- Spot Bitcoin ETFs recorded $131.35M in outflows on Monday, ending a $6.6B inflow streak

- ARK’s ARKB saw the biggest exit, while BlackRock’s IBIT held steady

- Investors cited profit-taking and rebalancing near all-time highs

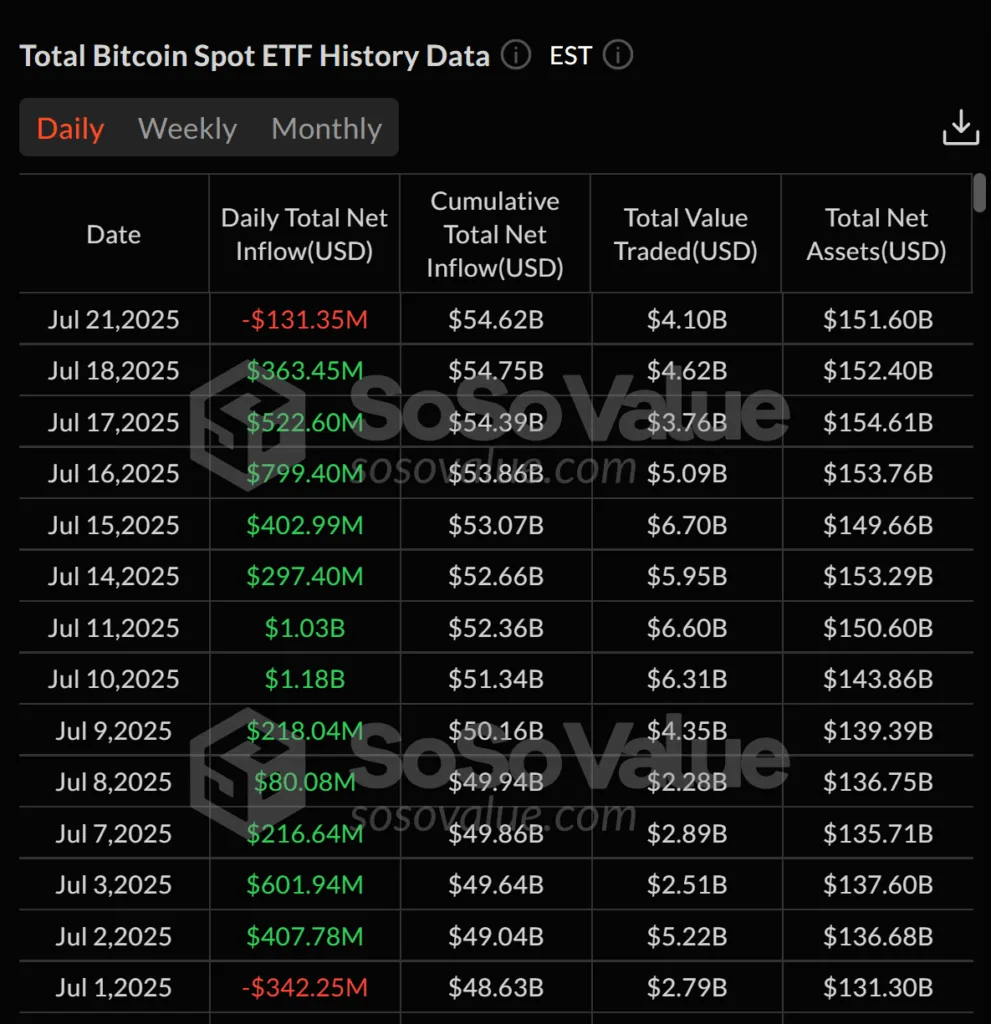

The recent momentum behind spot Bitcoin ETFs came to a halt on Monday, as the sector posted a net outflow of $131.35 million, ending a 12-day inflow streak that had brought in $6.6 billion. The reversal reflects what analysts call “profit-taking” near market highs, rather than a broader shift in investor sentiment.

According to data from SoSoValue, the largest single-day outflow came from ARK Invest’s ARKB, which saw $77.46 million in net withdrawals. Grayscale’s GBTC followed with $36.75 million in outflows, and Fidelity’s FBTC also saw a reduction of $12.75 million.

Smaller outflows were recorded by Bitwise’s BITB and VanEck’s HODL, at $1.91 million and $2.48 million, respectively. Notably, BlackRock’s IBIT, the largest Bitcoin ETF with $86.16 billion in net assets, remained unchanged, showing neither inflows nor outflows during the session.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Source: SoSoValue

Institutional strategy: Pause or panic?

Despite the sudden pause in inflows, cumulative net inflows across all spot Bitcoin ETFs remain strong at $54.62 billion, while total assets under management in the sector reached $151.60 billion representing 6.52% of Bitcoin’s entire market cap.

According to Vincent Liu, Chief Investment Officer at Kronos Research, the outflows are nothing more than a strategic breather. “The recent ETF outflows reflect profit-taking near the highs and measured institutional rebalancing to lock in gains,” Liu told Cointelegraph. He emphasised that this was not a reaction driven by fear but part of a natural market cycle.

It’s not panic but positioning, he said. It’s a routine correction after a solid upward trend.

Earlier this month, spot Bitcoin ETFs saw historic levels of inflows, with July 10 and 11 bringing in $1.18 billion and $1.03 billion, respectively. It was the first time in ETF history that two consecutive days recorded billion-dollar inflows.

Ether ETFs surge ahead with 12-day winning streak

While Bitcoin ETFs took a step back, Ethereum products surged ahead. Spot Ether ETFs posted $296.59 million in net inflows on Monday alone, pushing their cumulative total to $7.78 billion. The Ether ETF inflow streak has now hit 12 days in a row, demonstrating rising investor demand for Ethereum-based assets.

Last Wednesday marked a record-breaking day for Ether ETFs, with $726.74 million in inflows, followed by $602.02 million on Thursday, according to SoSoValue data. The back-to-back surge suggests that many investors are actively shifting their attention to Ethereum products — especially amid anticipation of broader Layer 2 growth and upcoming network upgrades.

What’s next for crypto ETFs?

Although Monday’s outflows might seem like a reversal, analysts agree that the move is largely temporary. The ETF sector remains robust, and the pause in Bitcoin could merely signal a shift toward Ether or a short-term breather after a red-hot rally.

With total assets still representing a sizeable portion of the overall Bitcoin market and institutional inflows dominating headlines, the broader narrative around crypto ETFs remains intact especially as more investors look for diversified exposure to digital assets through regulated products.