Adoption of Bitcoin treasury slowed down in the fourth quarter, but the biggest enterprises kept buying BTC. Now, public companies own more than 4.7% of all Bitcoin. In the fourth quarter of 2025, the number of people using Bitcoin treasury slowed down a lot. The biggest companies kept adding to their stacks covertly, while smaller companies pulled back.

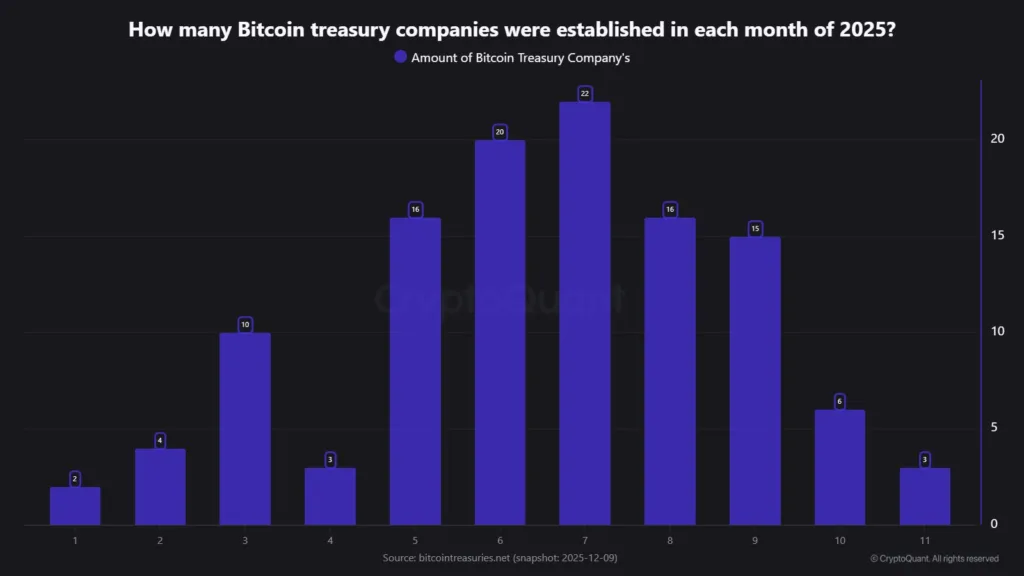

According to the blockchain data platform CryptoQuant, the number of new Bitcoin treasury companies fell from a high of 53 in the third quarter to just nine in the fourth quarter of 2025. So far this year, a total of 117 new companies have adopted Bitcoin.

“Even though the numbers are going up in 2025, most Bitcoin Treasury companies still don’t have a lot of money,” CryptoQuant said in a report on Thursday.

Still, the accumulation data suggests that the richest corporate treasuries are still buying up Bitcoin, even as smaller corporations and retail buyers are buying less.

Source: CryptoQuant

Some firms pause or sell holdings as market conditions tighten

Some companies that hold Bitcoin in their treasuries have ceased buying it this quarter. For example, Metaplanet, a Japanese investment company, hasn’t bought any Bitcoin in more than two months.

Some businesses are even selling their Bitcoin. Satsuma Technology, a tech business based in the UK that focusses on Bitcoin, sold 579 Bitcoin for almost $53 million, leaving the company with 620 Bitcoin on its balance sheet, according to a Wednesday announcement. Even if the economy is slowing down, some of the biggest companies are still buying up more Bitcoin.

On Monday, Strategy, the biggest company that owns Bitcoin, bought $962 million worth of BTC. This was its biggest purchase since July. CryptoQuant said that the company is now only $500 million short of the $21.97 billion worth of Bitcoin it bought in 2024.

BitcoinTreasuries.NET says that public companies already have more than 1 million Bitcoin worth $90.2 billion, which is 4.7% of the total supply.

Spot Bitcoin exchange-traded funds have another 1.49 million Bitcoin, which is 7% of the total supply. DATs make it harder to buy crypto because Ether treasury investments are down 81%.

Ether treasury investments plummet 81% as DAT activity weakens

The number of digital asset treasury (DAT) acquisitions is also going down. Evernorth Holdings, which is backed by Ripple, hasn’t done anything since the end of October, when it bought $950 million XRP XRP$2 coins.

Evernorth’s XRP assets were losing about $80 million in value weeks after the transaction because the market was going down and DATs were getting more pressure.

BitMine Immersion Technologies, the company that owns the most Ether (ETH$3,202), has similarly scaled down its Ether purchases in the last few months, going from a high of $2.6 billion in July to just $296 million in December.

Over the last three months, Ether treasury companies’ total investments dropped by 81%, from 1.97 million ETH in August to 370,000 ETH in November.