Metaplanet, Japan’s largest Bitcoin treasury firm, expects full-year operating profit to jump 81 percent in 2026, following a massive surge in options premiums that boosted profits 17-fold in 2025.

Last year, the company earned 6.29 billion yen ($40.8 million) in operating profit, with option-writing premiums rising from 691 million yen in 2024 to 7.98 billion yen. Total revenue climbed 738% to 8.9 billion yen.

Although the company had strong operating performance, declining Bitcoin prices, from around $125,000 to below $90,000 by the end of the year, resulted in a non-cash valuation loss of 102.2 billion yen, leading to a net loss of 95 billion yen ($605 million) for Metaplanet.

The contrast highlights how market volatility can overshadow even record-breaking revenue growth in crypto treasury operations.

Metaplanet bets on $2.4 billion Bitcoin holdings to drive 2026 revenue

Metaplanet is sitting on a hefty $2.4 billion in Bitcoin, and it’s betting that nearly all its 2026 revenue will come from these holdings. That said, the crypto market’s swings aren’t kind, with BTC at around $68,550.

The company is showing roughly $1.2 billion in unrealized losses on paper, thanks to the volatility in the segment at present.

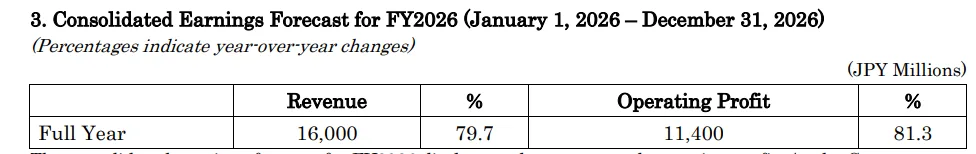

Still, Metaplanet is looking ahead with confidence. It expects revenue for 2026 to jump nearly 80 percent to 16 billion yen, with operating profit reaching 11.4 billion yen.

After the announcement, investors seemed cautiously optimistic about the firm’s outlook, sending shares up slightly to 326 yen.

The company’s strategy is clear: hold on to bitcoin for the long haul and let its treasury do the heavy lifting.

While short-term price drops sting on the balance sheet, Metaplanet is counting on BTC’s long-term growth to drive revenue and profits in the years ahead.

Metaplanet vows to continue Bitcoin accumulation despite market slump

Metaplanet previously stated that it will stick to its Bitcoin-buying strategy despite the recent market downturn. CEO Simon Gerovich told shareholders that the company’s plan for building its BTC treasury is still the same.

Gerovich said on X that the recent drops in stock prices have been hard, but he stressed that Metaplanet will keep steadily buying Bitcoin.

The move shows that the company is committed to BTC for the long term and believes that the cryptocurrency can help the company grow in the future, even when prices are volatile in the short term.