Crypto treasury firm BitMine Immersion Technologies has filed an 8-K form on Tuesday with the SEC to broaden its at-the-market equity offering programme to $24.5 billion, an amount that reflects multiple increases over the past few weeks.

BitMine continues to upsize its equity offering

As per the official filing, the company first pursued its ATM program on July 9 through a controlled equity sales agreement with Cantor Fitzgerald and Co and ThinkEquity LLC—a contract in which the latter two companies would be tasked with selling BitMine shares for an aggregate offering price of $2 billion. Later, the offering was upsized on July 24 to $4.5 billion.

BitMine says it is the largest corporate holder of Ethereum, and its substantial holdings place it ahead of SharpLink Gaming and Ethereum Foundation. South Korean investors have poured approximately $259 million into the company, as per a Bloomberg report.

Multiple investment funds have poured money into the company, including Cathie Wood’s ArkInvest, Peter Thiel’s Founder Fund.

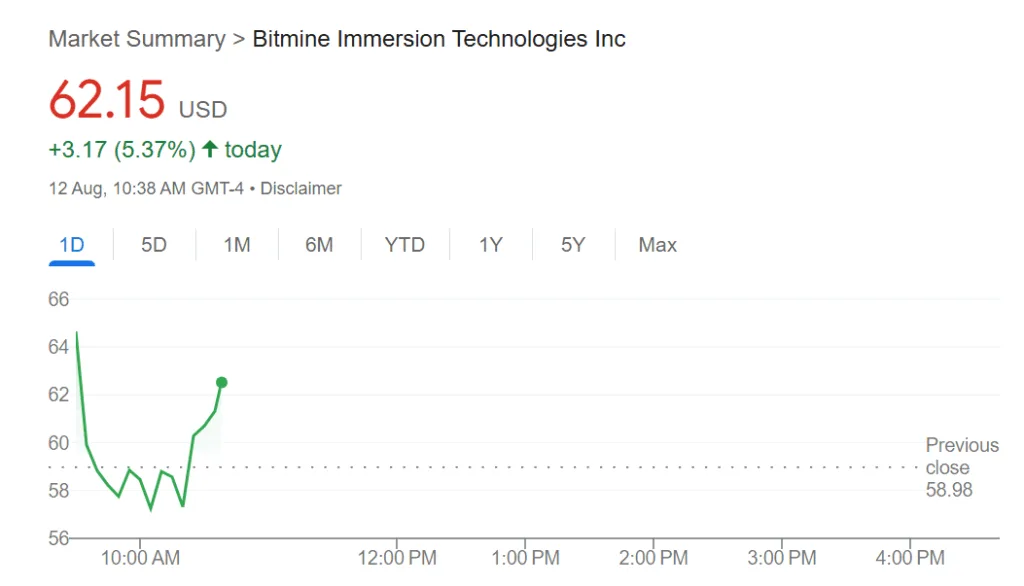

Source: Google Finance

The update comes at a time when multiple companies are creating a treasury solely for investment into blue-chip cryptocurrencies such as Bitcoin and Ethereum. However, this has raised concerns among analysts as to whether investors face an unreasonably high premium just for buying exposure to these assets.