Bitcoin transaction fees have dropped dramatically to levels not seen in over a decade. This shows a shift in how the network is being used, even though the largest cryptocurrency is hovering near all-time highs.

According to Glassnode data, the 14-day simple moving average of daily network fees now sits at just 3.5 BTC, the lowest throughput since around 2011.

Courtesy: Glassnode Data

Meanwhile, Galaxy Research reports that as of August 2025, the median daily transaction fee has collapsed by over 80% since April 2024. One of the reasons for the falling Bitcoin fees could be the fact that fewer people are using the network for transactions. Instead of spending it, most investors now treat Bitcoin like digital gold, something to hold onto rather than use for payments.

Transaction fees hit historic lows despite high BTC prices

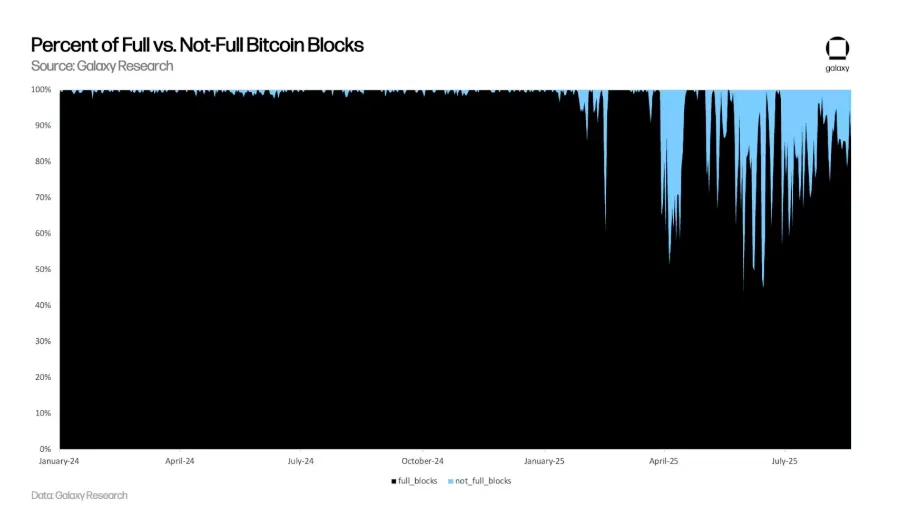

The Galaxy Research shows that about 15% of daily blocks now clear at a token rate of only 1 satoshi per virtual byte, which means it’s essentially free. This also shows that many blocks remain underutilized. Nearly 50% of blocks have failed to reach the maximum weight limit (4,000,000 weight units) despite room to include additional transactions.

“The mempool, Bitcoin’s waiting room for pending transactions, is frequently empty, and when it isn’t, it’s full of transactions that don’t need to pay high fees to get processed quickly,” Galaxy noted.

Courtesy: Galaxy Research

Moreover, the retreat of data-heavy transactions, like OP_RETURN use tied to Runes and Ordinals, which once made up 40–60% of activity, has contributed to the drop. They now account for barely 20% of transactions.

In simple terms, sending Bitcoin has become cheaper and faster. Now there are far fewer transactions vying for blockspace. Most users get included in a block quickly and at minimal cost. This development may be good news for average users, but not for Bitcoin Miners.

Impact of lower transaction cost for Bitcoin Miners

After Bitcoin’s 2024 halving cut mining rewards to 3.125 BTC, miners hoped higher transaction fees would make up for the drop. But fees have actually gone down, not up. With transaction fees evaporating, smaller mining operators are finding it harder to sustain profitability. This has also raised concerns about the long-term security model of the network.

This is very different from past bull markets, when rising prices led to network traffic and higher fees. For Bitcoin to stay secure over time, it needs a healthy fee market. Persistent low fees can negatively affect miners’ revenues, especially post-halving when block rewards are already reduced. Over time, this could discourage smaller miners, reducing network decentralization.

But there is a clear shift in who owns and where Bitcoin is headed. Big investors and ETFs now hold over 1.3 million Bitcoin, and those coins mostly stay off the blockchain. As a result, Bitcoin’s price is now driven by how much money flows into these investment products, not by activity on the blockchain itself. One can point out the fact that everyday users have moved to Solana, where trading memecoins and NFTs is faster and cheaper.