Bitcoin mining difficulty has dropped to one of its lowest levels since 2021, temporarily boosting profitability for active miners.

According to data from Blockchain.com, Bitcoin’s mining difficulty fell 11 percent, marking its largest drop since China’s 2021 crackdown. The decline comes as miners struggle amid plummeting Bitcoin prices and extreme winter storms in the U.S., which disrupted mining operations.

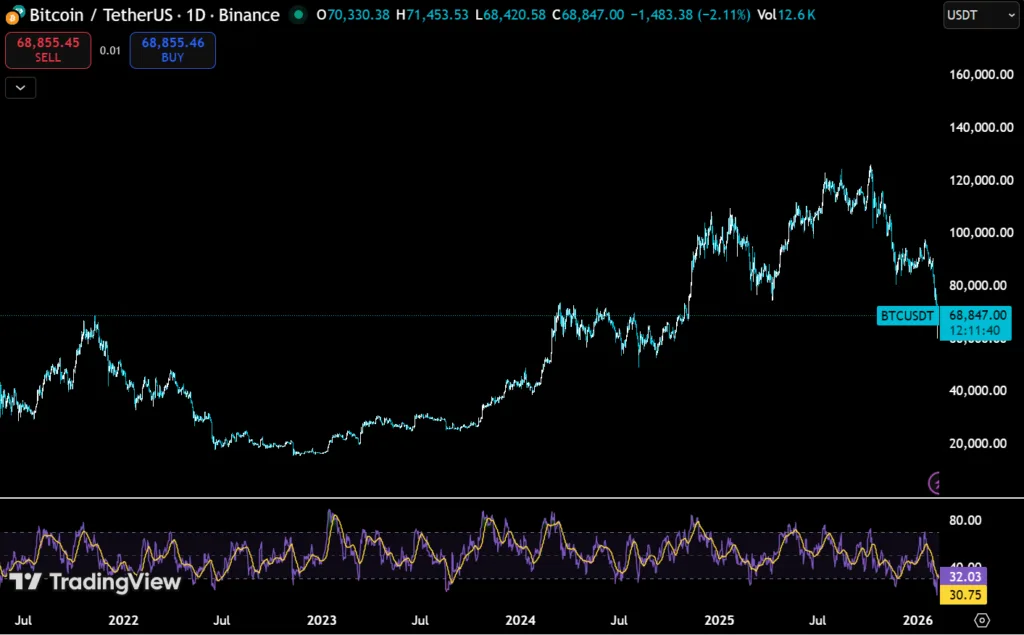

The price of the og-crypto is trading at $68,886.51, down 2.86 percent as compared to the same time last day.

The drop also signals a weaker network hash rate, as some miners shut down due to high costs or outages, highlighting Bitcoin’s sensitivity to both market and environmental factors.

Mining difficulty, which affects how tough it is to locate new Bitcoin blocks, is adjusted generally every two weeks to ensure a 10-minute block interval on the network.

A decrease in Bitcoin mining difficulty makes mining easier and more profitable, can briefly accelerate block production, but frequently reflects lower miner activity and somewhat poorer network security.

Bitcoin mining eases: But is it a good sign?

Bitcoin’s mining difficulty recently dropped from over 141.6 trillion to roughly 125.86 trillion, according to Blockchain.com, marking a sharp decline in the number of machines actively securing the network.

The slump reflects increasing pressure on miners, who have been buffeted by numerous challenges. Bitcoin prices have plunged from an all-time high of $126,000 in October to about $69,500 over the weekend, reducing mining profitability.

Coupled with higher operational difficulties, such as expensive energy or extreme weather, the drop in active hash rate forced difficulty to lower, allowing remaining miners to solve new blocks with reduced effort and cost.

Bitcoin mining revenue on a per terahash basis, measured via the hashprice, has plunged from nearly $70 at the time the cryptocurrency was trading at an all-time high, to now stand at little over $35.

Bitcoin miners hit by price swings and winter storms

The mining industry is going through a rough patch with wild swings in Bitcoin’s price hitting miners’ profits hard, and severe winter storms in the U.S. disrupting power and operations, forcing many to pause or slow down.

Now, miners are watching closely, looking for any sign that conditions might improve, whether it’s a rebound in prices or smoother weather.

Meanwhile, a fall in the revenue minted per mined block falling has pushed many in the industry to switch their energy towards AI data centers, while many have completely exited the market, as Coinheadlines reported earlier.

However, substantial difficulty cuts have signalled market capitulation in the past, frequently followed by a price stabilisation or rebound when miners sell the BTC they generate to fund operating expenditures.