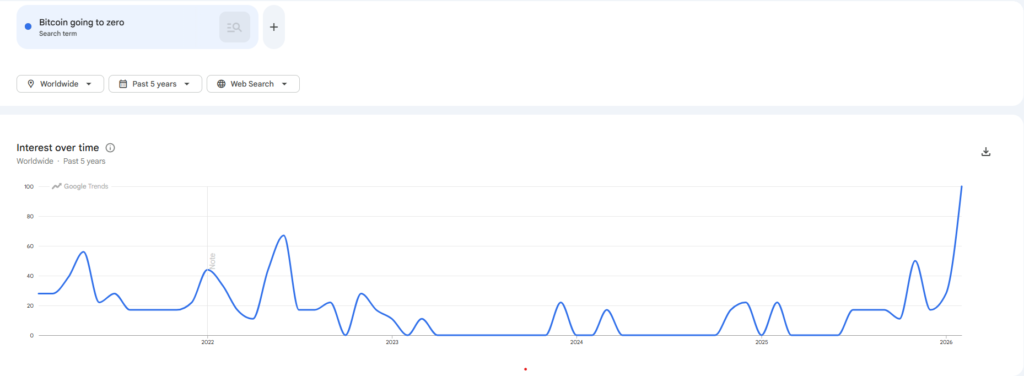

The current sell-off in Bitcoin is bringing back memories of the past, with “Bitcoin going to zero” searches reaching a two-year high.

The trend suggests that retail may be panicking again, even though institutional investors are still buying.

Google data shows that searches for “Bitcoin going to zero” have hit a two-year high since the panic that followed the collapse of FTX in November 2022, when customers lost nearly $8 billion.

The panic is in tandem with Bitcoin falling significantly from its all-time high in October 2025 of almost $126,000 to the current price of $66,500, down almost 50 percent.

Even investor sentiments are also experiencing the same fear. The Bitcoin Fear and Greed Index has fallen into extreme fear territory, with a score near 9, levels last seen during major market shocks like the Terra crash and the FTX fallout, which saw Bitcoin falling to $15,000.

Retail fear spikes during periods of market stress

Historically, spikes in such pessimistic search trends tend to appear during periods of heavy uncertainty, when retail investors worry about further losses and question the market’s near-term stability.

Even as online searches predicting “Bitcoin going to zero” surge-a sign of growing fear among retail investors-institutional players seem to be moving in the opposite direction.

Rather than leaving the market, institutional investors are quietly accumulating more Bitcoin during the current downturn.

Media reports highlight that sovereign wealth funds, such as those from Abu Dhabi, are increasing their exposure to Bitcoin through Bitcoin exchange-traded funds (ETFs).

At the same time, large corporations such as Strategy are continuing to accumulate more Bitcoin. The trend is a reflection of the same phenomenon that has been observed in the crypto market, where retail investor sentiment turns negative during a downturn in prices, but institutional investors see the same downturn as an opportunity to buy.

Bitcoin price sees downfall; ETF outflows rise

Bitcoin’s price has dropped about 50 percent since October, indicating how hard the markets have been hit lately.

At the same time, about $8.5 billion has flowed out of spot Bitcoin ETFs, showing that some investors have pulled money from the market during the downturn.

In addition, the tone of the Federal Reserve’s meeting in January was more hawkish, indicating that the Fed is still concerned about inflation and may maintain high interest rates for a longer period than the market anticipated.

The sudden change in tone shook the stock and cryptocurrency markets, as investors reassessed the impact of the high interest rates on riskier assets.

Since Bitcoin and other cryptocurrencies are known to thrive in an environment of easy liquidity and low interest rates, the prospect of high interest rates for a longer period made investors nervous.