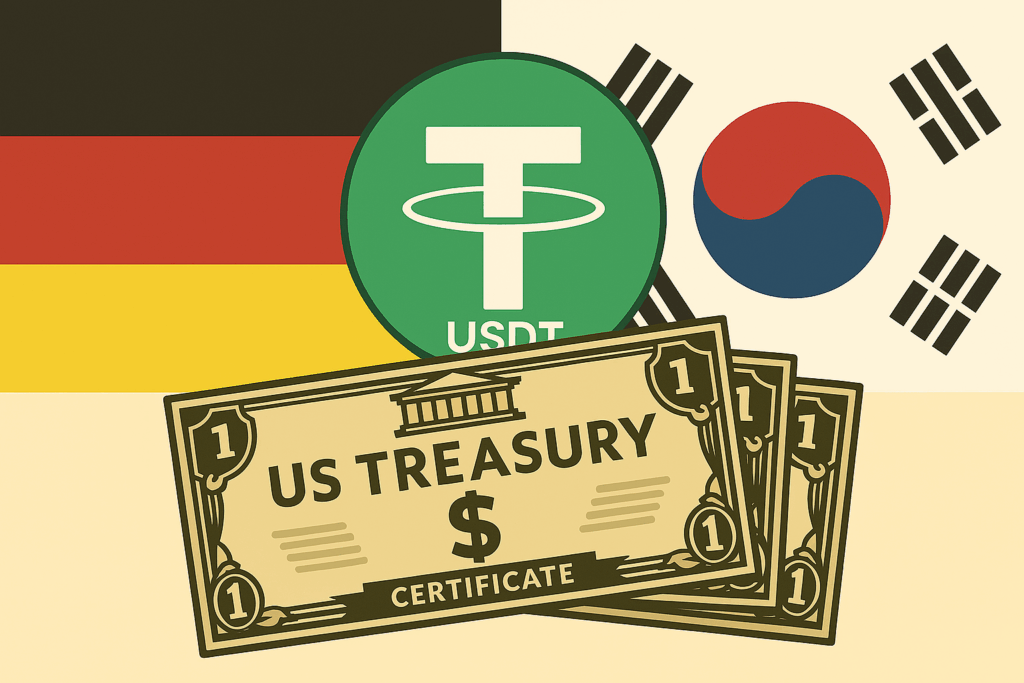

The largest stablecoin issuer, Tether, which has more than $151 billion in assets, has officially overtaken Germany in terms of ownership of US Treasury securities. An X post by @zerohedge was the first to note that the USDT stablecoin issuer owns more than $120 billion in U.S. treasury notes, while Germany held $111.4 billion. He attributed the data to the U.S. Department of the Treasury and Tether’s Q1 2025 attestation report.

With this Tether surpassed nations including Canada, Taiwan, and Mexico to become the seventh-largest foreign purchaser of U.S. Treasury securities in 2024.Treasurys forms a key component of Tether’s asset reserve strategy since they are widely regarded as one of the safest and most liquid investment vehicles available. This and gold reserves is what kept the stablecoin sturdy even during turbulent bitcoin downturn.

Tether CEO, Paolo Ardoino, was quick to react to the X post, noting that Tether had already surpassed Germany and was now looking to surpass South Korea. Ardoino used an illustration of a car’s side mirror that reads— ”objects in the mirror are closer than they appear”

This comes at a time when stablecoins are becoming more mainstream, and with two pieces of legislation pending in Congress. The Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act currently awaits a debate and a floor vote in the House of Representatives, whereas the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, which was stalled on May 8 after failing to gain support from key Democrats and now awaits a revote.

Tether is a stablecoin pegged to the US Dollar. A stablecoin is a type of cryptocurrency whose value is pegged to another fiat currency like the US Dollar, or a commodity like gold. At the time of publishing, Tether was trading unchanged at $1.00.