Fragbite Group AB has announced a second allocation of Bitcoin to its corporate treasury, purchasing approximately 2.7 BTC at an average price of $118,511, according to an official press release issued on July 31, 2025. The acquisition increases the company’s total holdings to 7 BTC, with the average purchase price for the combined position now at $115,099.

This move underscores the Group’s continued interest in integrating Bitcoin into its long-term strategic and financial planning. The latest acquisition was executed through the company’s Bitcoin Treasury unit, which was formed to manage digital asset exposure and optimize capital allocation.

Source: X (Twitter)

Bitcoin Treasury Director Patrik von Bahr said the company is steadily building its BTC position in parallel with investor engagement and strategic planning. “With two successful capital raises completed and relationships with new investors forged, Bitcoin Treasury is moving forward and gaining momentum. We are step by step adding to the Company’s bitcoin holding and positioning Fragbite Group as an attractive investment with long-term potential,” he said.

Bitcoin as a strategic treasury asset for long-term growth

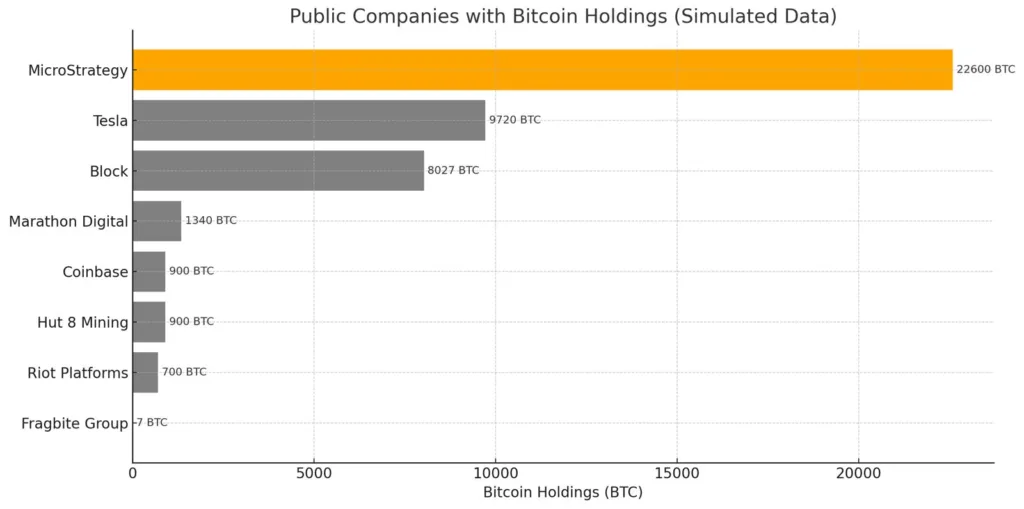

The company views Bitcoin as both a long-term store of value and a mechanism for diversifying reserves beyond traditional fiat assets. While Fragbite’s holdings remain relatively modest compared to other publicly listed firms in the sector, the public commitment to accumulating digital assets further aligns the Group with the growing cohort of corporates integrating Bitcoin into their balance sheets.

The decision also reflects the firm’s broader mission to create shareholder value while modernizing its capital structure. The Group has not disclosed a formal long-term BTC target but confirmed its treasury strategy will continue evolving based on market conditions and growth opportunities.

The news comes amid rising interest from Nordic firms exploring Bitcoin as a hedge against macro uncertainty and as a treasury diversification tool.

Publicly traded companies holding Bitcoin as part of their treasury strategies. Fragbite Group, with a recent purchase bringing its total to 7 BTC, joins a growing list of firms adopting BTC for long-term capital allocation.