-

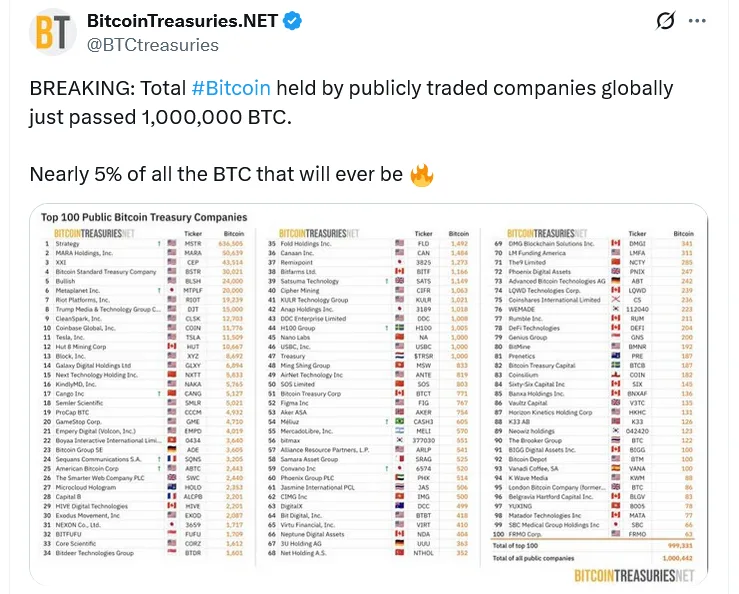

Publicly traded companies currently possess 1 million BTC, which represents 5.1% of Bitcoin’s total supply.

-

Strategy holds 636,505 BTC as newcomers speed up their accumulation.

-

Corporate adoption causes a supply shock, pushing Bitcoin past $124K.

Publicly traded firms currently possess over 1 million Bitcoin (BTC), representing approximately 5.1% of the cryptocurrency’s capped supply, as reported by BitcoinTreasuries.NET. The total of 1,000,698 BTC, valued at over $111 billion, signifies a significant milestone in the corporate embrace of digital assets.

Strategy, under Michael Saylor’s leadership, continues to be the top holder with 636,505 BTC, greatly surpassing competitors. MARA Holdings, the second-ranking Bitcoin miner, holds 52,477 BTC, whereas newcomers such as XXI and the Bitcoin Standard Treasury Company have swiftly ascended the rankings with 43,514 BTC and 30,021 BTC, respectively.

Additional significant corporate owners are Bullish Exchange (24,000 BTC), Metaplanet (20,000 BTC), and Coinbase (7,285 BTC). In total, almost 184 publicly traded companies globally currently have Bitcoin on their balance sheets, including those from the U.S., Canada, the UK, Hong Kong, and developing markets.

Newsletter

Get weekly updates on the newest crypto stories, case studies and tips right in your mailbox.

Market impact and outlook

The rise in corporate accumulation has aligned with Bitcoin’s recent ascent to a record peak of $124,450. Analysts claim the acquisitions are driving a demand shock, with merely 5.2% of Bitcoin remaining to be mined. Firms such as Metaplanet and Semler Scientific have set bold targets for 210,000 BTC and 105,000 BTC by 2027, respectively indicating increased supply pressure in the following years.

The growth of corporate treasuries comes after years of doubt. Strategy’s choice to keep purchasing during the 2022 bear market, even as Bitcoin dropped to $15,740 following FTX’s downfall, faced significant criticism. However, with Bitcoin currently exceeding $120,000, Saylor’s determination seems justified and has sparked a new surge in corporate acceptance.

Although public companies reaching the 1 million BTC mark is notable, they aren’t the top owners. Exchanges and ETFs hold 1.62 million BTC, with governments next at 526,363 BTC and private firms at 295,015 BTC. Nonetheless, the success emphasizes how Bitcoin is evolving from a retail-focused asset to a corporate treasury approach adopted globally.

Rita Dfouni

Rita Dfouni